Question

1. Identify four risks that Elaine and Paul are exposed too (think risk management) and explain why they are risks and how the risks you

1. Identify four risks that Elaine and Paul are exposed too (think risk management) and explain why they are risks and how the risks you have identified impact their personal finances? You can answer this question without showing calculations.

2. Using the income approach, calculate the amount of life insurance should each purchase to protect their family finances? Round up to the nearest $10,000 and assume they will retire when Paul turns 65. Assume payments are at the beginning of the period, use real after-tax interest rate of 2%, and ignore the CPP benefits.

3. Are there any issues with their current life insurance coverage? Is there anything they should do, or change, that could protect them?

4. Based on your needs analysis, what type of life insurance should they purchase and why?

5. Are there any issues with their insurance coverage (ignore life insurance)? Should they consider any other type of insurance?

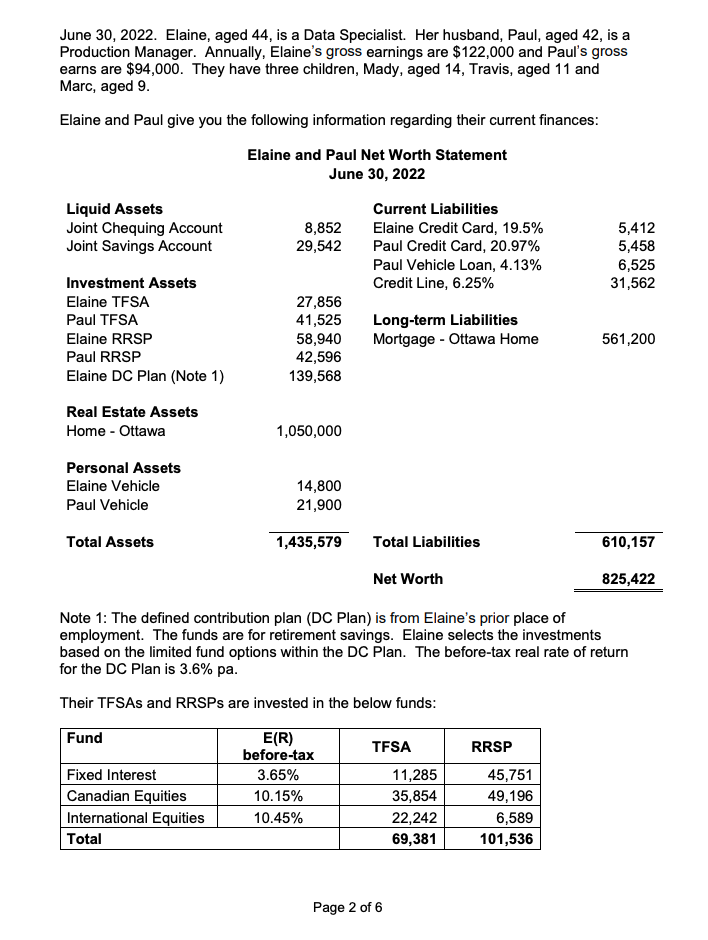

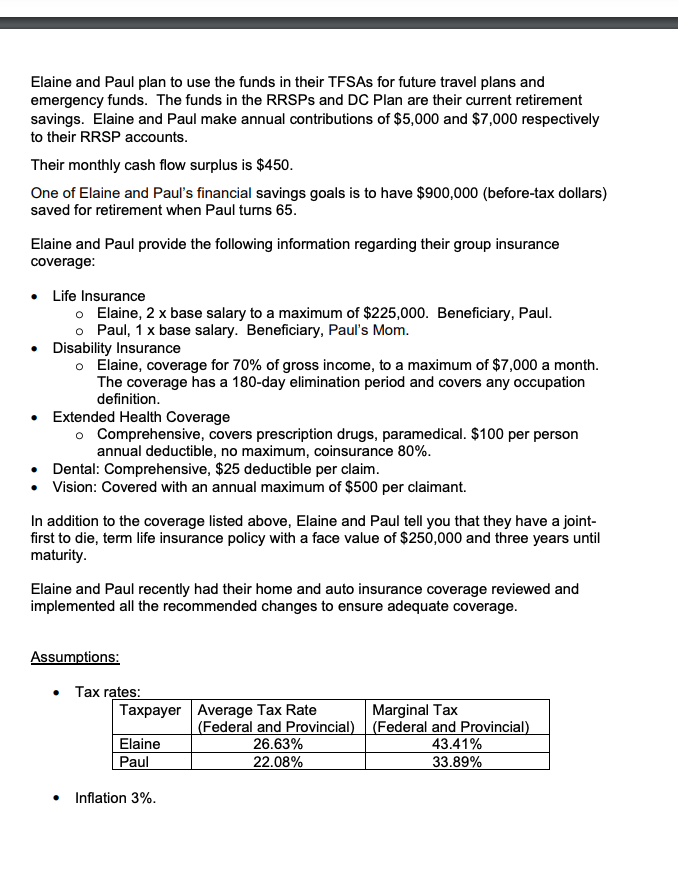

June 30, 2022. Elaine, aged 44, is a Data Specialist. Her husband, Paul, aged 42 , is a Production Manager. Annually, Elaine's gross earnings are $122,000 and Paul's gross earns are $94,000. They have three children, Mady, aged 14 , Travis, aged 11 and Marc, aged 9. Elaine and Paul give you the following information regarding their current finances: Note 1: The defined contribution plan (DC Plan) is from Elaine's prior place of employment. The funds are for retirement savings. Elaine selects the investments based on the limited fund options within the DC Plan. The before-tax real rate of return for the DC Plan is 3.6% pa. Their TFSAs and RRSPs are invested in the below funds: Page 2 of 6 Elaine and Paul plan to use the funds in their TFSAs for future travel plans and emergency funds. The funds in the RRSPs and DC Plan are their current retirement savings. Elaine and Paul make annual contributions of $5,000 and $7,000 respectively to their RRSP accounts. Their monthly cash flow surplus is $450. One of Elaine and Paul's financial savings goals is to have $900,000 (before-tax dollars) saved for retirement when Paul turns 65. Elaine and Paul provide the following information regarding their group insurance coverage: - Life Insurance - Elaine, 2x base salary to a maximum of $225,000. Beneficiary, Paul. - Paul, 1 x base salary. Beneficiary, Paul's Mom. - Disability Insurance - Elaine, coverage for 70% of gross income, to a maximum of $7,000 a month. The coverage has a 180-day elimination period and covers any occupation definition. - Extended Health Coverage - Comprehensive, covers prescription drugs, paramedical. $100 per person annual deductible, no maximum, coinsurance 80%. - Dental: Comprehensive, $25 deductible per claim. - Vision: Covered with an annual maximum of $500 per claimant. In addition to the coverage listed above, Elaine and Paul tell you that they have a jointfirst to die, term life insurance policy with a face value of $250,000 and three years until maturity. Elaine and Paul recently had their home and auto insurance coverage reviewed and implemented all the recommended changes to ensure adequate coverage. Assumptions: - Taumara - Inflation 3\%. June 30, 2022. Elaine, aged 44, is a Data Specialist. Her husband, Paul, aged 42 , is a Production Manager. Annually, Elaine's gross earnings are $122,000 and Paul's gross earns are $94,000. They have three children, Mady, aged 14 , Travis, aged 11 and Marc, aged 9. Elaine and Paul give you the following information regarding their current finances: Note 1: The defined contribution plan (DC Plan) is from Elaine's prior place of employment. The funds are for retirement savings. Elaine selects the investments based on the limited fund options within the DC Plan. The before-tax real rate of return for the DC Plan is 3.6% pa. Their TFSAs and RRSPs are invested in the below funds: Page 2 of 6 Elaine and Paul plan to use the funds in their TFSAs for future travel plans and emergency funds. The funds in the RRSPs and DC Plan are their current retirement savings. Elaine and Paul make annual contributions of $5,000 and $7,000 respectively to their RRSP accounts. Their monthly cash flow surplus is $450. One of Elaine and Paul's financial savings goals is to have $900,000 (before-tax dollars) saved for retirement when Paul turns 65. Elaine and Paul provide the following information regarding their group insurance coverage: - Life Insurance - Elaine, 2x base salary to a maximum of $225,000. Beneficiary, Paul. - Paul, 1 x base salary. Beneficiary, Paul's Mom. - Disability Insurance - Elaine, coverage for 70% of gross income, to a maximum of $7,000 a month. The coverage has a 180-day elimination period and covers any occupation definition. - Extended Health Coverage - Comprehensive, covers prescription drugs, paramedical. $100 per person annual deductible, no maximum, coinsurance 80%. - Dental: Comprehensive, $25 deductible per claim. - Vision: Covered with an annual maximum of $500 per claimant. In addition to the coverage listed above, Elaine and Paul tell you that they have a jointfirst to die, term life insurance policy with a face value of $250,000 and three years until maturity. Elaine and Paul recently had their home and auto insurance coverage reviewed and implemented all the recommended changes to ensure adequate coverage. Assumptions: - Taumara - Inflation 3\%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started