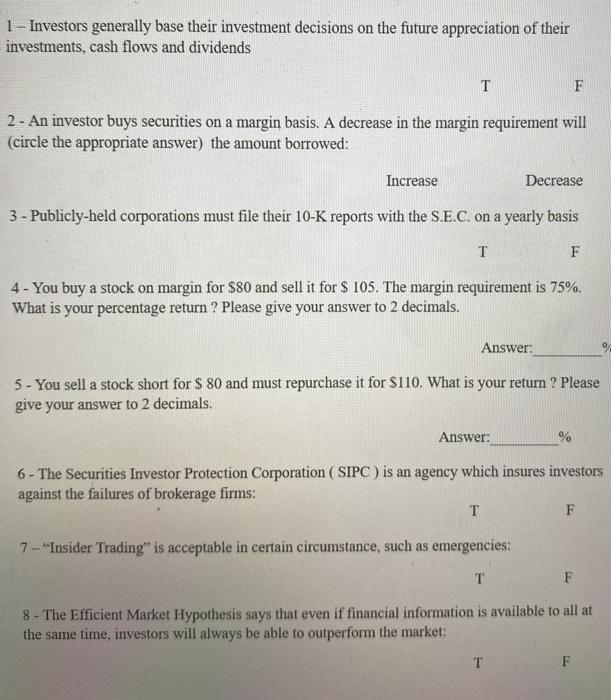

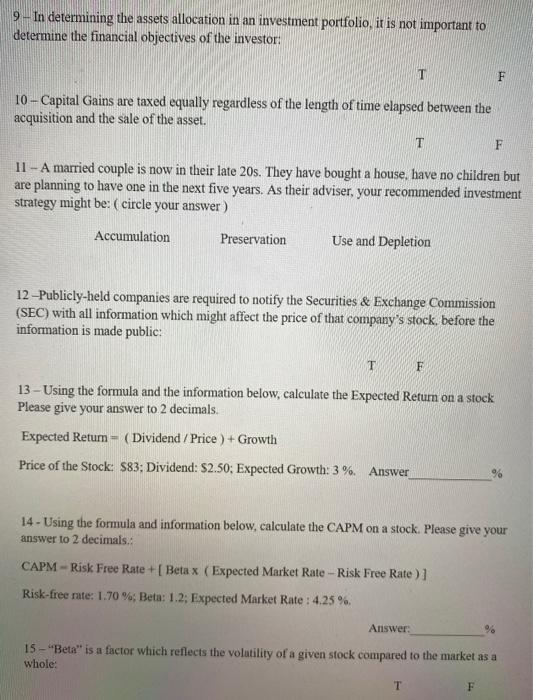

1 - Investors generally base their investment decisions on the future appreciation of their investments, cash flows and dividends T F 2 - An investor buys securities on a margin basis. A decrease in the margin requirement will (circle the appropriate answer) the amount borrowed: Increase Decrease 3 - Publicly-held corporations must file their 10-K reports with the S.E.C. on a yearly basis T F 4 - You buy a stock on margin for $80 and sell it for $ 105. The margin requirement is 75%. What is your percentage return? Please give your answer to 2 decimals. Answer: 5 - You sell a stock short for $ 80 and must repurchase it for $110. What is your return ? Please give your answer to 2 decimals. Answer: % 6- The Securities Investor Protection Corporation (SIPC) is an agency which insures investors against the failures of brokerage firms: T F 7 - "Insider Trading" is acceptable in certain circumstance, such as emergencies: T F 8- The Efficient Market Hypothesis says that even if financial information is available to all at the same time, investors will always be able to outperform the market: F 9- In determining the assets allocation in an investment portfolio, it is not important to determine the financial objectives of the investor: T F 10 - Capital Gains are taxed equally regardless of the length of time elapsed between the acquisition and the sale of the asset. T F 11 - A married couple is now in their late 20s. They have bought a house, have no children but are planning to have one in the next five years. As their adviser, your recommended investment strategy might be: (circle your answer) Accumulation Preservation Use and Depletion 12 --Publicly-held companies are required to notify the Securities & Exchange Commission (SEC) with all information which might affect the price of that company's stock, before the information is made public: T F 13- Using the formula and the information below, calculate the Expected Return on a stock Please give your answer to 2 decimals. Expected Retum = (Dividend / Price ) + Growth Price of the Stock: 83: Dividend: $2.50: Expected Growth: 3 %. Answer 14 - Using the formula and information below, calculate the CAPM on a stock. Please give your answer to 2 decimals.: CAPM - Risk Free Rate + [ Beta x (Expected Market Rate - Risk Free Rate) Risk-free rate: 1.70%; Beta: 1.2; Expected Market Rate : 4.25% Answer: 9 15 -- "Beta" is a factor which reflects the volatility of a given stock compared to the market as a whole: T F