Question

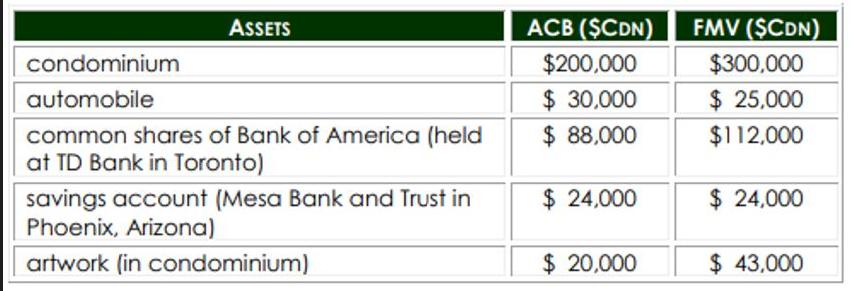

1. Kobe, aged 73, is a resident of Simcoe, Ontario. He spends five months in Arizona each winter where he owns a condominium. On March

1. Kobe, aged 73, is a resident of Simcoe, Ontario. He spends five months in Arizona each winter where he owns a condominium. On March 25th of this year, Kobe died from a stroke; his lawyer Jill was named as his executrix. Jill compiled a list of Kobe’s assets related to his U.S. property: What is the amount of Kobe’s US situs assets?

What is the amount of Kobe’s US situs assets?

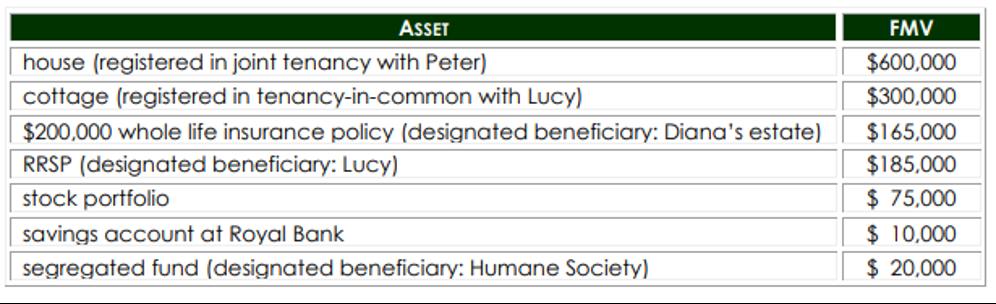

2. Diana died at age 77. At the time of her death, Diana was a widow; she is survived by her two adult, financially independent children, Peter, and Lucy. Below is a list of Diana's assets as of the date of her death.

What amount of Diana’s estate will be subject to probate fees?

3. Jerome died on August 3, 2023 and earned $70,000 of commission income from his position as a real estate agent up to the date of death. He sold a house on August 1, 2023, which he will receive the commission on that property on August 17, 2023 of about $15,000. Jerome is entitled to vacation pay of about $5,000 which as of the date of death, he had yet to take. His non-registered investment portfolio will garner interest income of $8,000 by the end of December 2023. Lastly, he has a general partnership with his brother Joshua, with the profits are to be shared equally by the end of the 2023 calendar year.

- 1) When should Jerome executor file his tax return?

- 2) Name all the tax returns that Jerome’s executor must file and identify which sources of income must be included in each applicable tax returns.

- 3) What form must the executor file in order absolve him or herself of any potential executor liability?

ASSETS condominium automobile common shares of Bank of America (held at TD Bank in Toronto) savings account (Mesa Bank and Trust in Phoenix, Arizona) artwork (in condominium) ACB ($CDN) $200,000 $ 30,000 $ 88,000 $ 24,000 $ 20,000 FMV (SCDN) $300,000 $ 25,000 $112,000 $ 24,000 $ 43,000

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started