Answered step by step

Verified Expert Solution

Question

1 Approved Answer

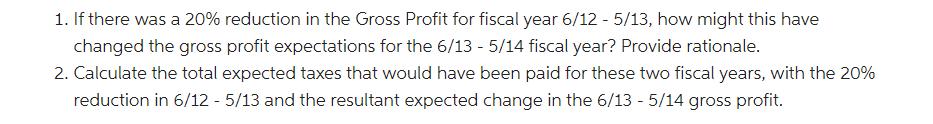

1. If there was a 20% reduction in the Gross Profit for fiscal year 6/12 - 5/13, how might this have changed the gross

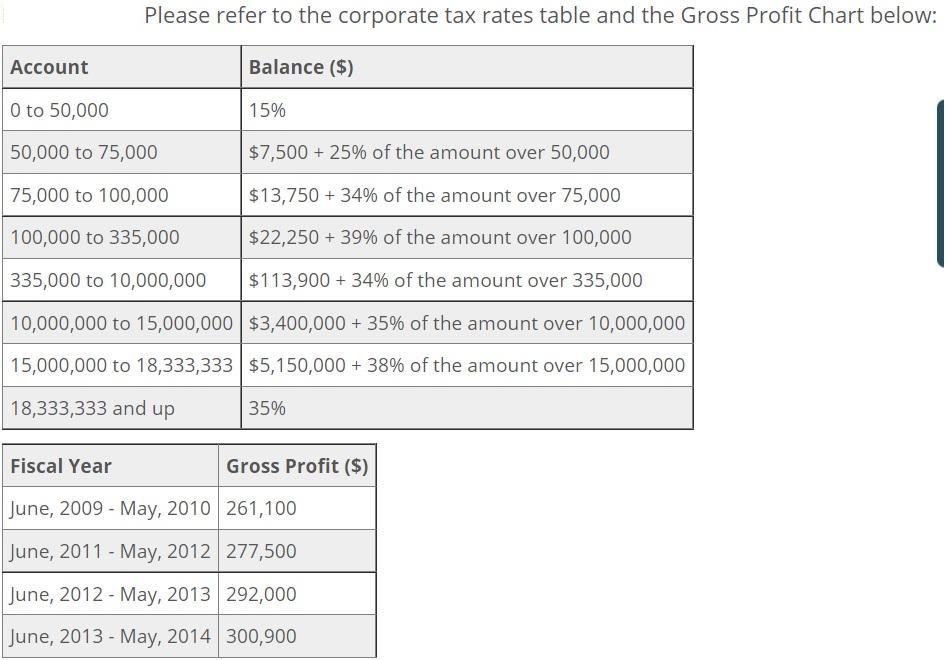

1. If there was a 20% reduction in the Gross Profit for fiscal year 6/12 - 5/13, how might this have changed the gross profit expectations for the 6/13 - 5/14 fiscal year? Provide rationale. 2. Calculate the total expected taxes that would have been paid for these two fiscal years, with the 20% reduction in 6/12 - 5/13 and the resultant expected change in the 6/13 - 5/14 gross profit. Account Please refer to the corporate tax rates table and the Gross Profit Chart below: Balance ($) 0 to 50,000 50,000 to 75,000 75,000 to 100,000 100,000 to 335,000 335,000 to 10,000,000 Fiscal Year $7,500 + 25% of the amount over 50,000 $13,750 + 34% of the amount over 75,000 $22,250 + 39% of the amount over 100,000 $113,900 + 34% of the amount over 335,000 10,000,000 to 15,000,000 $3,400,000 + 35% of the amount over 10,000,000 $5,150,000+ 38% of the amount over 15,000,000 15,000,000 to 18,333,333 18,333,333 and up 15% June, 2009 - May, 2010 June, 2011 - May, 2012 June, 2012 - May, 2013 June, 2013 - May, 2014 35% Gross Profit ($) 261,100 277,500 292,000 300,900

Step by Step Solution

★★★★★

3.56 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the expected gross profit for the fiscal year 613 514 with a 20 reduction in the gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started