Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. IBM is expected to pay its next dividend, in the amount of $10 per share, in one year. The dividend is expected to

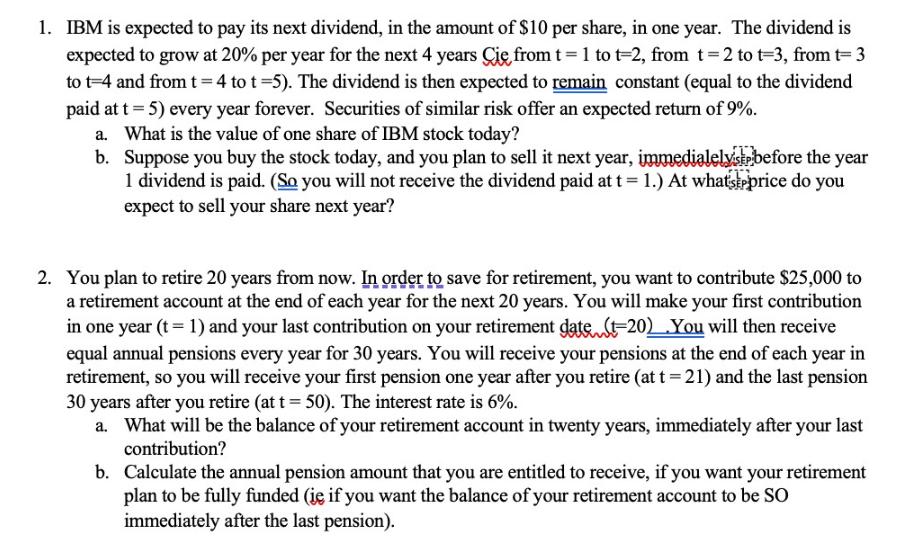

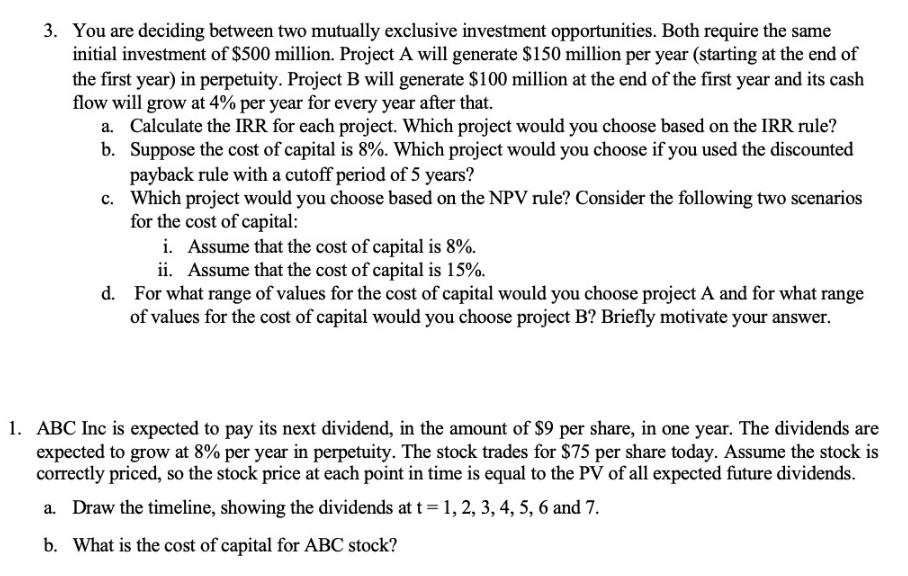

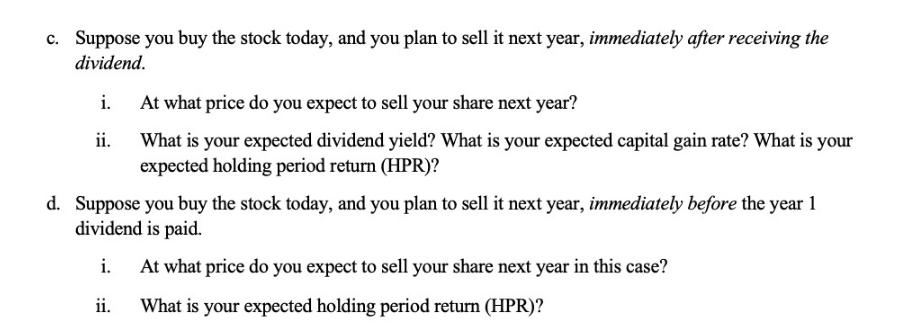

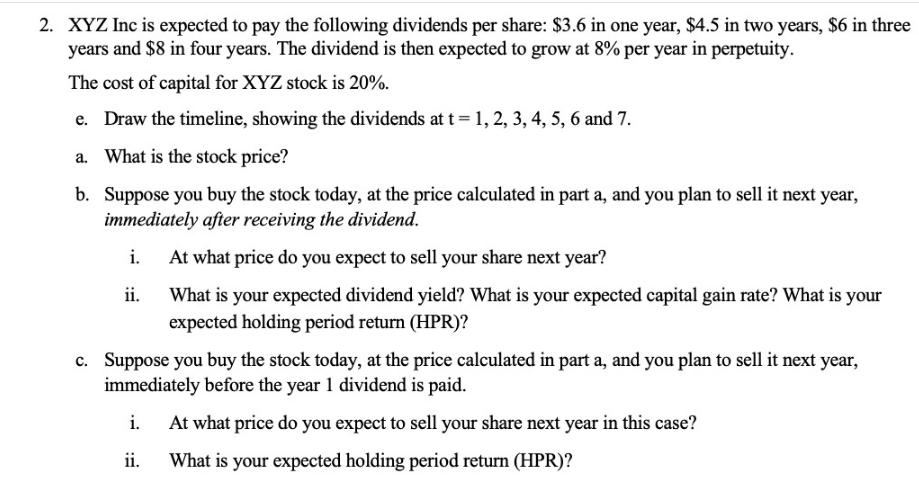

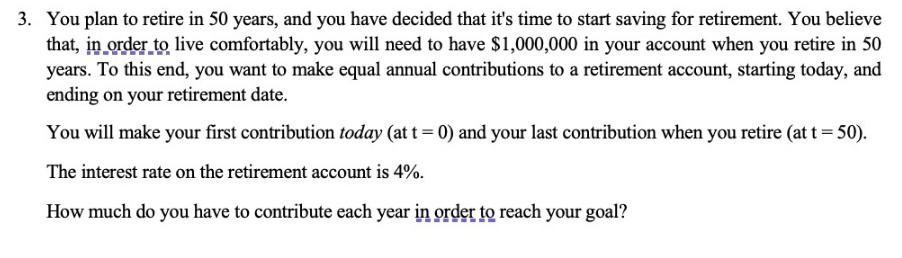

1. IBM is expected to pay its next dividend, in the amount of $10 per share, in one year. The dividend is expected to grow at 20% per year for the next 4 years Ci, from t=1 to t=2, from t = 2 to t=3, from t= 3 to t=4 and from t = 4 to t=5). The dividend is then expected to remain constant (equal to the dividend paid at t = 5) every year forever. Securities of similar risk offer an expected return of 9%. a. What is the value of one share of IBM stock today? b. Suppose you buy the stock today, and you plan to sell it next year, immedialelyst before the year 1 dividend is paid. (So you will not receive the dividend paid at t = 1.) At whatspprice do you expect to sell your share next year? 2. You plan to retire 20 years from now. In order to save for retirement, you want to contribute $25,000 to a retirement account at the end of each year for the next 20 years. You will make your first contribution in one year (t = 1) and your last contribution on your retirement date (-20) You will then receive equal annual pensions every year for 30 years. You will receive your pensions at the end of each year in retirement, so you will receive your first pension one year after you retire (at t=21) and the last pension 30 years after you retire (at t = 50). The interest rate is 6%. a. What will be the balance of your retirement account in twenty years, immediately after your last contribution? b. Calculate the annual pension amount that you are entitled to receive, if you want your retirement plan to be fully funded (i if you want the balance of your retirement account to be SO immediately after the last pension). 3. You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $500 million. Project A will generate $150 million per year (starting at the end of the first year) in perpetuity. Project B will generate $100 million at the end of the first year and its cash flow will grow at 4% per year for every year after that. a. Calculate the IRR for each project. Which project would you choose based on the IRR rule? b. Suppose the cost of capital is 8%. Which project would you choose if you used the discounted payback rule with a cutoff period of 5 years? c. Which project would you choose based on the NPV rule? Consider the following two scenarios for the cost of capital: i. Assume that the cost of capital is 8%. ii. Assume that the cost of capital is 15%. d. For what range of values for the cost of capital would you choose project A and for what range of values for the cost of capital would you choose project B? Briefly motivate your answer. 1. ABC Inc is expected to pay its next dividend, in the amount of $9 per share, in one year. The dividends are expected to grow at 8% per year in perpetuity. The stock trades for $75 per share today. Assume the stock is correctly priced, so the stock price at each point in time is equal to the PV of all expected future dividends. a. Draw the timeline, showing the dividends at t = 1, 2, 3, 4, 5, 6 and 7. b. What is the cost of capital for ABC stock? c. Suppose you buy the stock today, and you plan to sell it next year, immediately after receiving the dividend. i. ii. At what price do you expect to sell your share next year? What is your expected dividend yield? What is your expected capital gain rate? What is your expected holding period return (HPR)? d. Suppose you buy the stock today, and you plan to sell it next year, immediately before the year 1 dividend is paid. i. At what price do you expect to sell your share next year in this case? What is your expected holding period return (HPR)? ii. 2. XYZ Inc is expected to pay the following dividends per share: $3.6 in one year, $4.5 in two years, $6 in three years and $8 in four years. The dividend is then expected to grow at 8% per year in perpetuity. The cost of capital for XYZ stock is 20%. e. Draw the timeline, showing the dividends at t =1, 2, 3, 4, 5, 6 and 7. a. What is the stock price? b. Suppose you buy the stock today, at the price calculated in part a, and you plan to sell it next year, immediately after receiving the dividend. i. At what price do you expect to sell your share next year? ii. What is your expected dividend yield? What is your expected capital gain rate? What is your expected holding period return (HPR)? c. Suppose you buy the stock today, at the price calculated in part a, and you plan to sell it next year, immediately before the year 1 dividend is paid. i. At what price do you expect to sell your share next year in this case? ii. What is your expected holding period return (HPR)? 3. You plan to retire in 50 years, and you have decided that it's time to start saving for retirement. You believe that, in order to live comfortably, you will need to have $1,000,000 in your account when you retire in 50 years. . To this end, you want to make equal annual contributions to a retirement account, starting today, and ending on your retirement date. You will make your first contribution today (at t=0) and your last contribution when you retire (at t = 50). The interest rate on the retirement account is 4%. How much do you have to contribute each year in order to reach your goal?

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the value of one share of IBM stock today we need to determine the present value of the future dividends The dividends are expected to grow at 20 per year for the first four years and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started