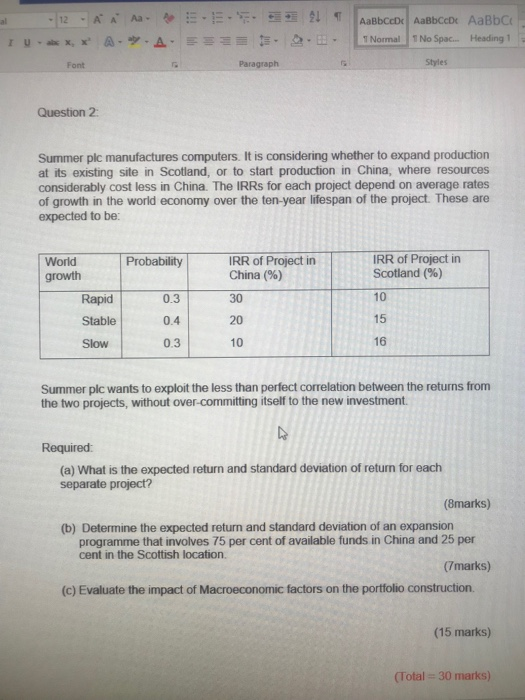

:::. 1.. ka" |AaBbCcD(1 AaBbCcDe AaBbCt Aa. 12 TE--Normal 1 No Spac... Heading Styles Paragraph Font Question 2 Summer plc manufactures computers. It is considering whether to expand production at its existing site in Scotland, or to start production in China, where resources considerably cost less in China. The IRRs for each project depend on average rates of growth in the world economy over the ten-year lifespan of the project. These are expected to be: IRR of Project in Scotland (96) 10 15 16 IRR of Project in China (%) World growth Rapid03 30 Stable Slow 20 0.4 0.3 10 Summer plc wants to exploit the less than perfect correlation between the returns from the two projects, without over-committing itself to the new investment Required (a) What is the expected return and standard deviation of return for each separate project? (8marks) (b) Determine the expected return and standard deviation of an expansion programme that involves 75 per cent of available funds in China and 25 per cent in the Scottish location. (7marks) (c) Evaluate the impact of Macroeconomic factors on the portfolio construction. (15 marks) (Total 30 marks) :::. 1.. ka" |AaBbCcD(1 AaBbCcDe AaBbCt Aa. 12 TE--Normal 1 No Spac... Heading Styles Paragraph Font Question 2 Summer plc manufactures computers. It is considering whether to expand production at its existing site in Scotland, or to start production in China, where resources considerably cost less in China. The IRRs for each project depend on average rates of growth in the world economy over the ten-year lifespan of the project. These are expected to be: IRR of Project in Scotland (96) 10 15 16 IRR of Project in China (%) World growth Rapid03 30 Stable Slow 20 0.4 0.3 10 Summer plc wants to exploit the less than perfect correlation between the returns from the two projects, without over-committing itself to the new investment Required (a) What is the expected return and standard deviation of return for each separate project? (8marks) (b) Determine the expected return and standard deviation of an expansion programme that involves 75 per cent of available funds in China and 25 per cent in the Scottish location. (7marks) (c) Evaluate the impact of Macroeconomic factors on the portfolio construction. (15 marks) (Total 30 marks)