Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. If each stock in the DJIA goes up by $.50 per share, what is the point change in the DJIA if the divisor

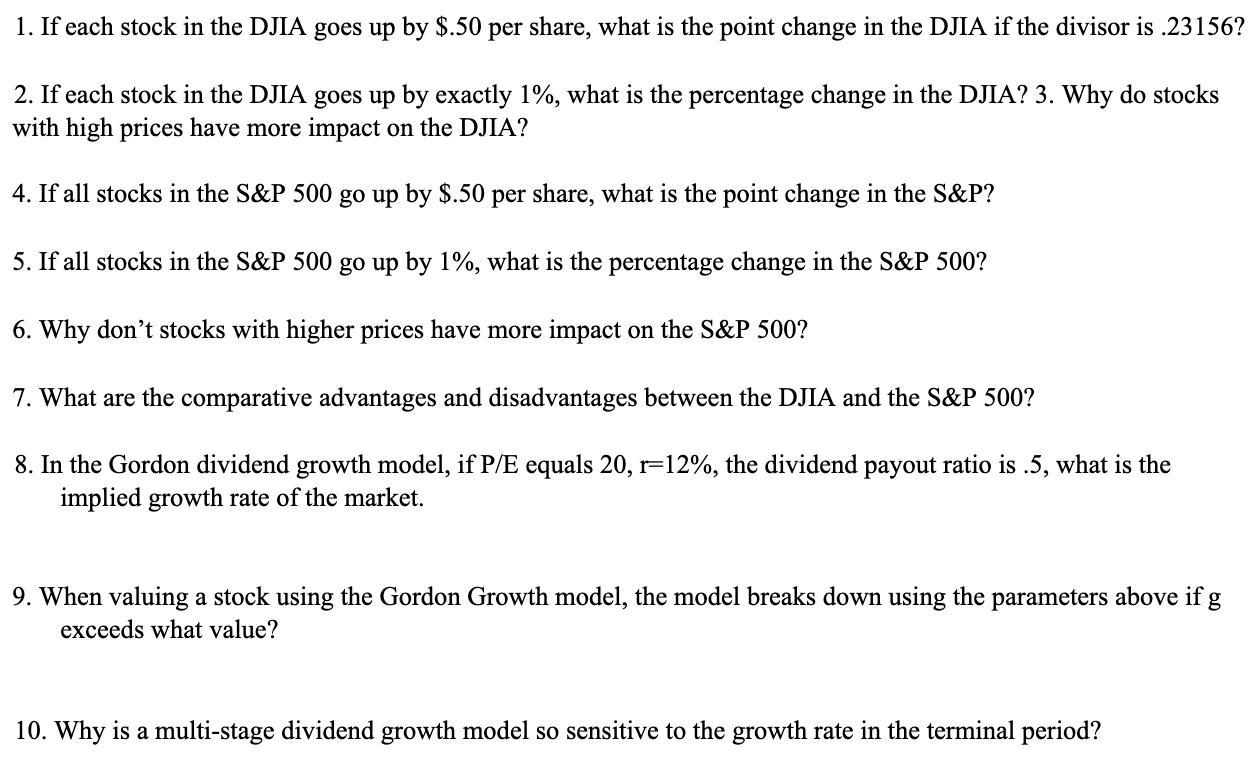

1. If each stock in the DJIA goes up by $.50 per share, what is the point change in the DJIA if the divisor is .23156? 2. If each stock in the DJIA goes up by exactly 1%, what is the percentage change in the DJIA? 3. Why do stocks with high prices have more impact on the DJIA? 4. If all stocks in the S&P 500 go up by $.50 per share, what is the point change in the S&P? 5. If all stocks in the S&P 500 go up by 1%, what is the percentage change in the S&P 500? 6. Why don't stocks with higher prices have more impact on the S&P 500? 7. What are the comparative advantages and disadvantages between the DJIA and the S&P 500? 8. In the Gordon dividend growth model, if P/E equals 20, r=12%, the dividend payout ratio is .5, what is the implied growth rate of the market. 9. When valuing a stock using the Gordon Growth model, the model breaks down using the parameters above if g exceeds what value? 10. Why is a multi-stage dividend growth model so sensitive to the growth rate in the terminal period?

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The DJIA is a priceweighted index so the point change is calculated by multiplying the price change of each stock by its weighting in the index the divisor is used to scale the index level If each sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started