Answered step by step

Verified Expert Solution

Question

1 Approved Answer

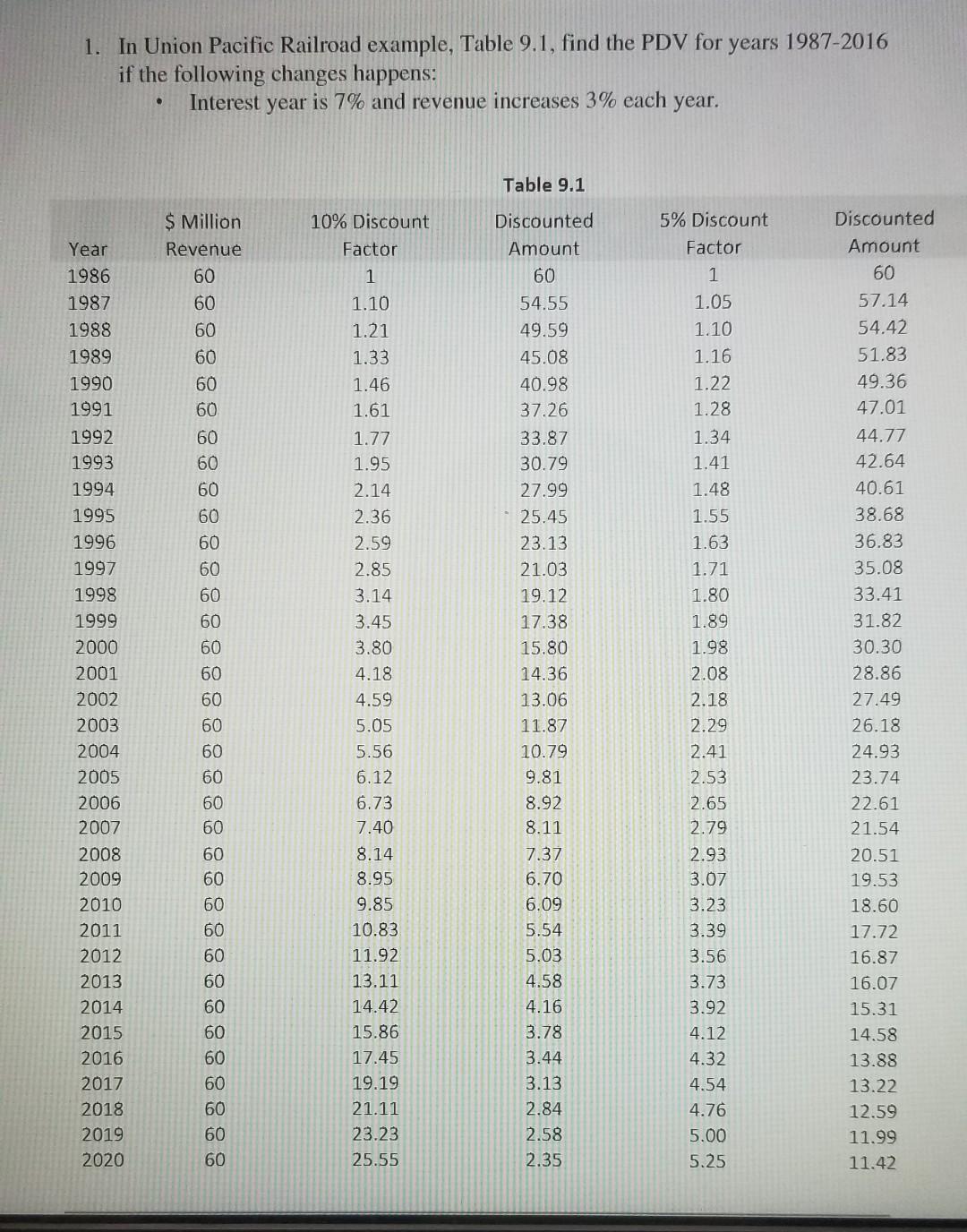

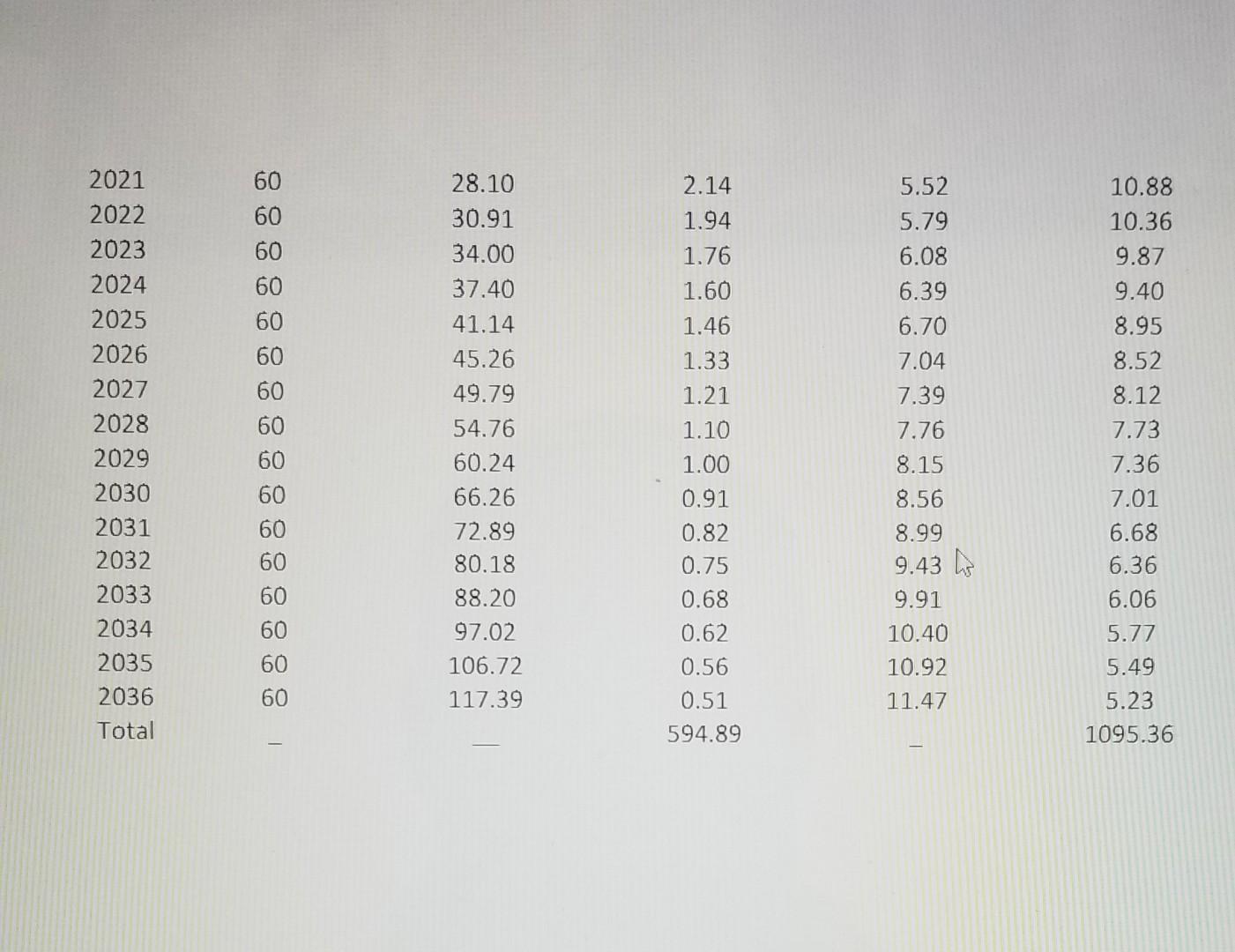

1. In Union Pacific Railroad example, Table 9.1, find the PDV for years 1987-2016 if the following changes happens: Interest year is 7% and revenue

1. In Union Pacific Railroad example, Table 9.1, find the PDV for years 1987-2016 if the following changes happens: Interest year is 7% and revenue increases 3% each year. Table 9.1 Year $ Million Revenue 60 60 60 60 60 60 60 60 60 60 60 60 60 60 60 60 60 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 10% Discount Factor 1 1.10 1.21 1.33 1.46 1.61 1.77 1.95 2.14 2.36 2.59 2.85 3.14 3.45 3.80 4.18 4.59 5.05 5.56 6.12 6.73 7.40 8.14 8.95 9.85 10.83 11.92 13.11 14.42 15.86 17.45 19.19 21.11 23.23 25.55 Discounted Amount 60 54.55 49.59 45.08 40.98 37.26 33.87 30.79 27.99 25.45 23.13 21.03 19.12 17.38 15.80 14.36 13.06 11.87 10.79 9.81 8.92 8.11 5% Discount Factor 1 1.05 1.10 1.16 1.22 1.28 1.34 1.41 1.48 1.55 1.63 1.71 1.80 1.89 1.98 2.08 2.18 2.29 2.41 2.53 2.65 2.79 2.93 3.07 3.23 3.39 3.56 3.73 3.92 4.12 4.32 4.54 4.76 5.00 5.25 Discounted Amount 60 57.14 54.42 51.83 49.36 47.01 44.77 42.64 40.61 38.68 36.83 35.08 33.41 31.82 30.30 28.86 27.49 26.18 24.93 23.74 22.61 21.54 20.51 19.53 18.60 17.72 16.87 16.07 15.31 14.58 13.88 13.22 12.59 11.99 11.42 60 60 60 60 60 7.37 60 60 60 60 60 60 60 60 60 60 60 60 60 6.70 6.09 5.54 5.03 4.58 4.16 3.78 3.44 3.13 2.84 2.58 2.35 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Total 60 60 60 60 60 60 60 60 60 60 60 60 60 60 60 60 28.10 30.91 34.00 37.40 41.14 45.26 49.79 54.76 60.24 66.26 72.89 80.18 88.20 97.02 106.72 117.39 2.14 1.94 1.76 1.60 1.46 1.33 1.21 1.10 1.00 0.91 0.82 0.75 0.68 0.62 0.56 0.51 594.89 5.52 5.79 6.08 6.39 6.70 7.04 7.39 7.76 8.15 8.56 8.99 9.43 M 9.91 10.40 10.92 11.47 10.88 10.36 9.87 9.40 8.95 8.52 8.12 7.73 7.36 7.01 6.68 6.36 6.06 5.77 5.49 5.23 1095.36

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started