Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Jagadison Co. leases computer equipment to customers under sales-type leases. The equipment has no residual value at the end of the lease and

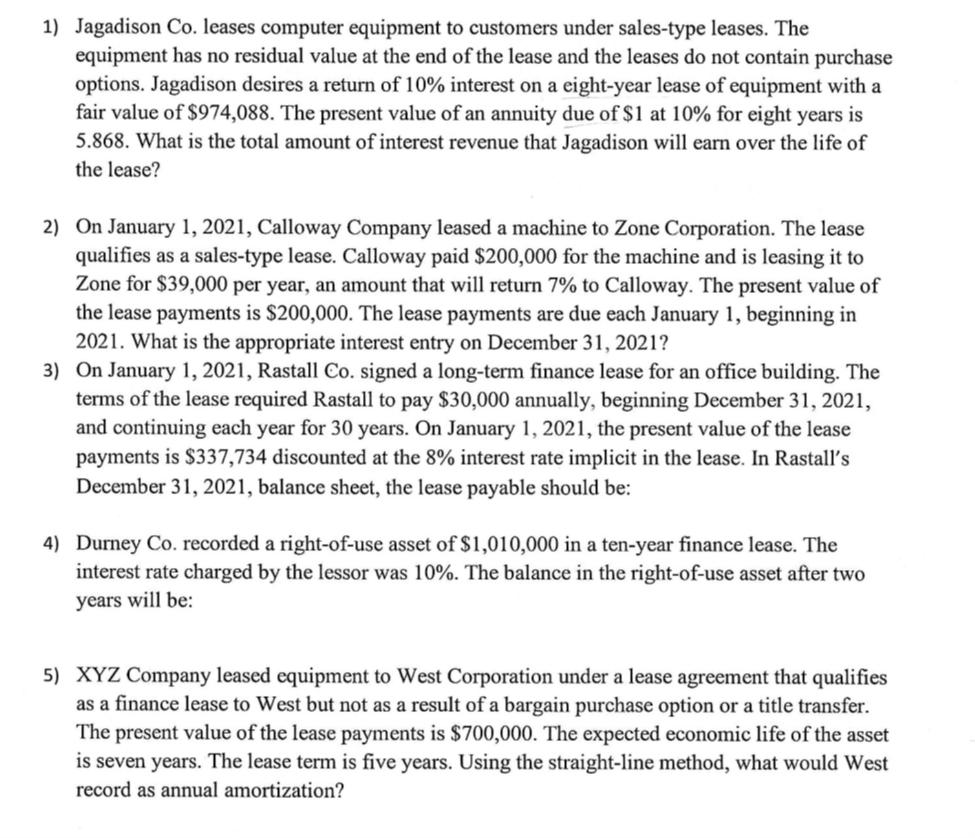

1) Jagadison Co. leases computer equipment to customers under sales-type leases. The equipment has no residual value at the end of the lease and the leases do not contain purchase options. Jagadison desires a return of 10% interest on a eight-year lease of equipment with a fair value of $974,088. The present value of an annuity due of $1 at 10% for eight years is 5.868. What is the total amount of interest revenue that Jagadison will earn over the life of the lease? 2) On January 1, 2021, Calloway Company leased a machine to Zone Corporation. The lease qualifies as a sales-type lease. Calloway paid $200,000 for the machine and is leasing it to Zone for $39,000 per year, an amount that will return 7% to Calloway. The present value of the lease payments is $200,000. The lease payments are due each January 1, beginning in 2021. What is the appropriate interest entry on December 31, 2021? 3) On January 1, 2021, Rastall Co. signed a long-term finance lease for an office building. The terms of the lease required Rastall to pay $30,000 annually, beginning December 31, 2021, and continuing each year for 30 years. On January 1, 2021, the present value of the lease payments is $337,734 discounted at the 8% interest rate implicit in the lease. In Rastall's December 31, 2021, balance sheet, the lease payable should be: 4) Durney Co. recorded a right-of-use asset of $1,010,000 in a ten-year finance lease. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset after two years will be: 5) XYZ Company leased equipment to West Corporation under a lease agreement that qualifies as a finance lease to West but not as a result of a bargain purchase option or a title transfer. The present value of the lease payments is $700,000. The expected economic life of the asset is seven years. The lease term is five years. Using the straight-line method, what would West record as annual amortization?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started