Answered step by step

Verified Expert Solution

Question

1 Approved Answer

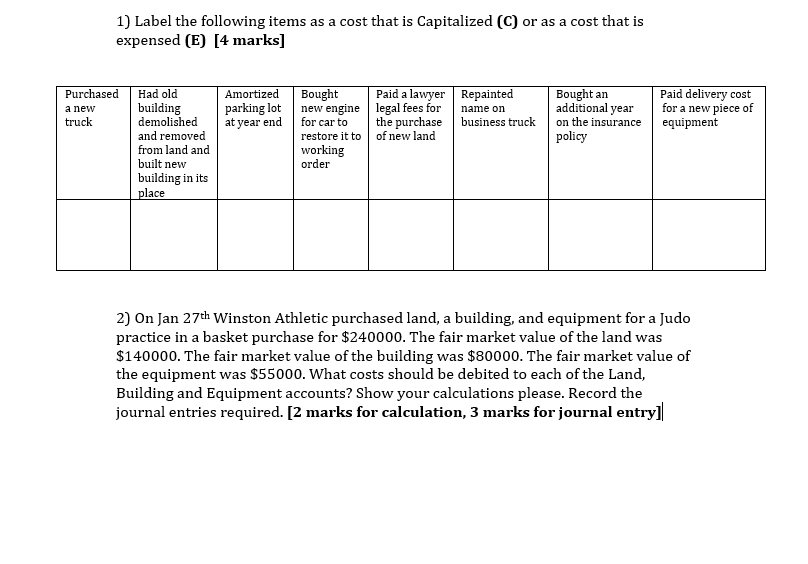

1) Label the following items as a cost that is Capitalized (C) or as a cost that is expensed (E) [4 marks] Purchased a

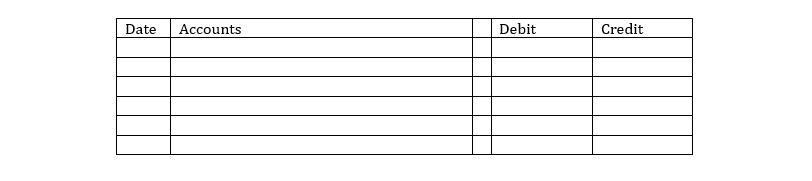

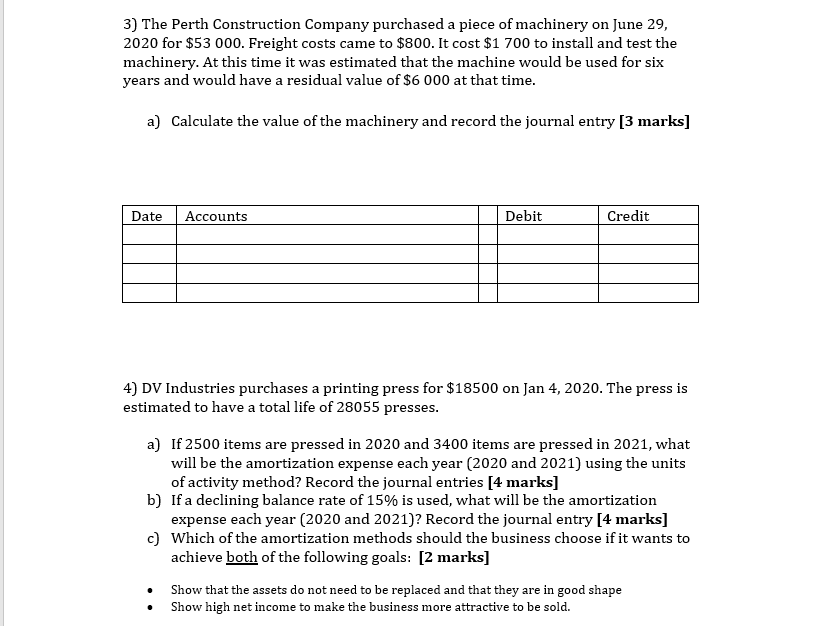

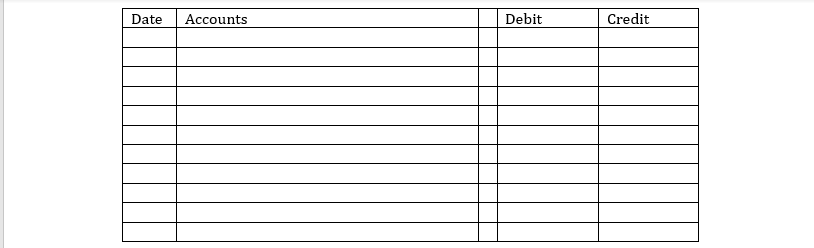

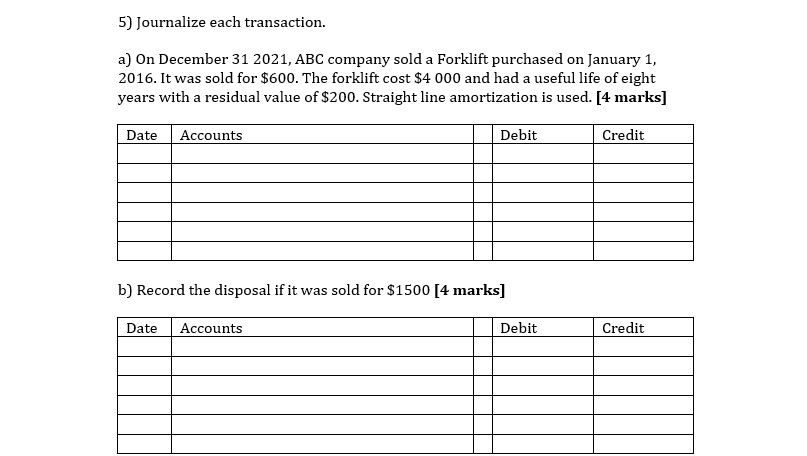

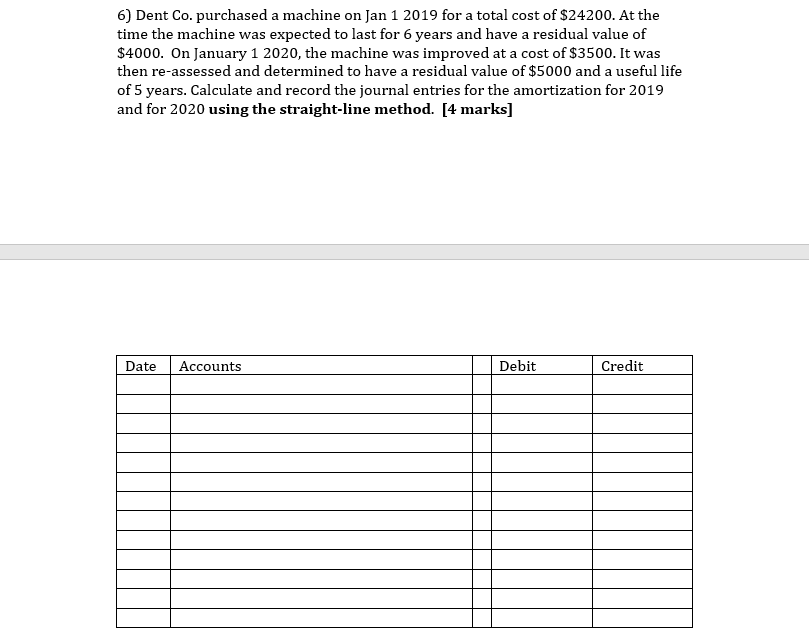

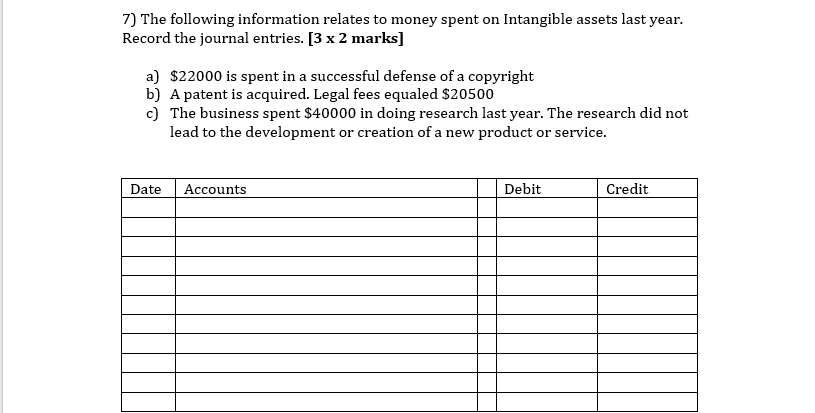

1) Label the following items as a cost that is Capitalized (C) or as a cost that is expensed (E) [4 marks] Purchased a new truck Had old building demolished and removed from land and built new building in its place Amortized parking lot at year end Bought new engine Paid a lawyer Repainted legal fees for for car to restore it to working order the purchase of new land name on Bought an additional year business truck on the insurance policy Paid delivery cost for a new piece of equipment 2) On Jan 27th Winston Athletic purchased land, a building, and equipment for a Judo practice in a basket purchase for $240000. The fair market value of the land was $140000. The fair market value of the building was $80000. The fair market value of the equipment was $55000. What costs should be debited to each of the Land, Building and Equipment accounts? Show your calculations please. Record the journal entries required. [2 marks for calculation, 3 marks for journal entry]| Date Accounts Debit Credit 3) The Perth Construction Company purchased a piece of machinery on June 29, 2020 for $53 000. Freight costs came to $800. It cost $1 700 to install and test the machinery. At this time it was estimated that the machine would be used for six years and would have a residual value of $6 000 at that time. a) Calculate the value of the machinery and record the journal entry [3 marks] Date Accounts Debit Credit 4) DV Industries purchases a printing press for $18500 on Jan 4, 2020. The press is estimated to have a total life of 28055 presses. a) If 2500 items are pressed in 2020 and 3400 items are pressed in 2021, what will be the amortization expense each year (2020 and 2021) using the units of activity method? Record the journal entries [4 marks] b) If a declining balance rate of 15% is used, what will be the amortization expense each year (2020 and 2021)? Record the journal entry [4 marks] c) Which of the amortization methods should the business choose if it wants to achieve both of the following goals: [2 marks] Show that the assets do not need to be replaced and that they are in good shape Show high net income to make the business more attractive to be sold. Date Accounts Debit Credit 5) Journalize each transaction. a) On December 31 2021, ABC company sold a Forklift purchased on January 1, 2016. It was sold for $600. The forklift cost $4 000 and had a useful life of eight years with a residual value of $200. Straight line amortization is used. [4 marks] Date Accounts Debit b) Record the disposal if it was sold for $1500 [4 marks] Date Accounts Credit Debit Credit 6) Dent Co. purchased a machine on Jan 1 2019 for a total cost of $24200. At the time the machine was expected to last for 6 years and have a residual value of $4000. On January 1 2020, the machine was improved at a cost of $3500. It was then re-assessed and determined to have a residual value of $5000 and a useful life of 5 years. Calculate and record the journal entries for the amortization for 2019 and for 2020 using the straight-line method. [4 marks] Date Accounts Debit Credit 7) The following information relates to money spent on Intangible assets last year. Record the journal entries. [3 x 2 marks] a) $22000 is spent in a successful defense of a copyright b) A patent is acquired. Legal fees equaled $20500 c) The business spent $40000 in doing research last year. The research did not lead to the development or creation of a new product or service. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started