Answered step by step

Verified Expert Solution

Question

1 Approved Answer

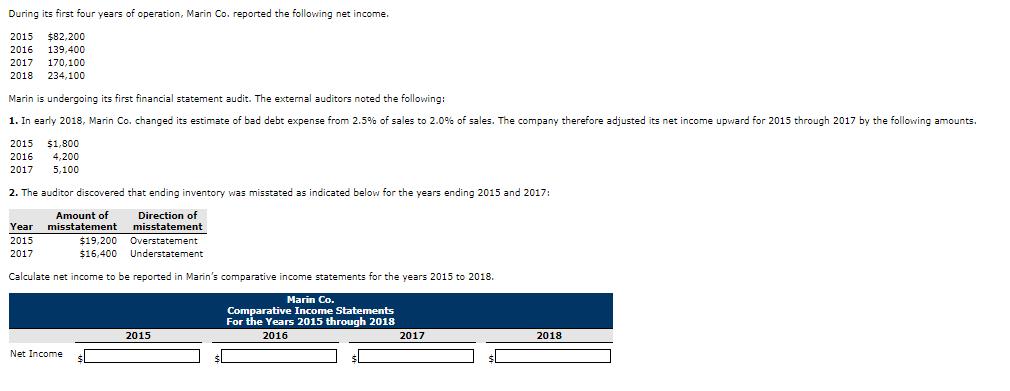

During its first four years of operation, Marin Co. reported the following net income. 2015 $82,200 2016 139,400 2017 170,100 2018 234,100 Marin is

During its first four years of operation, Marin Co. reported the following net income. 2015 $82,200 2016 139,400 2017 170,100 2018 234,100 Marin is undergoing its first financial statement audit. The external auditors noted the following: 1. In early 2018, Marin Co. changed its estimate of bad debt expense from 2.5% of sales to 2.0% of sales. The company therefore adjusted its net income upward for 2015 through 2017 by the following amounts. 2015 $1,800 2016 4,200 2017 5,100 2. The auditor discovered that ending inventory was misstated as indicated below for the years ending 2015 and 2017: Amount of Direction of misstatement Year misstatement Overstatement 2015 2017 $19,200 $16,400 Understatement Calculate net income to be reported in Marin's comparative income statements for the years 2015 to 2018. Marin Co. Comparative Income Statements For the Years 2015 through 2018 2016 Net Income 2015 2017 2018

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Bad debt Reducing the percentage of estimate of bad debts from 25 to 2 of sales will lead to oversta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started