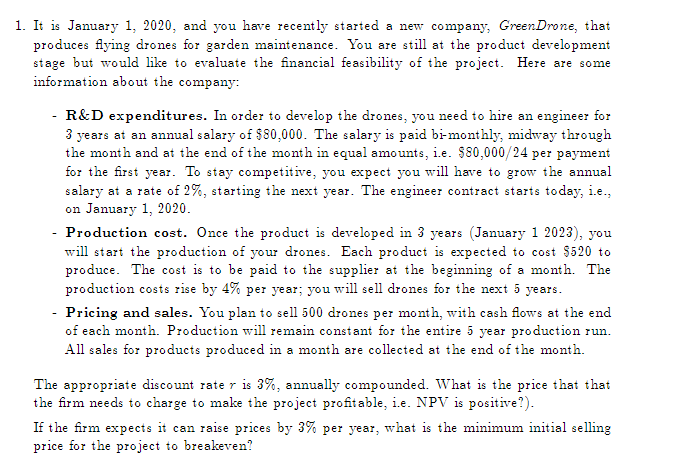

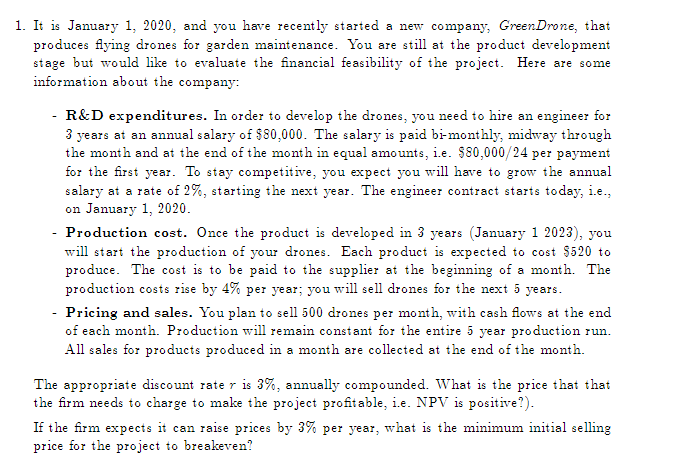

1. It is January 1, 2020, and you have recently started a new company, Green Drone, that produces flying drones for garden maintenance. You are still at the product development stage but would like to evaluate the financial feasibility of the project. Here are some information about the company: - R&D expenditures. In order to develop the drones, you need to hire an engineer for 3 years at an annual salary of $80,000. The salary is paid bi-monthly, midway through the month and at the end of the month in equal amounts, i.e. $80,000/24 per payment for the first year. To stay competitive, you expect you will have to grow the annual salary at a rate of 2%, starting the next year. The engineer contract starts today, i.e., on January 1, 2020. - Production cost. Once the product is developed in 3 years (January 1 2023), you will start the production of your drones. Each product is expected to cost $520 to produce. The cost is to be paid to the supplier at the beginning of a month. The production costs rise by 4% per year; you will sell drones for the next 5 years. - Pricing and sales. You plan to sell 500 drones per month, with cash flows at the end of each month. Production will remain constant for the entire 5 year production run. All sales for products produced in a month are collected at the end of the month. The appropriate discount rate r is 3%, annually compounded. What is the price that that the firm needs to charge to make the project profitable, i.e. NPV is positive?). If the firm expects it can raise prices by 3% per year, what is the minimum initial selling price for the project to breakeven? 1. It is January 1, 2020, and you have recently started a new company, Green Drone, that produces flying drones for garden maintenance. You are still at the product development stage but would like to evaluate the financial feasibility of the project. Here are some information about the company: - R&D expenditures. In order to develop the drones, you need to hire an engineer for 3 years at an annual salary of $80,000. The salary is paid bi-monthly, midway through the month and at the end of the month in equal amounts, i.e. $80,000/24 per payment for the first year. To stay competitive, you expect you will have to grow the annual salary at a rate of 2%, starting the next year. The engineer contract starts today, i.e., on January 1, 2020. - Production cost. Once the product is developed in 3 years (January 1 2023), you will start the production of your drones. Each product is expected to cost $520 to produce. The cost is to be paid to the supplier at the beginning of a month. The production costs rise by 4% per year; you will sell drones for the next 5 years. - Pricing and sales. You plan to sell 500 drones per month, with cash flows at the end of each month. Production will remain constant for the entire 5 year production run. All sales for products produced in a month are collected at the end of the month. The appropriate discount rate r is 3%, annually compounded. What is the price that that the firm needs to charge to make the project profitable, i.e. NPV is positive?). If the firm expects it can raise prices by 3% per year, what is the minimum initial selling price for the project to breakeven