Question

1. Journalize the following transactions in the general journal On January 1, 2018, a payment in cash for $12,000 is made for prepaying rent for

1. Journalize the following transactions in the general journal

- On January 1, 2018, a payment in cash for $12,000 is made for prepaying rent for the entire year 2018.

- On January 4, 2018, accounting services are performed and payment is received in cash for the amount of $1,900.

- On January 9, 2018, a payment in cash for advertising is made in the amount of $850.

- On January 10, 2018, office supplies are purchased in the amount of $75 with cash.

- On January 14, 2018, accounting services are performed and payment is received in cash for the amount of $2,725.

- On January 20, 2018, the telephone bill for the amount of $660 is received and paid with cash.

- On January 20, 2018, the utility bill for $2,925 is received. The bill won’t be paid until it’s due on February 15, 2018.

- On January 27, 2018, accounting services are performed on account in the amount of $3,750.

- On January 28, 2018, a payment in cash for $1,500 is made for a bill from an advertising agency.

2. Post the general journal entries from the journal to the corresponding general ledger accounts, paying particular attention to whether they’re debits or credits

3. Calculate the balances in the general ledger accounts, running the numbers several times for accuracy.. To calculate the balances in the ledger accounts, do the following:

- Add the debits.

- Add the credits.

- Subtract the larger amount from the other, or, alternatively, keep the running balance of the amount in the account and whether it’s a debit or credit on the ledger.

4. Create an unadjusted trial balance from the balances in the general ledger accounts.

5. Journalize the following adjusting journal entries in the general journal, being sure that the debits equal the credits:

- Calculate and make the adjustment for the amount of prepaid rent that has been used.

- Make an adjusting journal entry in the amount of $1,000 for depreciation of the vehicles.

- Make an adjusting journal entry in the amount of $100 for depreciation of the equipment.

6. Post the adjusting journal entries to the respective general ledger accounts

7. Calculate the new balances in the general ledger accounts. Create an adjusted trial balance from the balances in the general ledger accounts

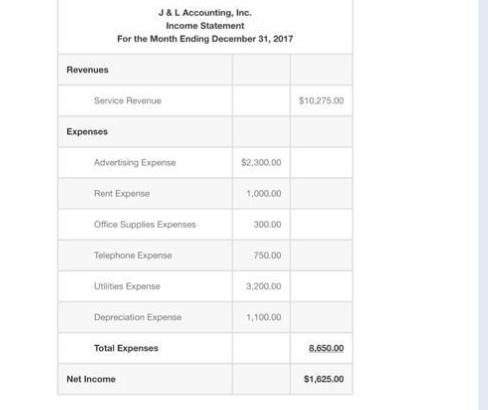

8. Create the income statement for J & L Accounting, Inc. using the information from the adjusted trial balance.

9. Create the closing journal entries in the general journal to close the revenue, expense, and dividend accounts to the retained earnings account, paying attention to debits equaling credits.

10. Post the closing journal entries to the respective general ledger accounts.

11. Calculate the balances in the general ledger accounts.

12. Create a post-closing trial balance from the balances in the general ledger accounts

13. Create the balance sheet for J & L Accounting, Inc. using the information from the post-closing trial balance.

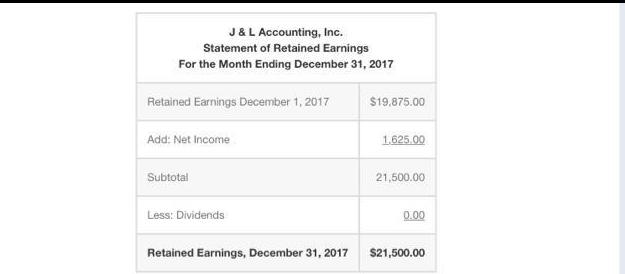

14. Create the statement of retained earnings for J & L Accounting, Inc. using the ending balance from the statement of retained earnings from the prior period and the net income from the income statement for the January accounting period. (No dividends were paid out during the month of January.)

J & L Accounting, Inc. Statement of Retained Earnings For the Month Ending December 31, 2017 Retained Earnings December 1, 2017 Add: Net Income Subtotal Less: Dividends Retained Earnings, December 31, 2017 $19.875.00 1.625.00 21,500.00 0.00 $21,500.00

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Journal Entries Date January 1 2018 Accounts Debit Prepaid Rent 12000 Credit Cash 12000 Date January 4 2018 Accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started