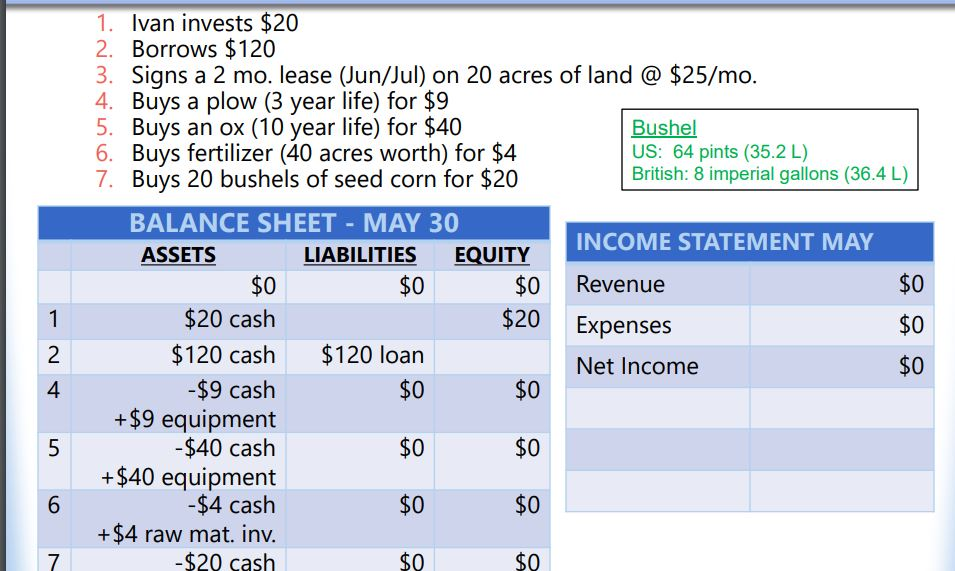

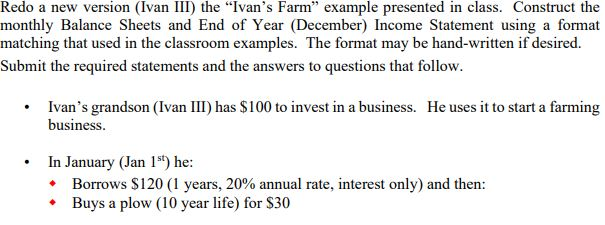

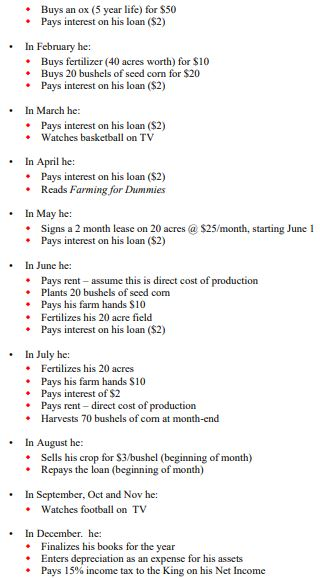

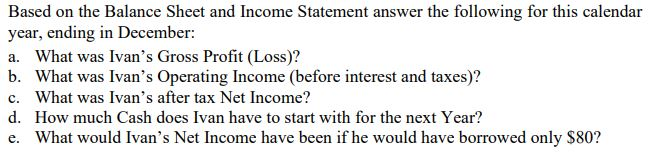

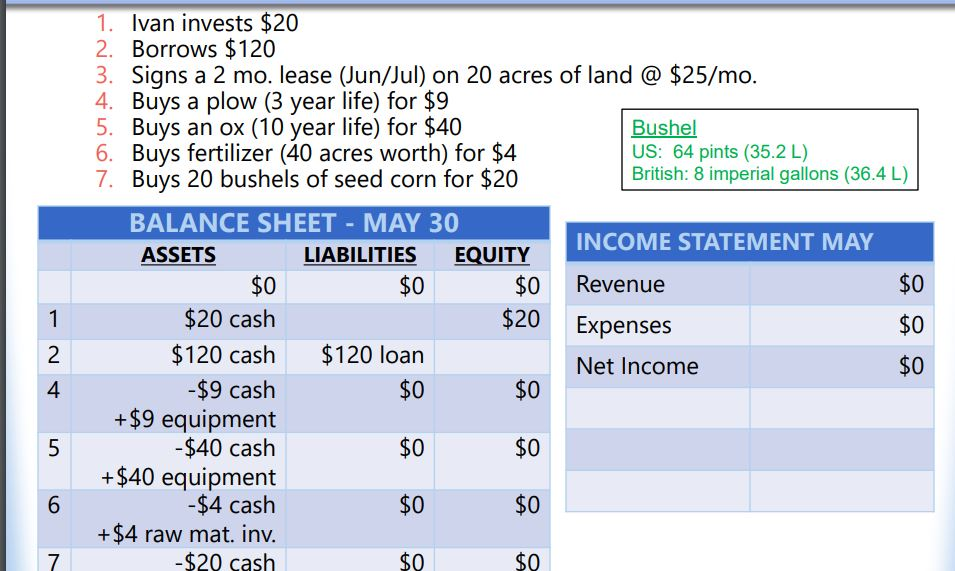

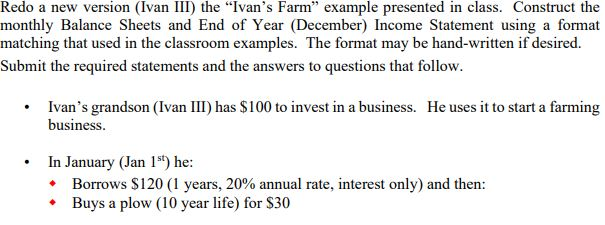

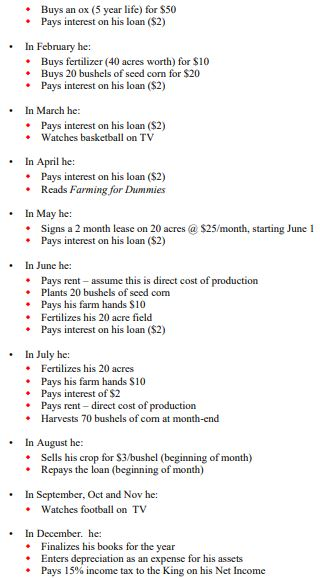

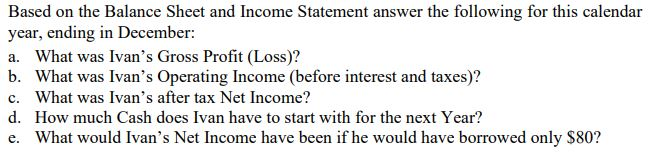

1. Ivan invests $20 2. Borrows $120 3. Signs a 2 mo. lease (Jun/Jul) on 20 acres of land @ $25/mo. 4. Buys a plow (3 year life) for $9 5. Buys an ox (10 year life) for $40 Bushel 6. Buys fertilizer (40 acres worth) for $4 US: 64 pints (35.2 L) 7. Buys 20 bushels of seed corn for $20 British: 8 imperial gallons (36.4 L) BALANCE SHEET - MAY 30 INCOME STATEMENT MAY ASSETS LIABILITIES EQUITY $0 $0 $0 Revenue $0 $20 cash $20 Expenses $0 $120 cash $120 loan Net Income $0 -$9 cash $0 $0 +$9 equipment -$40 cash $0 $0 +$40 equipment -$4 cash $0 $0 + $4 raw mat. inv. -$20 cash $0 $0 1 2 4 5 6 7 Redo a new version (Ivan III) the "Ivan's Farm" example presented in class. Construct the monthly Balance Sheets and End of Year (December) Income Statement using a format matching that used in the classroom examples. The format may be hand-written if desired. Submit the required statements and the answers to questions that follow. Ivan's grandson (Ivan III) has $100 to invest in a business. He uses it to start a farming business. In January (Jan 19') he: Borrows $120 (1 years, 20% annual rate, interest only) and then: Buys a plow (10 year life) for $30 . Buys an ox (5 year life) for $50 Pays interest on his loan (82) In February he: Buys fertilizer (40 acres worth) for $10 Buys 20 bushels of seed corn for $20 Pays interest on his loan ($2) In March he: Pays interest on his loan (82) Watches basketball on TV In April he: Pays interest on his loan (52) Reads Farming for Dummies In May he: Signs a 2 month lease on 20 acres @ $25/month, starting June 1 Pays interest on his loan (52) In June he: Pays rent - assume this is direct cost of production Plants 20 bushels of seed com Pays his farm hands $10 Fertilizes his 20 acre field Pays interest on his loan (82) In July he: Fertilizes his 20 acres Pays his farm hands $10 Pays interest of $2 Pays rent - direct cost of production Harvests 70 bushels of com at month-end In August he: Sells his crop for $3/bushel (beginning of month) Repays the loan (beginning of month) In September, Oct and Nov he: Watches football on TV In December. he: Finalizes his books for the year Enters depreciation as an expense for his assets Pays 15% income tax to the King on his Net Income . . Based on the Balance Sheet and Income Statement answer the following for this calendar year, ending in December: a. What was Ivan's Gross Profit (Loss)? b. What was Ivan's Operating Income (before interest and taxes)? c. What was Ivan's after tax Net Income? d. How much Cash does Ivan have to start with for the next Year? e. What would Ivan's Net Income have been if he would have borrowed only $80