Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Include a short introduction about the company. 2. 3. 4. 5. address: (a) (b) (c) Carry out valuation using the Dividend Discount Model

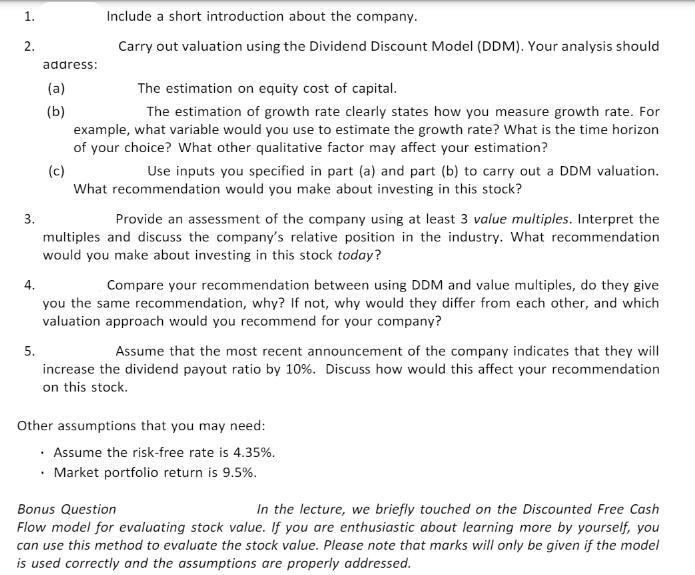

1. Include a short introduction about the company. 2. 3. 4. 5. address: (a) (b) (c) Carry out valuation using the Dividend Discount Model (DDM). Your analysis should The estimation on equity cost of capital. The estimation of growth rate clearly states how you measure growth rate. For example, what variable would you use to estimate the growth rate? What is the time horizon of your choice? What other qualitative factor may affect your estimation? Use inputs you specified in part (a) and part (b) to carry out a DDM valuation. What recommendation would you make about investing in this stock? Provide an assessment of the company using at least 3 value multiples. Interpret the multiples and discuss the company's relative position in the industry. What recommendation would you make about investing in this stock today? Compare your recommendation between using DDM and value multiples, do they give you the same recommendation, why? If not, why would they differ from each other, and which valuation approach would you recommend for your company? Assume that the most recent announcement of the company indicates that they will increase the dividend payout ratio by 10%. Discuss how would this affect your recommendation on this stock. Other assumptions that you may need: Assume the risk-free rate is 4.35%. Market portfolio return is 9.5%. Bonus Question In the lecture, we briefly touched on the Discounted Free Cash Flow model for evaluating stock value. If you are enthusiastic about learning more by yourself, you can use this method to evaluate the stock value. Please note that marks will only be given if the model is used correctly and the assumptions are properly addressed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started