Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. If you use the yield to maturity on the 30 year United States treasury bond to discount the NOI of a property that is

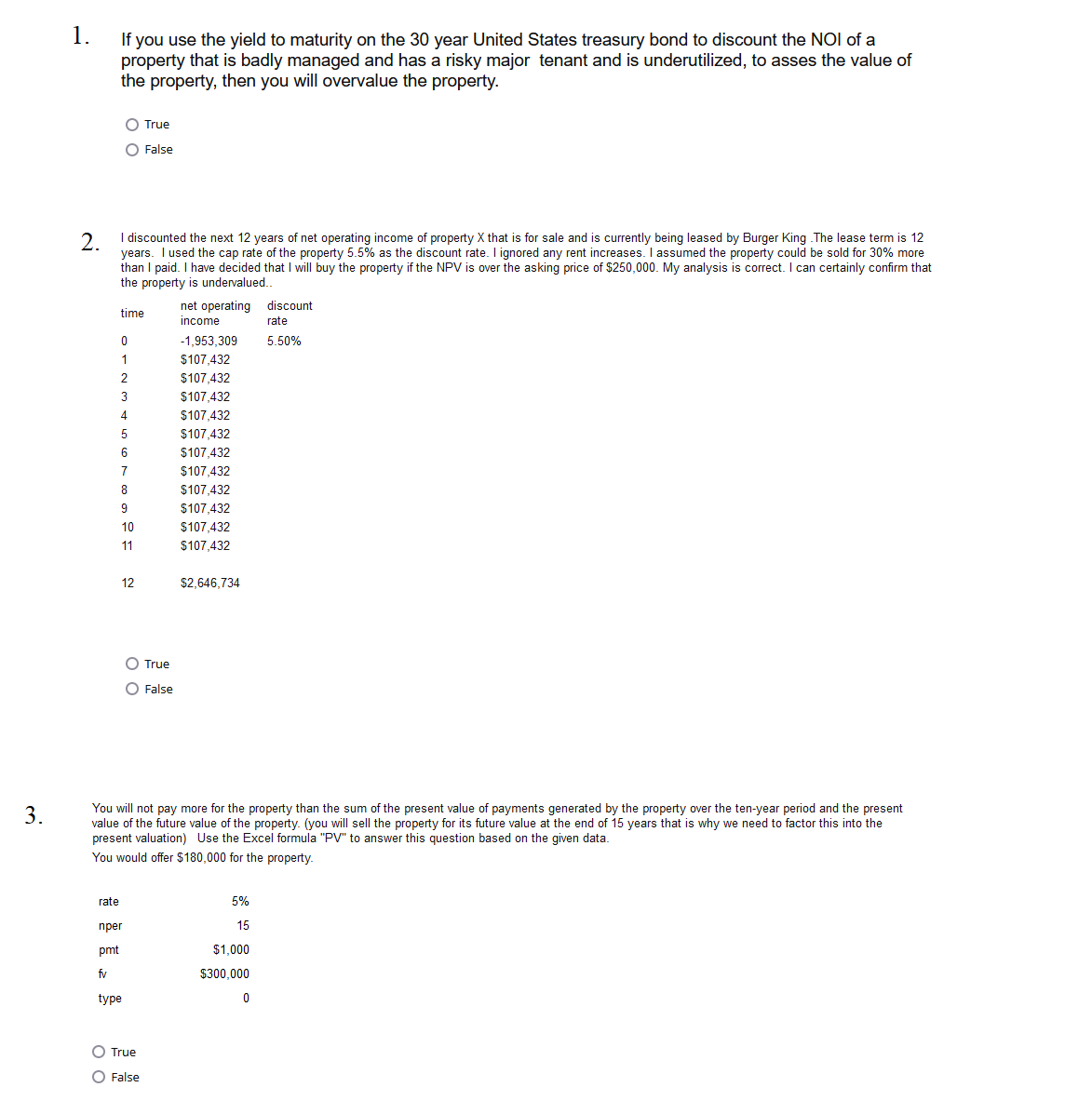

1. If you use the yield to maturity on the 30 year United States treasury bond to discount the NOI of a property that is badly managed and has a risky major tenant and is underutilized, to asses the value of the property, then you will overvalue the property. True False 2. I discounted the next 12 years of net operating income of property X that is for sale and is currently being leased by Burger King . The lease term is 12 years. I used the cap rate of the property 5.5% as the discount rate. I ignored any rent increases. I assumed the property could be sold for 30% more than I paid. I have decided that I will buy the property if the NPV is over the asking price of $250,000. My analysis is correct. I can certainly confirm that the property is undervalued.. 12 $2,646,734 True False 3. You will not pay more for the property than the sum of the present value of payments generated by the property over the ten-year period and the present value of the future value of the property. (you will sell the property for its future value at the end of 15 years that is why we need to factor this into the present valuation) Use the Excel formula "PV" to answer this question based on the given data. You would offer $180,000 for the property. True False

1. If you use the yield to maturity on the 30 year United States treasury bond to discount the NOI of a property that is badly managed and has a risky major tenant and is underutilized, to asses the value of the property, then you will overvalue the property. True False 2. I discounted the next 12 years of net operating income of property X that is for sale and is currently being leased by Burger King . The lease term is 12 years. I used the cap rate of the property 5.5% as the discount rate. I ignored any rent increases. I assumed the property could be sold for 30% more than I paid. I have decided that I will buy the property if the NPV is over the asking price of $250,000. My analysis is correct. I can certainly confirm that the property is undervalued.. 12 $2,646,734 True False 3. You will not pay more for the property than the sum of the present value of payments generated by the property over the ten-year period and the present value of the future value of the property. (you will sell the property for its future value at the end of 15 years that is why we need to factor this into the present valuation) Use the Excel formula "PV" to answer this question based on the given data. You would offer $180,000 for the property. True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started