Question

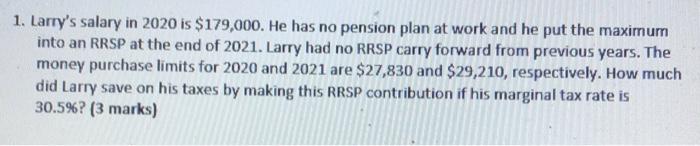

1. Larry's salary in 2020 is $179,000. He has no pension plan at work and he put the maximum into an RRSP at the

1. Larry's salary in 2020 is $179,000. He has no pension plan at work and he put the maximum into an RRSP at the end of 2021. Larry had no RRSP carry forward from previous years. The money purchase limits for 2020 and 2021 are $27,830 and $29,210, respectively. How much did Larry save on his taxes by making this RRSP contribution if his marginal tax rate is 30.5%? (3 marks)

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The RRSP deduction limit 18 CRA e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts In Federal Taxation

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

19th Edition

978-0324379556, 324379552, 978-1111579876

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App