Answered step by step

Verified Expert Solution

Question

1 Approved Answer

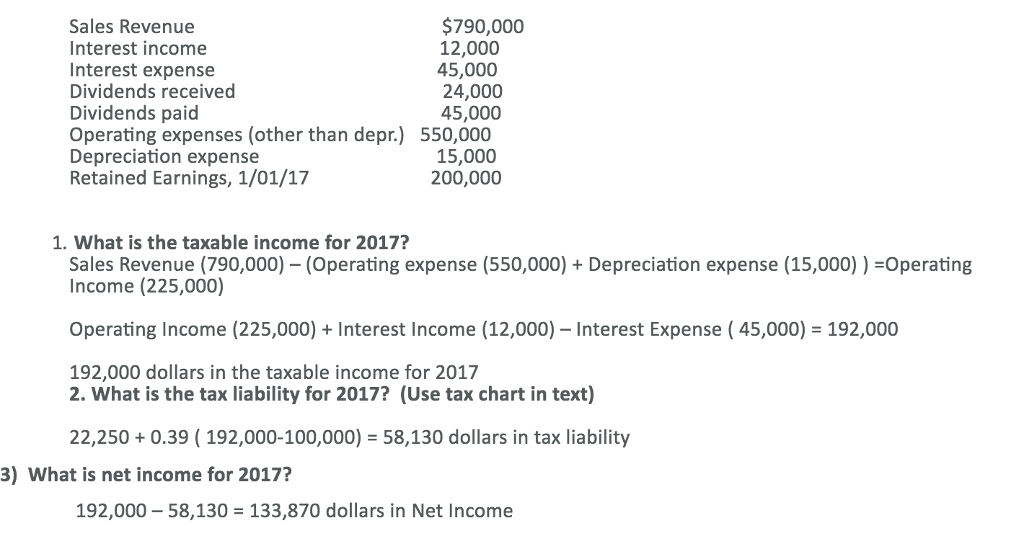

1) Indicate whether you agree with the primary post calculation. If you do not agree, explain what the corrected numbers would be. 2) Why are

1) Indicate whether you agree with the primary post calculation. If you do not agree, explain what the corrected numbers would be.

2) Why are taxable income and net income different? 3) Using the correct numbers, what is the Retained Earning Balance 12/31/17?

4) Calculate and explain what, if any, changes you would make to NET INCOME to calculate cash flow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started