Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Introduction to accounting : 6 marks (a) Differentiate between financial and management accounting. (3 marks Maximum of 100 words) (b) You have a

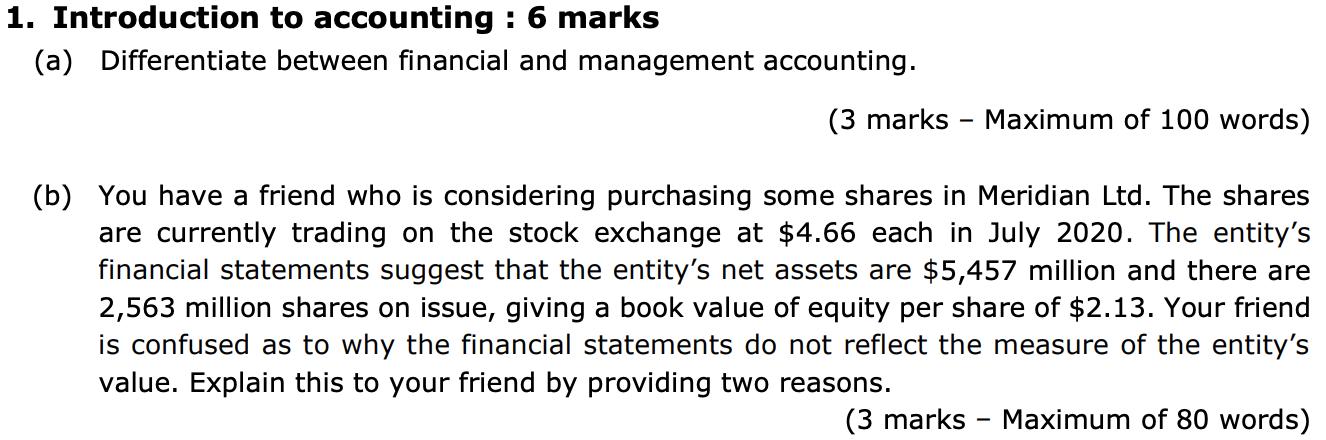

1. Introduction to accounting : 6 marks (a) Differentiate between financial and management accounting. (3 marks Maximum of 100 words) (b) You have a friend who is considering purchasing some shares in Meridian Ltd. The shares are currently trading on the stock exchange at $4.66 each in July 2020. The entity's financial statements suggest that the entity's net assets are $5,457 million and there are 2,563 million shares on issue, giving a book value of equity per share of $2.13. Your friend is confused as to why the financial statements do not reflect the measure of the entity's value. Explain this to your friend by providing two reasons. (3 marks Maximum of 80 words)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Financial accounting is collection of data regarding all sales and purchases and expenses and prepar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started