Question

1. How much will $1,516 become if discounted 6.32% per year for 7 years? My answer is PV=1516/(1.0632)^7=1516/1.5356=987.2362 However, it was incorrect. Can you tell

1. How much will $1,516 become if discounted 6.32% per year for 7 years?

My answer is PV=1516/(1.0632)^7=1516/1.5356=987.2362 However, it was incorrect. Can you tell me the correct answer?

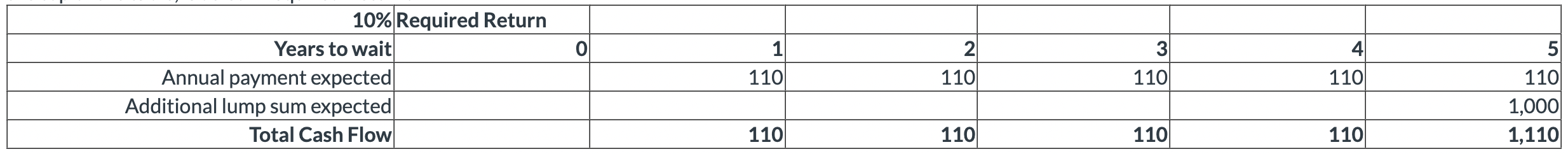

2. You are considering buying a bond which will pay annual amounts as shown at the end of this year, and at the end of every year until five year from now. At the end of the fifth year, the bond will also pay you an extra $1,000. The following table shows your expected cash inflows and timing. The percent return you demand from your investments is at the top of the table, labeled "Required Return."

What is this bond worth in today's money?

My answer was PV=(110/1.1)+(110/1.21)+(110/1.331)+(110/1.4641)+(1110/1.6105)=1037.9119, but this was incorrect. can you tell me the correct answer?

3. If PQR Ltd. expects sales to grow from $98.043 million to $114.578 million, and all their sales are on account, by what percentage should they expect accounts receivable to grow?

\begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{\begin{tabular}{l|l} 10% & Required Return \\ \end{tabular}} \\ \hline Years to wait & 0 & 1 & 2 & 3 & 4 & 5 \\ \hline Annual payment expected & & 110 & 110 & 110 & 110 & 110 \\ \hline Additional lump sum expected & & & & & & 1,000 \\ \hline Total Cash Flow & & 110 & 110 & 110 & 110 & 1,110 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started