Question

1. Labant Corporation is considering two financing alternatives. Under the first alternative, interest expense would be $280,000 and there would be 208,000 common shares outstanding.

1. Labant Corporation is considering two financing alternatives. Under the first alternative, interest expense would be $280,000 and there would be 208,000 common shares outstanding. Under the second alternative, interest costs would be $200,000 and there would be 210,000 common shares outstanding. Labant has EBIT of $800,000 and is in the 30% tax bracket.

What is the degree of financial leverage for Labant's second financing alternative?

A. 1.54

B. 1.49

C. 1.96

D. 2.55

E. 1.33

F. It is impossible to tell from the information given.

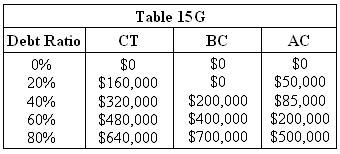

2. Hutchison Corporation is using the compromise approach to find the best debt-equity mix. Hutchison's CFO has concluded that the value of the firm without any debt financing is $10,000,000. The CFO has also prepared the estimates given in Table 15G of the corporate income tax effect (CT), the bankruptcy cost effect (BC), and the agency cost effect (AC) at various debt ratios. What is Hutchison's optimum debt-equity mix?

A. A debt ratio of 40%.

B. A debt ratio of 80%.

C. A debt ratio of 60%.

D. A debt ratio of 20%.

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Table 15G } \\ \hline Debt Ratio & CT & BC & AC \\ \hline 0% & $0 & $0 & $0 \\ 20% & $160,000 & $0 & $50,000 \\ 40% & $320,000 & $200,000 & $85,000 \\ 60% & $480,000 & $400,000 & $200,000 \\ 80% & $640,000 & $700,000 & $500,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started