Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. In the attached excel file, the sheet named KL shows the following table, in which KL's profits are displayed for various price combinations.

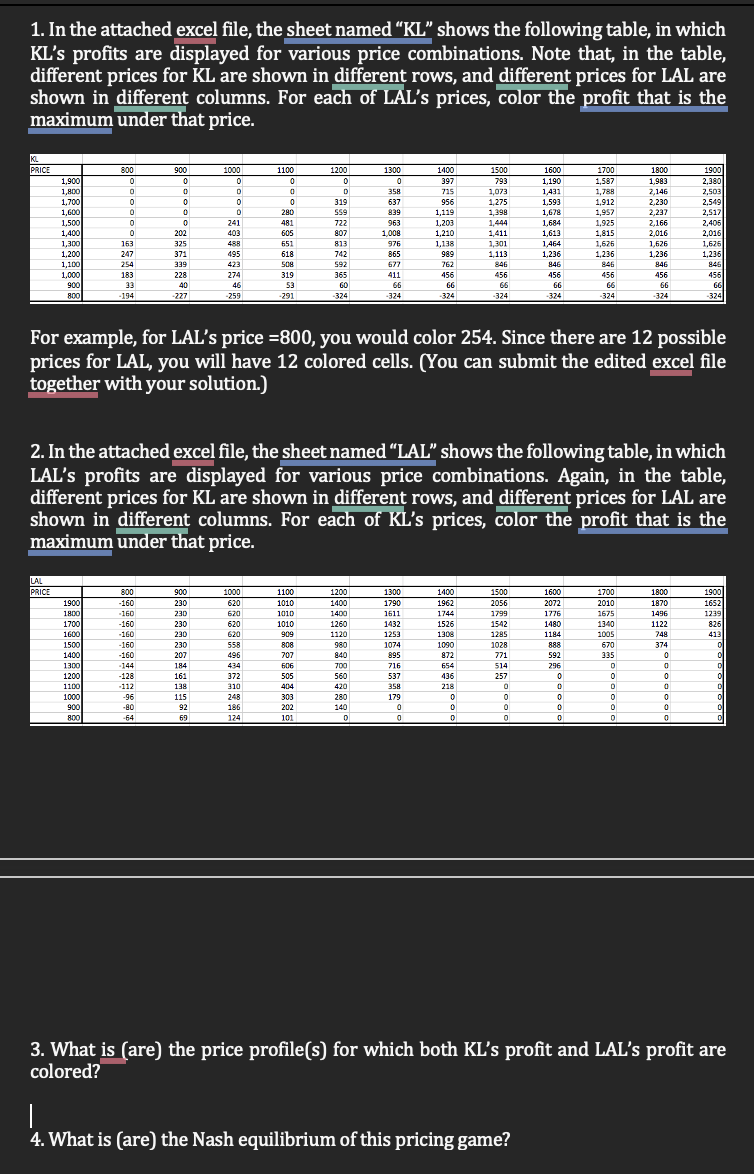

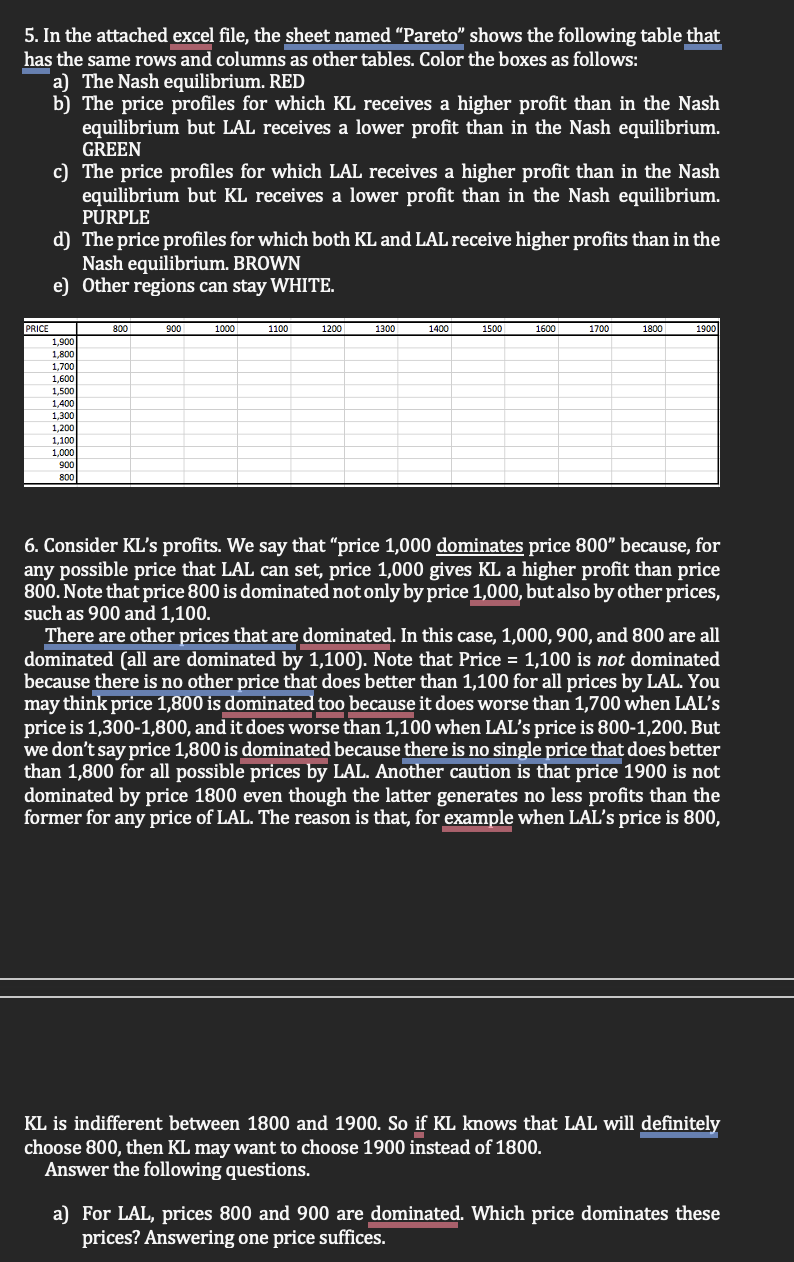

1. In the attached excel file, the sheet named "KL" shows the following table, in which KL's profits are displayed for various price combinations. Note that, in the table, different prices for KL are shown in different rows, and different prices for LAL are shown in different columns. For each of LAL's prices, color the profit that is the maximum under that price. KL PRICE 800 900 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900 1,900 0 0 0 0 0 0 397 793 1,190 1,587 1,983 2,380 1,800 0 0 0 D 358 715 1,073 1,431 1,788 2,146 2,503 1,700 0 0 0 319 637 956 1,275 1,593 1,912 2,230 2,549 1,600 0 280 559 839 1,119 1,398 1,678 1,957 2,237 2,517 1,500 0 241 481 722 963 1,203 1,444 1,684 1,925 2,166 2,405 1,400 0 202 403 605 807 1,008 1,210 1,411 1,613 1,815 2,016 2,016 1,300 163 325 488 651 813 976 1,138 1,301 1,464 1,626 1,626 1,626 1,200 247 371 495 618 742 865 989 1,113 1,236 1,236 1,236 1,236 1,100 254 339 423 508 592 677 762 846 846 846 846 846 1,000 183 228 274 319 365 411 456 456 456 456 456 456 900 33 40 46 53 60 66 66 66 66 66 66 66 800 -194 -227 -259 -291 -324 -324 -324 -324 -324 -324 -324 -324 For example, for LAL's price =800, you would color 254. Since there are 12 possible prices for LAL, you will have 12 colored cells. (You can submit the edited excel file together with your solution.) 2. In the attached excel file, the sheet named "LAL" shows the following table, in which LAL's profits are displayed for various price combinations. Again, in the table, different prices for KL are shown in different rows, and different prices for LAL are shown in different columns. For each of KL's prices, color the profit that is the maximum under that price. LAL PRICE 800 900 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900 1900 -160 230 620 1010 1400 1790 1962 2056 2072 2010 1870 1652 1800 -160 230 620 1010 1400 1611 1744 1799 1776 1675 1496 1239 1700 -160 230 620 1010 1260 1432 1526 1542 1480 1340 1122 826 1600 -160 230 620 909 1120 1253 1308 1285 1184 1005 748 413 1500 -160 230 558 808 980 1074 1090 1028 888 670 374 0 1400 -160 207 496 707 840 895 872 771 592 335 0 0 1300 -144 184 434 606 700 716 654 514 296 0 D 1200 -128 161 372 505 560 537 436 257 0 0 0 0 1100 -112 138 310 404 420 358 218 0 0 0 0 D 1000 -96 115 248 303 280 179 0 0 0 0 0 900 -80 92 186 202 140 0 0 0 0 0 0 D 800 -64 69 124 101 0 0 0 0 0 0 3. What is (are) the price profile(s) for which both KL's profit and LAL's profit are colored? 4. What is (are) the Nash equilibrium of this pricing game? 5. In the attached excel file, the sheet named "Pareto" shows the following table that has the same rows and columns as other tables. Color the boxes as follows: a) The Nash equilibrium. RED b) The price profiles for which KL receives a higher profit than in the Nash equilibrium but LAL receives a lower profit than in the Nash equilibrium. GREEN c) The price profiles for which LAL receives a higher profit than in the Nash equilibrium but KL receives a lower profit than in the Nash equilibrium. PURPLE d) The price profiles for which both KL and LAL receive higher profits than in the Nash equilibrium. BROWN e) Other regions can stay WHITE. PRICE 800 900 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900 1,900 1,800 1,700 1,600 1,500 1,400 1,300 1,200 1,100 1,000 900 800 6. Consider KL's profits. We say that "price 1,000 dominates price 800" because, for any possible price that LAL can set, price 1,000 gives KL a higher profit than price 800. Note that price 800 is dominated not only by price 1,000, but also by other prices, such as 900 and 1,100. There are other prices that are dominated. In this case, 1,000, 900, and 800 are all dominated (all are dominated by 1,100). Note that Price =1,100 is not dominated because there is no other price that does better than 1,100 for all prices by LAL. You may think price 1,800 is dominated too because it does worse than 1,700 when LAL's price is 1,300-1,800, and it does worse than 1,100 when LAL's price is 800-1,200. But we don't say price 1,800 is dominated because there is no single price that does better than 1,800 for all possible prices by LAL. Another caution is that price 1900 is not dominated by price 1800 even though the latter generates no less profits than the former for any price of LAL. The reason is that, for example when LAL's price is 800, KL is indifferent between 1800 and 1900. So if KL knows that LAL will definitely choose 800, then KL may want to choose 1900 instead of 1800. Answer the following questions. a) For LAL, prices 800 and 900 are dominated. Which price dominates these prices? Answering one price suffices. b) Now, consider a smaller payoff table in which KL's price can take only 1,100- 1,900 and LAL's price can only take 1,000-1,900. In this small table, KL's price of 1,100 is dominated by price 1,200 because, for any price of LAL between 1,000 and 1,900, 1,200 does better than 1,100. Note that 1,100 was not dominated by 1,200 before deleting the prices 800 and 900 from the choice set of LAL. This is because, if LAL's price was 800, 1,100 would do better than 1,200. There is one more price that is dominated. What is it? In the same way, consider LAL's price. In the small payoff table in which KL's price can take only 1,100-1,900 and LAL's price can only take 1,000-1,900, there are four prices of LAL that are dominated. What are they? c) At this point we have deleted five prices from the choice set of KL and six prices from LAL's choice set. In the resulting small table, now, identify the prices that are dominated. d) Proceed in the same fashion until you have no price that is dominated. What are the price(s) that are left? 7. Suppose that LAL commits to its price, and then observing the committed price, KL makes its pricing decision. What is LAL's optimal choice in this game, and what is KL's optimal choice? Does KL's profit increase compared to the profit under the Nash equilibrium? Does LAL's profit increase? 8. Suppose that KL commits to its price, and then observing the committed price, LAL makes its pricing decision. What is KL's optimal choice in this game, and what is LAL'S optimal choice? Does KL's profit increase compared to the profit under the Nash equilibrium? Does LAL's profit increase? 9. (bonus, extra credit) Comparing the answers from the above two questions, is it better to be the first mover or the second mover? If your answer is "the first mover," can you come up with an example of a pricing game in which it is better to be the second mover than to be the first mover? If your answer is "the second mover," can you come up with an example of a pricing game in which it is better to be the first mover than to be the second mover?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started