Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Kuandyk Co reported net income of 5250000KZT in 2016. Depreciation expense for the year was 1300000KZT. During the year accounts receivable increased by 850000KZT

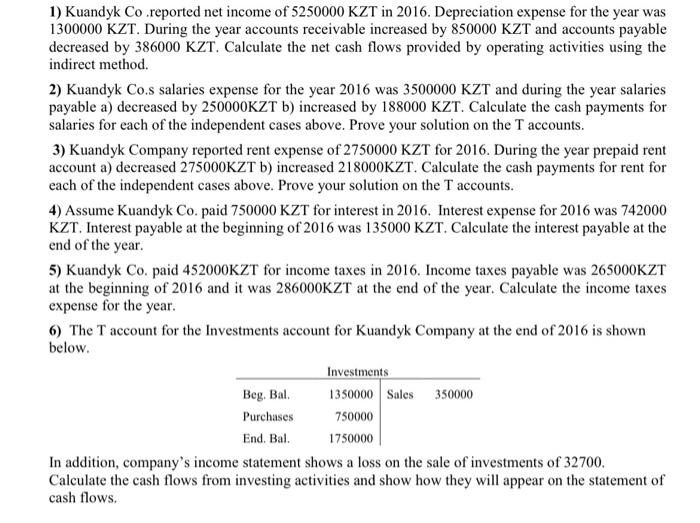

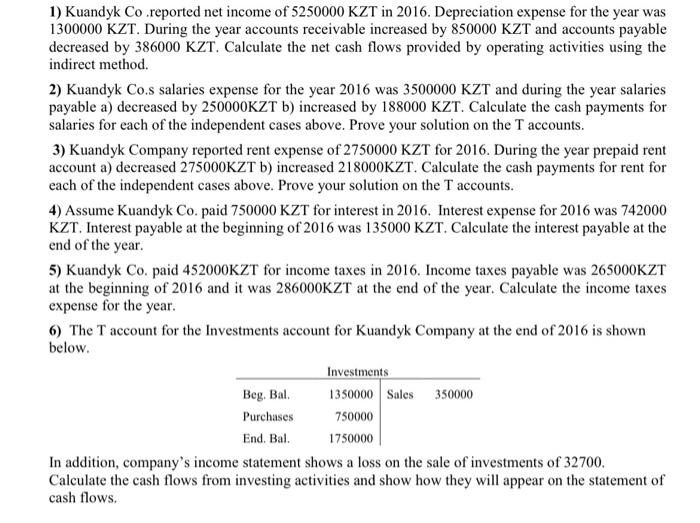

1) Kuandyk Co reported net income of 5250000KZT in 2016. Depreciation expense for the year was 1300000KZT. During the year accounts receivable increased by 850000KZT and accounts payable decreased by 386000KZT. Calculate the net cash flows provided by operating activities using the indirect method. 2) Kuandyk Co.s salaries expense for the year 2016 was 3500000KZT and during the year salaries payable a) decreased by 250000KZT b) increased by 188000KZT. Calculate the cash payments for salaries for each of the independent cases above. Prove your solution on the T accounts. 3) Kuandyk Company reported rent expense of 2750000 KZT for 2016. During the year prepaid rent account a) decreased 275000KZT b) increased 218000KZT. Calculate the cash payments for rent for each of the independent cases above. Prove your solution on the T accounts. 4) Assume Kuandyk Co. paid 750000 KZT for interest in 2016. Interest expense for 2016 was 742000 KZT. Interest payable at the beginning of 2016 was 135000 KZT. Calculate the interest payable at the end of the year. 5) Kuandyk Co. paid 452000KZT for income taxes in 2016. Income taxes payable was 265000KZT at the beginning of 2016 and it was 286000KZT at the end of the year. Calculate the income taxes expense for the year. 6) The T account for the Investments account for Kuandyk Company at the end of 2016 is shown below. In addition, company's income statement shows a loss on the sale of investments of 32700 . Calculate the cash flows from investing activities and show how they will appear on the statement of cash flows

1) Kuandyk Co reported net income of 5250000KZT in 2016. Depreciation expense for the year was 1300000KZT. During the year accounts receivable increased by 850000KZT and accounts payable decreased by 386000KZT. Calculate the net cash flows provided by operating activities using the indirect method. 2) Kuandyk Co.s salaries expense for the year 2016 was 3500000KZT and during the year salaries payable a) decreased by 250000KZT b) increased by 188000KZT. Calculate the cash payments for salaries for each of the independent cases above. Prove your solution on the T accounts. 3) Kuandyk Company reported rent expense of 2750000 KZT for 2016. During the year prepaid rent account a) decreased 275000KZT b) increased 218000KZT. Calculate the cash payments for rent for each of the independent cases above. Prove your solution on the T accounts. 4) Assume Kuandyk Co. paid 750000 KZT for interest in 2016. Interest expense for 2016 was 742000 KZT. Interest payable at the beginning of 2016 was 135000 KZT. Calculate the interest payable at the end of the year. 5) Kuandyk Co. paid 452000KZT for income taxes in 2016. Income taxes payable was 265000KZT at the beginning of 2016 and it was 286000KZT at the end of the year. Calculate the income taxes expense for the year. 6) The T account for the Investments account for Kuandyk Company at the end of 2016 is shown below. In addition, company's income statement shows a loss on the sale of investments of 32700 . Calculate the cash flows from investing activities and show how they will appear on the statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started