Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In a severe recession, the major source of risk faced by investors who purchase corporate bonds is A) purchasing power risk. B) interest

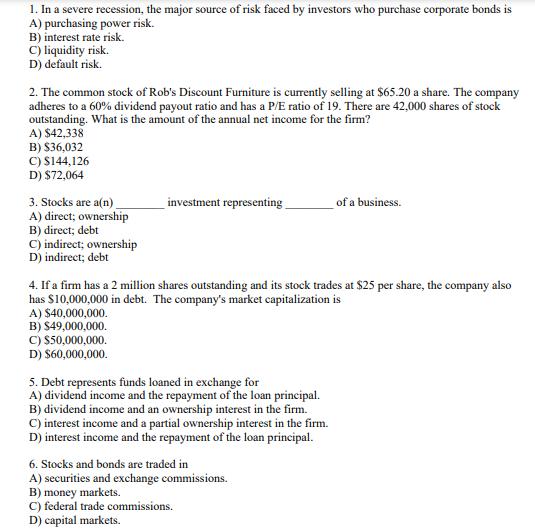

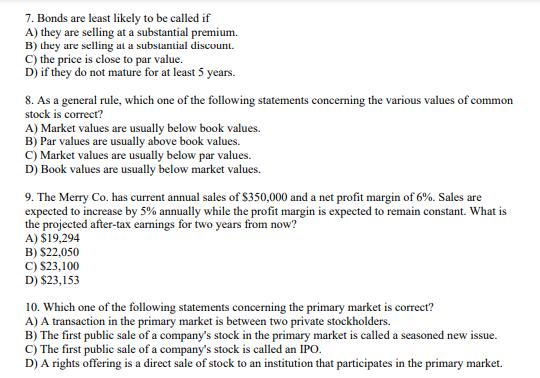

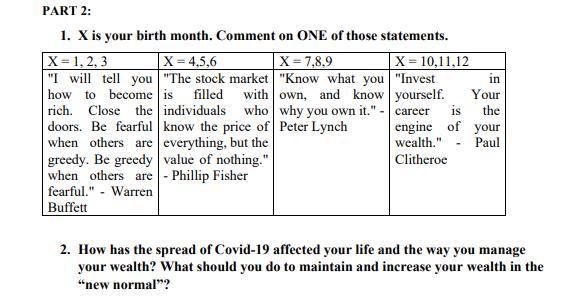

1. In a severe recession, the major source of risk faced by investors who purchase corporate bonds is A) purchasing power risk. B) interest rate risk. C) liquidity risk. D) default risk. 2. The common stock of Rob's Discount Furniture is currently selling at $65.20 a share. The company adheres to a 60% dividend payout ratio and has a P/E ratio of 19. There are 42,000 shares of stock outstanding. What is the amount of the annual net income for the firm? A) $42,338 B) $36,032 $144,126 C) D) $72,064 3. Stocks are a(n)_ A) direct; ownership B) direct; debt C) indirect; ownership D) indirect; debt investment representing C) $50,000,000. D) $60,000,000. 4. If a firm has a 2 million shares outstanding and its stock trades at $25 per share, the company also has $10,000,000 in debt. The company's market capitalization is A) $40,000,000. B) $49,000,000. 5. Debt represents funds loaned in exchange for A) dividend income and the repayment of the loan principal. B) dividend income and an ownership interest in the firm. C) interest income and a partial ownership interest in the firm. D) interest income and the repayment of the loan principal. of a business. 6. Stocks and bonds are traded in A) securities and exchange commissions. B) money markets. C) federal trade commissions. D) capital markets. 7. Bonds are least likely to be called if A) they are selling at a substantial premium. B) they are selling at a substantial discount. C) the price is close to par value. D) if they do not mature for at least 5 years. 8. As a general rule, which one of the following statements concerning the various values of common stock is correct? A) Market values are usually below book values. B) Par values are usually above book values. C) Market values are usually below par values. D) Book values are usually below market values. 9. The Merry Co. has current annual sales of $350,000 and a net profit margin of 6%. Sales are expected to increase by 5% annually while the profit margin is expected to remain constant. What is the projected after-tax earnings for two years from now? A) $19,294 B) $22,050 C) $23,100 D) $23,153 10. Which one of the following statements concerning the primary market is correct? A) A transaction in the primary market is between two private stockholders. B) The first public sale of a company's stock in the primary market is called a seasoned new issue. C) The first public sale of a company's stock is called an IPO. D) A rights offering is a direct sale of stock to an institution that participates in the primary market. PART 2: 1. X is your birth month. Comment on ONE of those statements. X = 1, 2, 3 X= 7,8,9 "Know what you filled with own, and know X = 10,11,12 "Invest in "I will tell you how to become rich. Close the doors. Be fearful when others are why you own it." - Peter Lynch yourself. Your career is the engine of your wealth." - Paul Clitheroe X = 4,5,6 "The stock market is individuals who know the price of everything, but the value of nothing." greedy. Be greedy when others are - Phillip Fisher fearful." - Warren Buffett 2. How has the spread of Covid-19 affected your life and the way you manage your wealth? What should you do to maintain and increase your wealth in the "new normal"?

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The common stock of Robs Discount Furniture is currently selling at 6520 a share The co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started