Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) If you invest $5,000 today, how much will you have a) In 3 years at 6%? b) In 15 years at 8%? c)

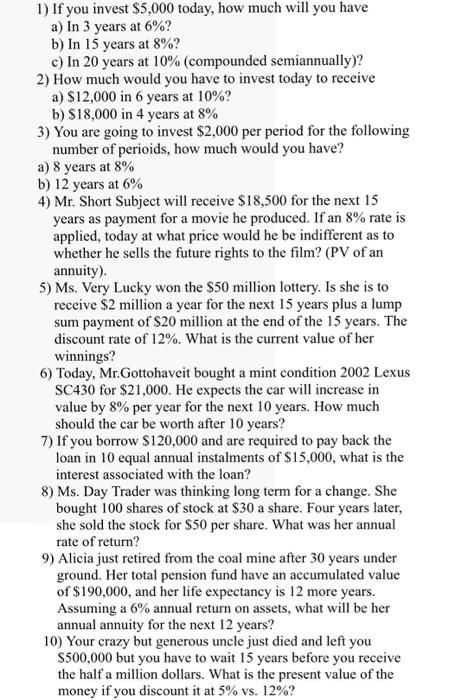

1) If you invest $5,000 today, how much will you have a) In 3 years at 6%? b) In 15 years at 8%? c) In 20 years at 10% (compounded semiannually)? 2) How much would you have to invest today to receive a) $12,000 in 6 years at 10%? b) $18,000 in 4 years at 8% 3) You are going to invest $2,000 per period for the following number of perioids, how much would you have? a) 8 years at 8% b) 12 years at 6% 4) Mr. Short Subject will receive $18,500 for the next 15 years as payment for a movie he produced. If an 8% rate is applied, today at what price would he be indifferent as to whether he sells the future rights to the film? (PV of an annuity). 5) Ms. Very Lucky won the $50 million lottery. Is she is to receive $2 million a year for the next 15 years plus a lump sum payment of $20 million at the end of the 15 years. The discount rate of 12%. What is the current value of her winnings? 6) Today, Mr.Gottohaveit bought a mint condition 2002 Lexus SC430 for $21,000. He expects the car will increase in value by 8% per year for the next 10 years. How much should the car be worth after 10 years? 7) If you borrow $120,000 and are required to pay back the loan in 10 equal annual instalments of $15,000, what is the interest associated with the loan? 8) Ms. Day Trader was thinking long term for a change. She bought 100 shares of stock at $30 a share. Four years later, she sold the stock for $50 per share. What was her annual rate of return? 9) Alicia just retired from the coal mine after 30 years under ground. Her total pension fund have an accumulated value of $190,000, and her life expectancy is 12 more years. Assuming a 6% annual return on assets, what will be her annual annuity for the next 12 years? 10) Your crazy but generous uncle just died and left you $500,000 but you have to wait 15 years before you receive the half a million dollars. What is the present value of the money if you discount it at 5% vs. 12%?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

If you Invest 5000 Today how much w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started