Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Is the change in accounts payable a cash inflow or outflow? Explain. 2) Is the change in inventory a cash inflow or outflow?

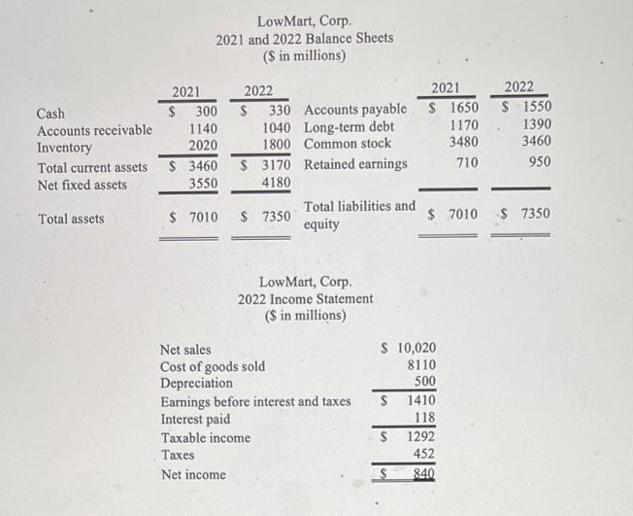

1) Is the change in accounts payable a cash inflow or outflow? Explain. 2) Is the change in inventory a cash inflow or outflow? Explain. 3) What is the average corporate income tax rate of LowMart company in 2022? 4) If the company has 500 million outstanding shares, what is the dividend per share paid by the Low Mart company in 2022? (Hint: First find the additions to retained earnings and total dividends paid) Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets 2021 S S LowMart, Corp. 2021 and 2022 Balance Sheets ($ in millions) 300 S 1140 2020 3460 3550 2022 $ 7010 330 1040 1800 $ 3170 4180 $ 7350 2021 Accounts payable $ 1650 Long-term debt 1170 Common stock 3480 Retained earnings 710 Net sales Cost of goods sold Depreciation Total liabilities and equity Low Mart, Corp. 2022 Income Statement ($ in millions) Earnings before interest and taxes Interest paid Taxable income Taxes Net income $ 10,020 8110 500 S $ 7010 S 1410 118 1292 452 840 2022 $ 1550 1390 3460 950 $ 7350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started