Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Instead assume that A finds out that he is terminally ill and has about 2 years to live. A sells his insurance contract

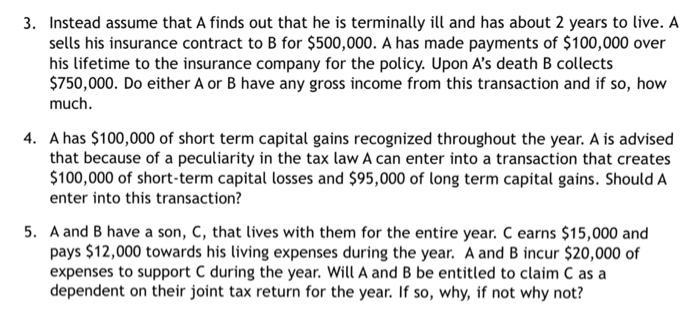

3. Instead assume that A finds out that he is terminally ill and has about 2 years to live. A sells his insurance contract to B for $500,000. A has made payments of $100,000 over his lifetime to the insurance company for the policy. Upon A's death B collects $750,000. Do either A or B have any gross income from this transaction and if so, how much. 4. A has $100,000 of short term capital gains recognized throughout the year. A is advised that because of a peculiarity in the tax law A can enter into a transaction that creates $100,000 of short-term capital losses and $95,000 of long term capital gains. Should A enter into this transaction? 5. A and B have a son, C, that lives with them for the entire year. C earns $15,000 and pays $12,000 towards his living expenses during the year. A and B incur $20,000 of expenses to support C during the year. Will A and B be entitled to claim C as a dependent on their joint tax return for the year. If so, why, if not why not?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes both A and B will have a gross income from this transaction Gross income of A will be the amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started