Question

1. Journalize each of the projected transactions. 2. Prepare a projected statement of cost of goods sold for 1993, a projected income statement for 1993,

1. Journalize each of the projected transactions.

2. Prepare a projected statement of cost of goods sold for 1993, a projected income statement for 1993, and a projected balance sheet as of December 31, 2993.

3. Describe the principal differences between 1993 estimates and the 1992 figures as shown in Exhibits 1, 2, and 3. In what respects is 1993 performance expected to be better than 1992 performance, and in what respects is it expected to be worse?

The management of Fahning Manufacturing Company annually prepared a budget of expected financial operations for the ensuing calendar year. The completed budget provided information on all aspects of the coming year?s operations. It included a projected balance sheet as of the end of the year and a projected income statement.

The final preparation of statements was accomplished only after careful integration of detailed computations submitted by each department. This was done to ensure that the operations of all departments were in balance with one another. For example, the finance department needed to base its schedules of loan transactions and of collections and disbursements on numbers that were dependent on manufacturing, purchasing, and selling expectations. The level of production would be geared to the forecasts of the sales department, and purchasing would be geared to the proposed manufacturing schedule.

In short, it was necessary to integrate the estimates of each department and to revise them in terms of the overall effect on operations to arrive at a coordinated and profitable plan of operations for the coming year. The budget statements ultimately derived from the adjusted estimated transactions would then serve the company as a reliable guide and measure of the coming year?s operations.

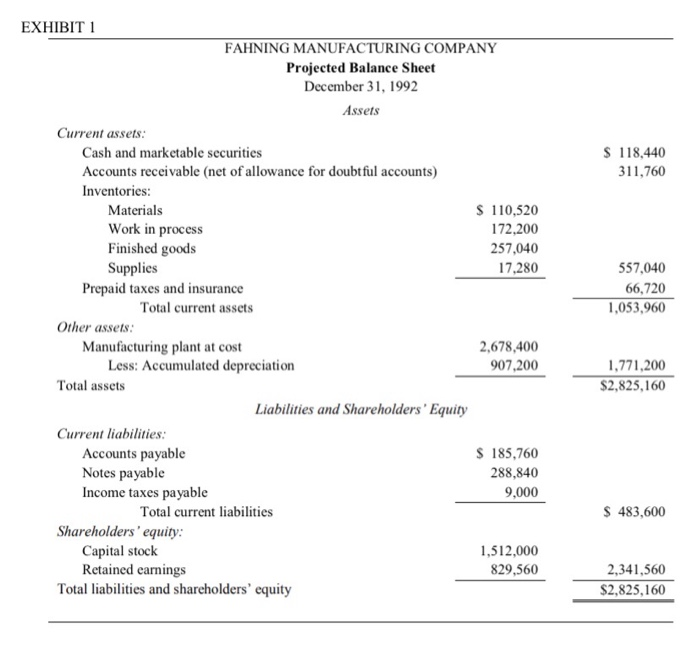

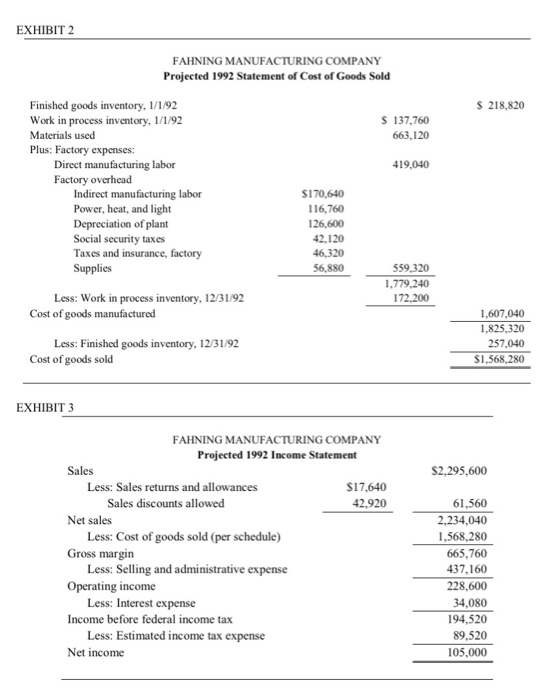

At the time the 1993 budget was being prepared, in November of 1992, projected 1992 financial statements were compiled for use as a comparison with the budgeted figures. These 1992 statements were based on ten months? actual and two months? projected transactions. They appear as Exhibits 1, 2, and 3.

Below is the summary of expected operations for the budget year 1993 as finally accepted:

1. Sales: All on credit, $2,562,000; sales returns and allowances, $19,200; sales discounts taken by customers (for prompt payment), $49,200. (The sales figure is net of expected bad debts.)

2. Purchases of goods and services:

a. New assets:

Purchased for cash: manufacturing plant and equipment, $144,000; prepaid manufacturing taxes and insurance, $78,000. Purchased on 60% credit: materials, $825,000; supplies, $66,000.

b. Services used to convert materials into work in process, all purchased for cash: direct manufacturing labor, $198,000; social security taxes on labor, $49,200; power, heat, and light, $135,600.

c. Selling and administrative services purchased for cash: $522,000.

3. Conversion of assets into work in process: This appears as an increase in the cost of work in process and a decrease in the appropriate asset accounts. Depreciation of manufacturing building and equipment, $140,000; expiration of prepaid taxes and insurance, $52,800; supplies used in manufacturing, $61,200; materials put into process, $818,800.

4. Transfer of work in process to finished goods: This appears as an increase in finished goods and a decrease in work in process. Total cost accumulated on goods that have been completed and transferred to finished goods, $1,901,952.

5. Cost of finished goods sold to customers: $1,806,624.

6. Financial transactions:

a. $264,000, borrowed on notes payable to bank.

b. Notes payable repaid, $300,000.

c. Cash payment to bank of $38,400 for interest on loans.

7. Cash receipts from customers on accounts receivable: $2,604,000.

8. Cash payments on liabilities:

a. Payment of accounts payable, $788,400.

b. Payment on 1992 income tax, $9,000.

9. Estimated federal income tax on 1993 income: $58,000, of which $5,800 is estimated to be unpaid as of December 31, 1993.

10. Dividends declared for year and paid in cash: $36,000.

This summary presents the complete cycle of the Fahning Manufacturing Company?s budgeted yearly operations from the purchase of goods and services through their various stages of conversion to completion of the finished product to the sale of this product. All costs and cash receipts and disbursements involved in this cycle are presented. Including the provision for federal income taxes and the payment of dividends.

EXHIBIT 1 Current assets: Cash and marketable securities Accounts receivable (net of allowance for doubtful accounts) Inventories: Materials Work in process Finished goods Supplies Prepaid taxes and insurance Total current assets Other assets: FAHNING MANUFACTURING COMPANY Projected Balance Sheet December 31, 1992 Assets Manufacturing plant at cost Less: Accumulated depreciation Total assets Current liabilities: Accounts payable Notes payable Income taxes payable Liabilities and Shareholders' Equity Total current liabilities Shareholders' equity: Capital stock Retained earnings Total liabilities and shareholders' equity $ 110,520 172,200 257,040 17,280 2,678,400 907,200 $ 185,760 288,840 9,000 1,512,000 829,560 $ 118,440 311,760 557,040 66,720 1,053,960 1,771,200 $2,825,160 $ 483,600 2,341,560 $2,825,160 EXHIBIT 2 Finished goods inventory, 1/1/92 Work in process inventory, 1/1/92 Materials used Plus: Factory expenses: Direct manufacturing labor Factory overhead Indirect manufacturing labor Power, heat, and light Depreciation of plant Social security taxes Taxes and insurance, factory Supplies FAHNING MANUFACTURING COMPANY Projected 1992 Statement of Cost of Goods Sold Less: Work in process inventory, 12/31/92 Cost of goods manufactured Less: Finished goods inventory, 12/31/92 Cost of goods sold EXHIBIT 3 Sales Net sales Less: Sales returns and allowances Sales discounts allowed Less: Cost of goods sold (per schedule) Gross margin Less: Selling and administrative expense Operating income FAHNING MANUFACTURING COMPANY Projected 1992 Income Statement Less: Interest expense Income before federal income tax Net income Less: Estimated income tax expense $170,640 116,760 126,600 42,120 46,320 56,880 $ 137,760 663,120 419,040 559,320 1,779,240 172,200 $17,640 42,920 $ 218,820 1,607,040 1,825,320 257,040 $1,568,280 $2,295,600 61,560 2,234,040 1,568,280 665,760 437,160 228,600 34,080 194,520 89,520 105,000

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

3Cost of Goods Sold has increased in Budget 1993 as compared to estimates of 1992 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started