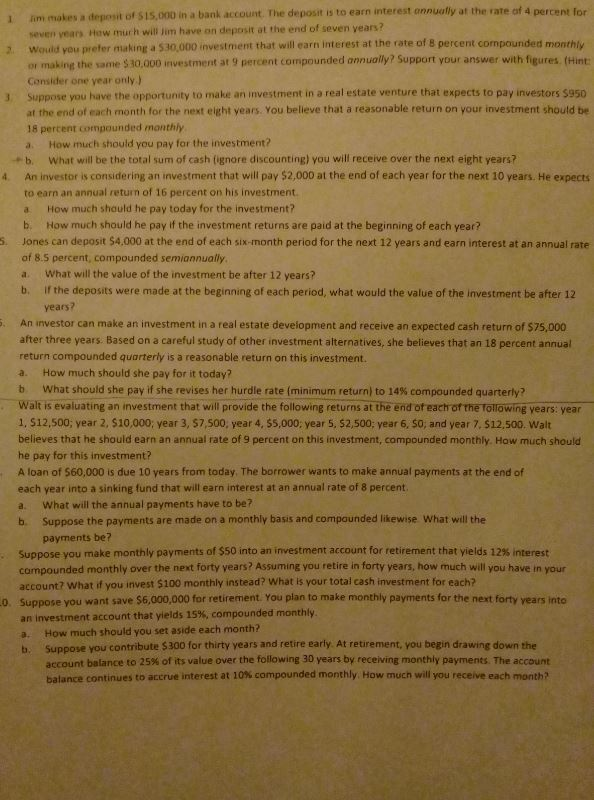

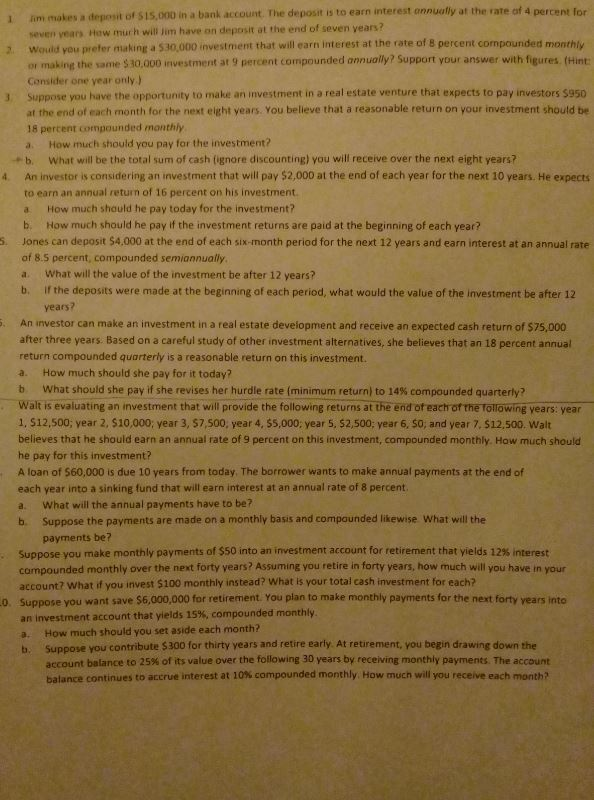

1 im makes a deposit of $15,000 in a bank account. The deposit is to earn interest onnually at the rate af 4 percent for seven years Haw murh will lim have on deposit at the end of seven vears? 2. Would you preter making a 530,000 investment that will earn interest at the rate of 8 percent compounded monthly or making the same $ 30,000 investment at 9 percent compounded annually? Support your answer with figures, (Hint Consider one year only ) 3 Suppose you have the opportunity to make an imvestment in a real estate venture that expects to pay investors $950 at the end of each month for the next eight years. You believe that a reasonable return on your investment should be 18 percent compounded monthly How much should you pay for the investment? b. What will be the total sum of cash (ignore discounting) you will receive over the next eight years? An investor is considering an investment that will pay $2,000 at the end of each year for the next 10 years. He expects to earn an annual return of 16 percent on his investment. 4. How much should he pay today for the investment? b. How much should he pay if the investment returns are paid at the beginning of each year? Jones can deposit $4,000 at the end of each six-month period for the next 12 years and earn interest at an annual rate of 8.5 percent, compounded semiannually a. What will the value of the investment be after 12 years? b. If the deposits were made at the beginning of each period, what would the value of the investment be after 12 S. years? An investor can make an investment in a real estate development and receive an expected cash return of $75,000 after three years. Based on a careful study of other investment alternatives, she believes that an 18 percent annual return compounded quarterly is a reasonable return on this investment. a. How much should she pay for it today? b what should she pay if she revises her hurdle rate (minimum return) to 14% compounded quarterly? Walt is evaluating an investment that will provide the following returns at the end of eachr of the following years: yea 1, $12,500; year 2, $10,000; year 3, $7,500, year 4, 55,000: year 5, $2,500; year 6, 50, and year 7, $12,500. Walt believes that he should earn an annual rate of 9 percent on this investment, compounded monthly. How much should he pay for this investment? A loan of $60,000 is due 10 years from today. The borrower wants to make annual payments at the end of each year into a sinking fund that will earn interest at an annual rate of 8 percent What will the annual payments have to be? b. Suppose the payments are made on a monthly basis and compounded likewise What wll the payments be? Suppose you make monthly payments of S50 into an investment account for retirement that yields 12% interest campounded monthly over the next forty years? Assuming you retire in forty years, how much will you have in your account? What if you invest $100 monthly instead? What is your totai cash investment for each? Suppose you want save $6,000,000 for retirement. You plan to make monthly payments for the next forty years into an investment account that yields 15%. compounded monthly o. How much should you set aside each month b. Suppose you contribute $300 for thirty years and retire early At retirement, you begin drawing down the account balance to 25% of its value over the following 30 years by receiving monthly payments. The account balance continues to accrue interest at 10% compounded monthly How much will you receive each month