Answered step by step

Verified Expert Solution

Question

1 Approved Answer

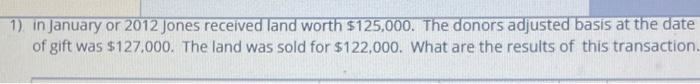

1) in January or 2012 Jones received land worth $125,000. The donors adjusted basis at the date of gift was $127.000. The land was

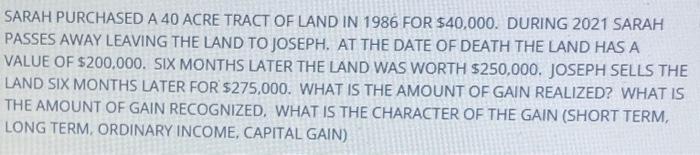

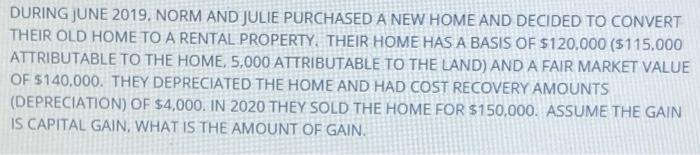

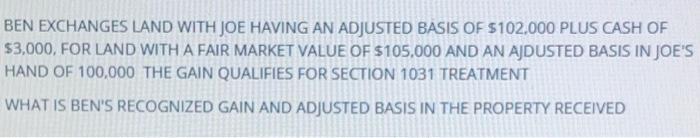

1) in January or 2012 Jones received land worth $125,000. The donors adjusted basis at the date of gift was $127.000. The land was sold for $122,000. What are the results of this transaction. SARAH PURCHASED A 40 ACRE TRACT OF LAND IN 1986 FOR $40,000. DURING 2021 SARAH PASSES AWAY LEAVING THE LAND TO JOSEPH. AT THE DATE OF DEATH THE LAND HAS A VALUE OF $200,000. SIX MONTHS LATER THE LAND WAS WORTH $250,000. JOSEPH SELLS THE LAND SIX MONTHS LATER FOR $275,000. WHAT IS THE AMOUNT OF GAIN REALIZED? WHAT IS THE AMOUNT OF GAIN RECOGNIZED, WHAT IS THE CHARACTER OF THE GAIN (SHORT TERM, LONG TERM, ORDINARY INCOME, CAPITAL GAIN) DURING JUNE 2019, NORM AND JULIE PURCHASED A NEW HOME AND DECIDED TO CONVERT THEIR OLD HOME TO A RENTAL PROPERTY. THEIR HOME HAS A BASIS OF $120.000 ($115.000 ATTRIBUTABLE TO THE HOME, 5.000 ATTRIBUTABLE TO THE LAND) AND A FAIR MARKET VALUE OF $140,000. THEY DEPRECIATED THE HOME AND HAD COST RECOVERY AMOUNTS (DEPRECIATION) OF $4,000. IN 2020 THEY SOLD THE HOME FOR $150,000. ASSUME THE GAIN IS CAPITAL GAIN, WHAT IS THE AMOUNT OF GAIN. BEN EXCHANGES LAND WITH JOE HAVING AN ADJUSTED BASIS OF $102.000 PLUS CASH OF $3,000, FOR LAND WITH A FAIR MARKET VALUE OF $105,000 AND AN AJDUSTED BASIS IN JOE'S HAND OF 100,000 THE GAIN QUALIFIES FOR SECTION 1031 TREATMENT WHAT IS BEN'S RECOGNIZED GAIN AND ADJUSTED BASIS IN THE PROPERTY RECEIVED

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The amount of gain realized is 30000 The amount of gain recognized is 26000 The character of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started