Answered step by step

Verified Expert Solution

Question

1 Approved Answer

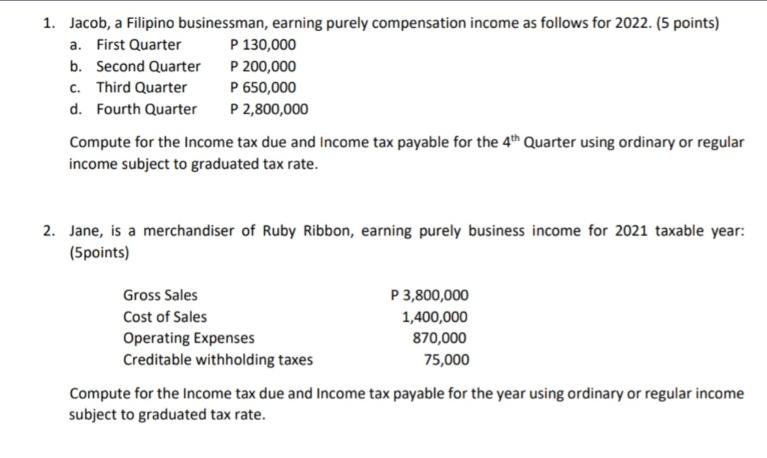

1. Jacob, a Filipino businessman, earning purely compensation income as follows for 2022. (5 points) a. First Quarter P 130,000 b. Second Quarter c.

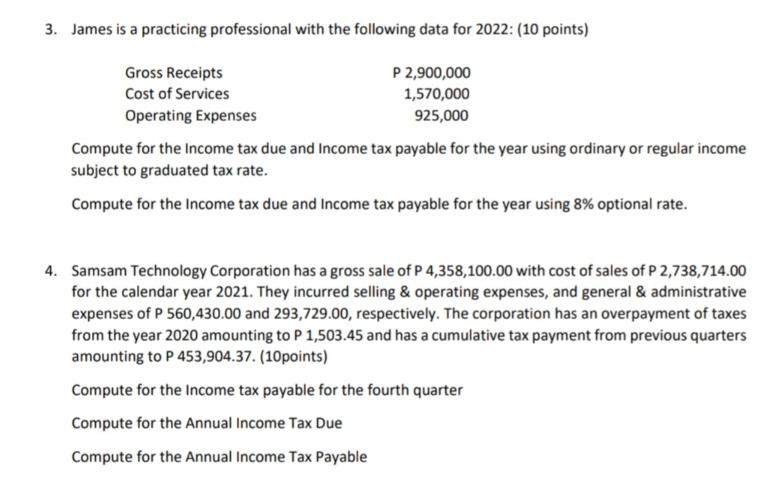

1. Jacob, a Filipino businessman, earning purely compensation income as follows for 2022. (5 points) a. First Quarter P 130,000 b. Second Quarter c. Third Quarter d. Fourth Quarter P 200,000 P 650,000 P 2,800,000 Compute for the Income tax due and Income tax payable for the 4th Quarter using ordinary or regular income subject to graduated tax rate. 2. Jane, is a merchandiser of Ruby Ribbon, earning purely business income for 2021 taxable year: (5points) Gross Sales Cost of Sales Operating Expenses Creditable withholding taxes P 3,800,000 1,400,000 870,000 75,000 Compute for the Income tax due and Income tax payable for the year using ordinary or regular income subject to graduated tax rate. 3. James is a practicing professional with the following data for 2022: (10 points) P 2,900,000 Gross Receipts Cost of Services 1,570,000 Operating Expenses 925,000 Compute for the Income tax due and Income tax payable for the year using ordinary or regular income subject to graduated tax rate. Compute for the Income tax due and Income tax payable for the year using 8% optional rate. 4. Samsam Technology Corporation has a gross sale of P 4,358,100.00 with cost of sales of P 2,738,714.00 for the calendar year 2021. They incurred selling & operating expenses, and general & administrative expenses of P 560,430.00 and 293,729.00, respectively. The corporation has an overpayment of taxes from the year 2020 amounting to P 1,503.45 and has a cumulative tax payment from previous quarters amounting to P 453,904.37. (10points) Compute for the Income tax payable for the fourth quarter Compute for the Annual Income Tax Due Compute for the Annual Income Tax Payable

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Jacobs Income Tax for the Fourth Quarter To compute the income tax due for the fourth quarter we need to determine Jacobs total taxable income for the year Lets calculate that first First Quarter P1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started