Answered step by step

Verified Expert Solution

Question

1 Approved Answer

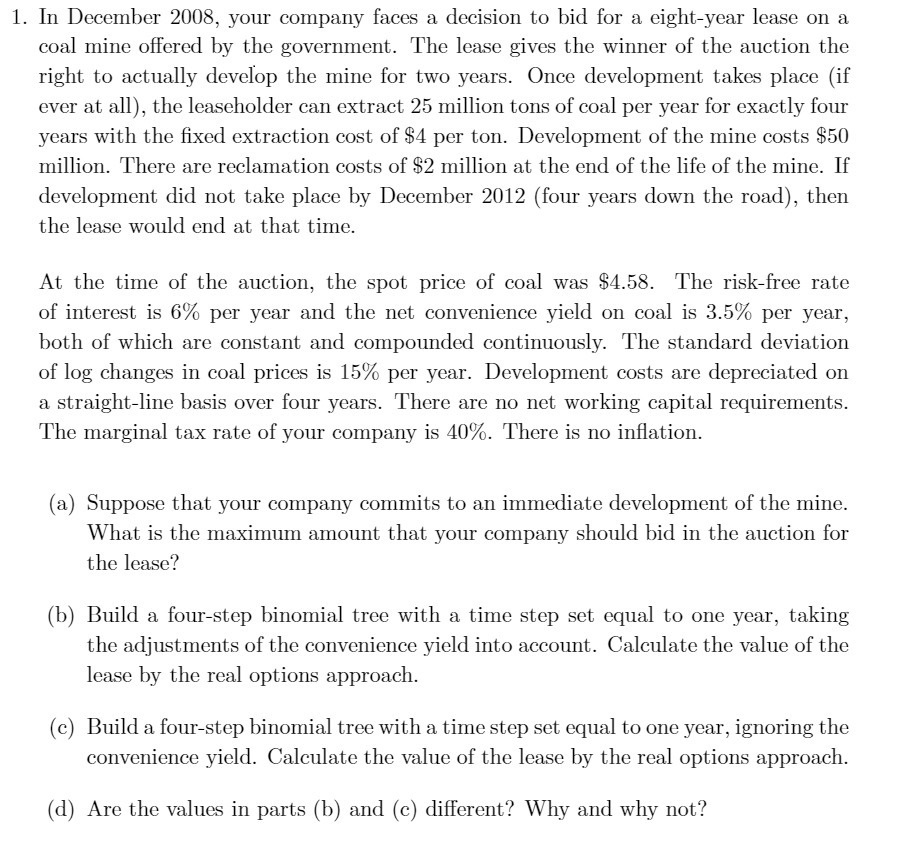

1. In December 2008, your company faces a decision to bid for a eight-year lease on a coal mine offered by the government. The

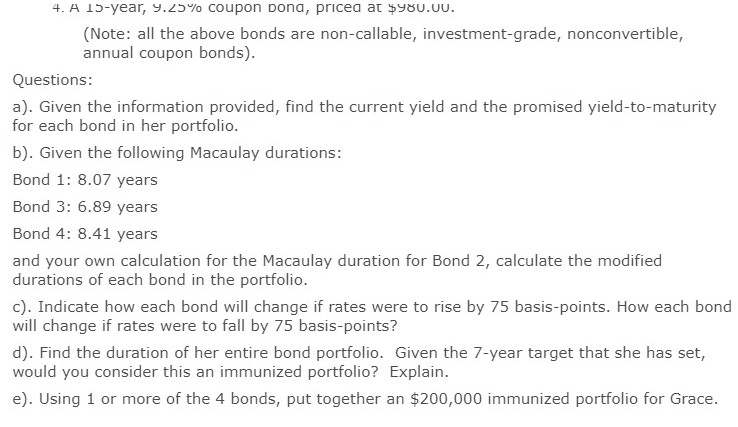

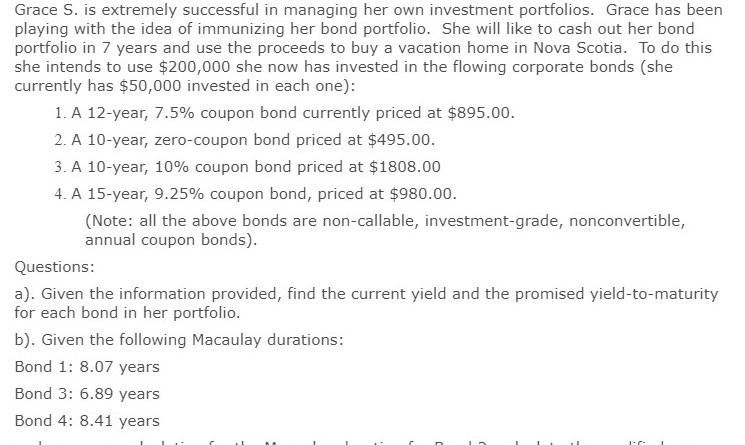

1. In December 2008, your company faces a decision to bid for a eight-year lease on a coal mine offered by the government. The lease gives the winner of the auction the right to actually develop the mine for two years. Once development takes place (if ever at all), the leaseholder can extract 25 million tons of coal per year for exactly four years with the fixed extraction cost of $4 per ton. Development of the mine costs $50 million. There are reclamation costs of $2 million at the end of the life of the mine. If development did not take place by December 2012 (four years down the road), then the lease would end at that time. At the time of the auction, the spot price of coal was $4.58. The risk-free rate of interest is 6% per year and the net convenience yield on coal is 3.5% per year, both of which are constant and compounded continuously. The standard deviation of log changes in coal prices is 15% per year. Development costs are depreciated on a straight-line basis over four years. There are no net working capital requirements. The marginal tax rate of your company is 40%. There is no inflation. (a) Suppose that your company commits to an immediate development of the mine. What is the maximum amount that your company should bid in the auction for the lease? (b) Build a four-step binomial tree with a time step set equal to one year, taking the adjustments of the convenience yield into account. Calculate the value of the lease by the real options approach. (c) Build a four-step binomial tree with a time step set equal to one year, ignoring the convenience yield. Calculate the value of the lease by the real options approach. (d) Are the values in parts (b) and (c) different? Why and why not? 4. A 15-year, 9.25% coupon pona, priced at $980.00. (Note: all the above bonds are non-callable, investment-grade, nonconvertible, annual coupon bonds). Questions: a). Given the information provided, find the current yield and the promised yield-to-maturity for each bond in her portfolio. b). Given the following Macaulay durations: Bond 1: 8.07 years Bond 3: 6.89 years Bond 4: 8.41 years and your own calculation for the Macaulay duration for Bond 2, calculate the modified durations of each bond in the portfolio. c). Indicate how each bond will change if rates were to rise by 75 basis-points. How each bond will change if rates were to fall by 75 basis-points? d). Find the duration of her entire bond portfolio. Given the 7-year target that she has set, would you consider this an immunized portfolio? Explain. e). Using 1 or more of the 4 bonds, put together an $200,000 immunized portfolio for Grace. Grace S. is extremely successful in managing her own investment portfolios. Grace has been playing with the idea of immunizing her bond portfolio. She will like to cash out her bond portfolio in 7 years and use the proceeds to buy a vacation home in Nova Scotia. To do this she intends to use $200,000 she now has invested in the flowing corporate bonds (she currently has $50,000 invested in each one): 1. A 12-year, 7.5% coupon bond currently priced at $895.00. 2. A 10-year, zero-coupon bond priced at $495.00. 3. A 10-year, 10% coupon bond priced at $1808.00 4. A 15-year, 9.25% coupon bond, priced at $980.00. (Note: all the above bonds are non-callable, investment-grade, nonconvertible, annual coupon bonds). Questions: a). Given the information provided, find the current yield and the promised yield-to-maturity for each bond in her portfolio. b). Given the following Macaulay durations: Bond 1: 8.07 years Bond 3: 6.89 years Bond 4: 8.41 years

Step by Step Solution

★★★★★

3.61 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Current Yield and YieldtoMaturity for each bond Bond 1 Current Yield Coupon Rate Price 75 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started