1. If Aircraft Parts makes the most conservative choices for all these adjustments that will result in the lowest net income number, what is the impact on assets and liabilities in terms of absolute dollar impact and percentage change?

2. If Aircraft Parts makes the least conservative choices for all these adjustments that will result in the highest net income number, what is the impact on assets and liabilities in terms of absolute dollar impact and percentage change?

3. What is the impact on the current ratio and the debt-to-equity ratio of these choices if management makes the most conservative choices? What is the impact on these ratios if management makes the least conservative choices?

I send it 2 parts, so it looks bigger, thanks

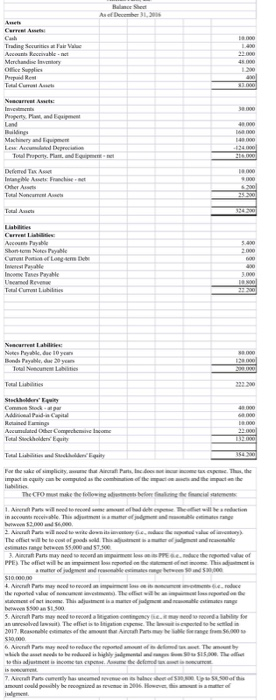

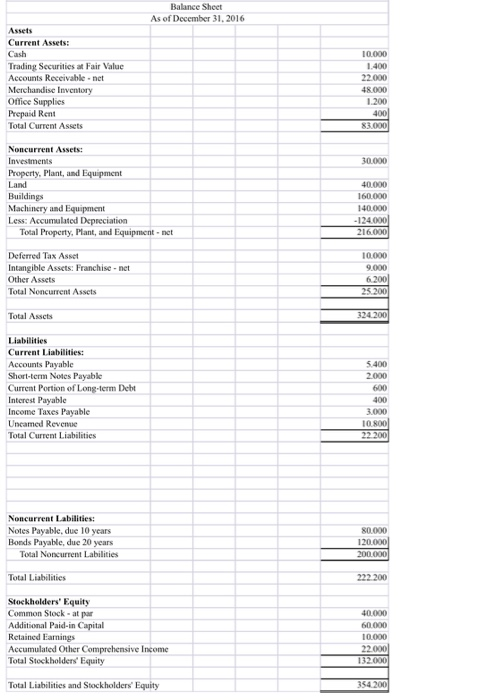

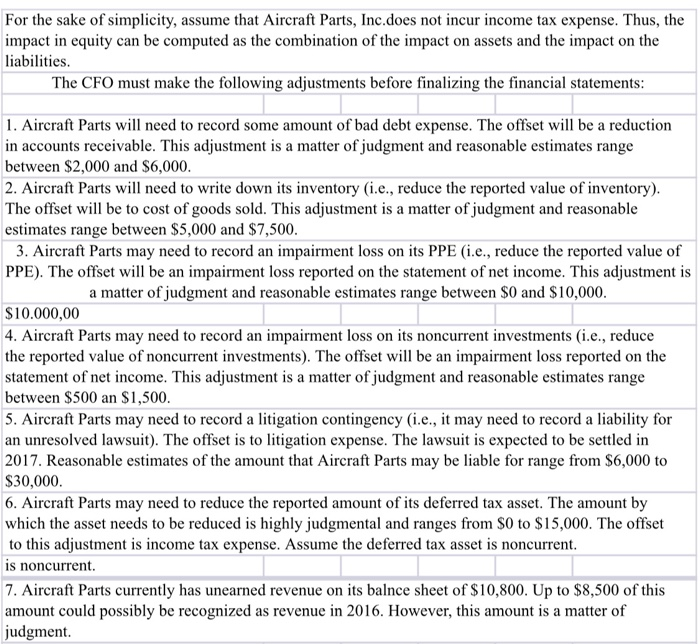

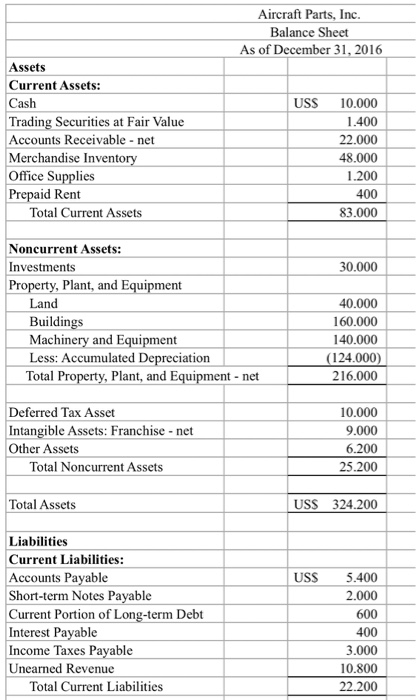

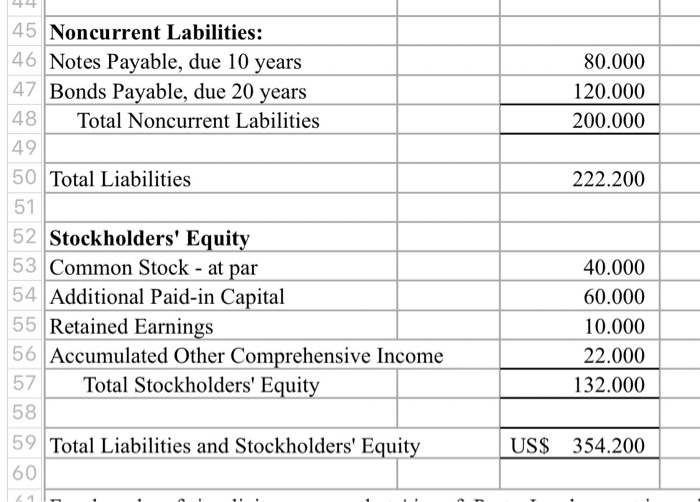

Machinery and me DTA Inne Franche- In Tess Parvable S hore' Equity Necumulated Other Competice come TL For the sake of city impact in quilty can become r as the com a te, Inc. e the Ther, the cand the impact on the The CFO o g film P will the 1 A in This is o n e The office will be too of good old Thist e d of Ara Panimonds Path PPE The Wilhet ed the thin reduse a bewon an to 5. A Parsed to reco vodlaw The 2017. Roofth r d for The orie di e rm000 Parth wie we were abby to this adjustment is income tax cp w 5.00. The w the defined 7. Party Based on the Balance Sheet As of December 31, 2016 Assets Current Assets: Cash Trading Securities at Fair Value Accounts Receivable.net Merchandise Inventory Office Supplies Prepaid Rent Total Current Assets 10.000 1.400 22000 48.000 1200 4001 8000 30.000 Noncurrent Assets: Investments Property, plant, and Equipment Land Buildings Machinery and Equipment Less: Accumulated Depreciation Total Property Mant, and Equipment-net 40.000 160.000 140.000 -124.000 216.000 Deferred Tax Asset Intangible Assets: Franchise - net Other Assets Total Noncurrent Assets 10.000 9.000 6.2001 25 200 Total Assets 324.200 5.400 2.000 Liabilities Current Liabilities: Accounts Payable Short-term Notes Payable Current Portion of Long-term Debt Interest Payable Income Taxes Payable Uncamed Revenue Total Current Liabilities 400 300 10.800 22 200 SOLO Noncurrent Labilities: Notes Payable, due 10 years Bonds Payable, due 20 years Total Noncurrent Labilities 120.000 200.000 Total Liabilities 222.200 Stockholders' Equity Common Stock - at par Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Income Total Stockholders' Equity 40.000 60 000 10.000 22.000 1327000 Total Liabilities and Stockholders' Equity 354.200 For the sake of simplicity, assume that Aircraft Parts, Inc.does not incur income tax expense. Thus, the impact in equity can be computed as the combination of the impact on assets and the impact on the liabilities. The CFO must make the following adjustments before finalizing the financial statements: 1. Aircraft Parts will need to record some amount of bad debt expense. The offset will be a reduction in accounts receivable. This adjustment is a matter of judgment and reasonable estimates range between $2,000 and $6,000. 2. Aircraft Parts will need to write down its inventory (i.e., reduce the reported value of inventory). The offset will be to cost of goods sold. This adjustment is a matter of judgment and reasonable estimates range between $5,000 and $7,500. 3. Aircraft Parts may need to record an impairment loss on its PPE (i.e., reduce the reported value of PPE). The offset will be an impairment loss reported on the statement of net income. This adjustment is a matter of judgment and reasonable estimates range between $0 and $10,000. $10.000,00 4. Aircraft Parts may need to record an impairment loss on its noncurrent investments (i.e., reduce the reported value of noncurrent investments). The offset will be an impairment loss reported on the statement of net income. This adjustment is a matter of judgment and reasonable estimates range between $500 an $1,500. 5. Aircraft Parts may need to record a litigation contingency (i.e., it may need to record a liability for an unresolved lawsuit). The offset is to litigation expense. The lawsuit is expected to be settled in 2017. Reasonable estimates of the amount that Aircraft Parts may be liable for range from $6,000 to $30,000. 6. Aircraft Parts may need to reduce the reported amount of its deferred tax asset. The amount by which the asset needs to be reduced is highly judgmental and ranges from $0 to $15,000. The offset to this adjustment is income tax expense. Assume the deferred tax asset is noncurrent. is noncurrent 7. Aircraft Parts currently has unearned revenue on its balnce sheet of $10,800. Up to $8,500 of this amount could possibly be recognized as revenue in 2016. However, this amount is a matter of judgment. Aircraft Parts, Inc. Balance Sheet As of December 31, 2016 USS Assets Current Assets: Cash Trading Securities at Fair Value Accounts Receivable - net Merchandise Inventory Office Supplies Prepaid Rent Total Current Assets 10.000 1.400 22.000 48.000 1.200 400 83.000 30.000 Noncurrent Assets: Investments Property, Plant, and Equipment Land Buildings Machinery and Equipment Less: Accumulated Depreciation Total Property, Plant, and Equipment - net 40.000 160.000 140.000 (124.000) 216.000 Deferred Tax Asset Intangible Assets: Franchise - net Other Assets Total Noncurrent Assets 10.000 9.000 6.200 25.200 Total Assets USS 324.200 USS Liabilities Current Liabilities: Accounts Payable Short-term Notes Payable Current Portion of Long-term Debt Interest Payable Income Taxes Payable Unearned Revenue Total Current Liabilities 5.400 2.000 600 400 3.000 10.800 22.200 80.000 120.000 200.000 222.200 44 45 Noncurrent Labilities: 46 Notes Payable, due 10 years 47 Bonds Payable, due 20 years Total Noncurrent Labilities 49 Total Liabilities 51 52 Stockholders' Equity Common Stock - at par 54 Additional Paid-in Capital 55 Retained Earnings Accumulated Other Comprehensive Income Total Stockholders' Equity 53 40.000 60.000 10.000 22.000 132.000 US$ 354.200 59 Total Liabilities and Stockholders' Equity 60