Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Justin acquires 90% of the voting common shares of Stevens on January 1, 2010. In 2010, Justin pays dividends of $350,000 and Stevens

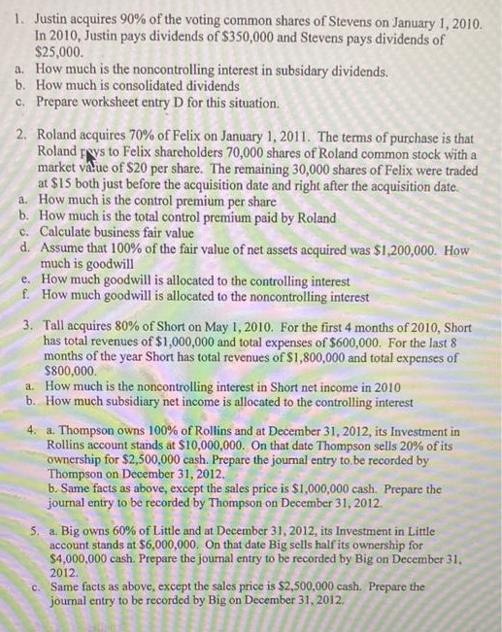

1. Justin acquires 90% of the voting common shares of Stevens on January 1, 2010. In 2010, Justin pays dividends of $350,000 and Stevens pays dividends of $25,000. a. How much is the noncontrolling interest in subsidary dividends. b. How much is consolidated dividends c. Prepare worksheet entry D for this situation. 2. Roland acquires 70% of Felix on January 1, 2011. The terms of purchase is that Roland pays to Felix shareholders 70,000 shares of Roland common stock with a market value of $20 per share. The remaining 30,000 shares of Felix were traded at $15 both just before the acquisition date and right after the acquisition date. a. How much is the control premium per share b. How much is the total control premium paid by Roland c. Calculate business fair value d. Assume that 100% of the fair value of net assets acquired was $1,200,000. How much is goodwill e. How much goodwill is allocated to the controlling interest f. How much goodwill is allocated to the noncontrolling interest 3. Tall acquires 80% of Short on May 1, 2010. For the first 4 months of 2010, Short has total revenues of $1,000,000 and total expenses of $600,000. For the last 8 months of the year Short has total revenues of $1,800,000 and total expenses of $800,000. a. How much is the noncontrolling interest in Short net income in 2010 b. How much subsidiary net income is allocated to the controlling interest 4. a. Thompson owns 100% of Rollins and at December 31, 2012, its Investment in Rollins account stands at $10,000,000. On that date Thompson sells 20% of its ownership for $2,500,000 cash. Prepare the journal entry to be recorded by Thompson on December 31, 2012. b. Same facts as above, except the sales price is $1,000,000 cash. Prepare the journal entry to be recorded by Thompson on December 31, 2012. 5. a. Big owns 60% of Little and at December 31, 2012, its Investment in Little account stands at $6,000,000. On that date Big sells half its ownership for $4,000,000 cash. Prepare the journal entry to be recorded by Big on December 31. 2012. c. Same facts as above, except the sales price is $2,500,000 cash. Prepare the journal entry to be recorded by Big on December 31, 2012.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Justin acquires 90 of the voting common shares of Stevens on January 1 2010 a How much is the noncontrolling interest in subsidiary dividends Noncontrolling interest in subsidiary dividends0125000 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started