Question

1: Indicate the nominal value to be purchased for the target defined 2: Indicate the effective value to be purchased for the target defined 3:

1: Indicate the nominal value to be purchased for the target defined

2: Indicate the effective value to be purchased for the target defined

3: Indicate the annual amount of coupon in SAR that we will receive

4: How much could be lost in value (effective value) in case of an immediate 0.10% increase in the YTM?

Settlement date: 15th OCTOBER 2023, we are going to buy Saudi bond.

Coupon: 2.72% (semiannual 30360, coupons are paid every 26 October and 26 April)

Maturity: 26th April 2026

Yield to Maturity: 5,40%

You are willing to obtain the following cash flows (SAR) just from the coupons, apart from the principal:

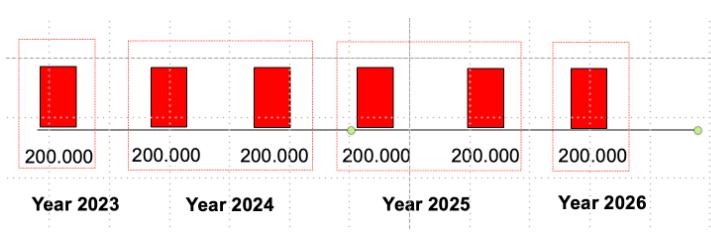

Expected cash flows

200.000 200.000 Year 2023 200.000 Year 2024 200.000 200.000 Year 2025 200.000 Year 2026

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 The nominal value face value of the bond can be calculated using the following formula Nominal Val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started