Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Last year, you invested $2,500 in Flash Fund and the investment company has just announced its year-end distributions. The fund paid a capital

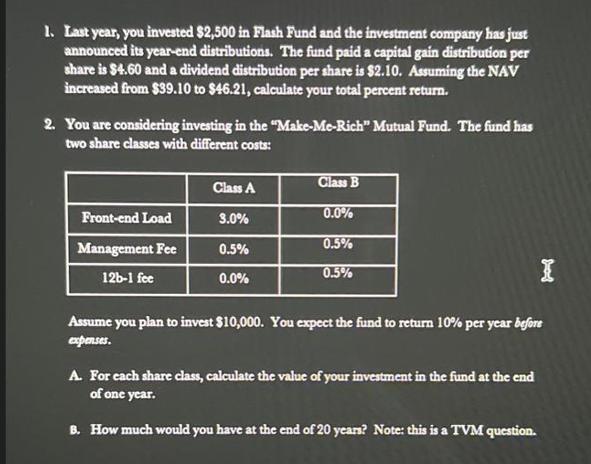

1. Last year, you invested $2,500 in Flash Fund and the investment company has just announced its year-end distributions. The fund paid a capital gain distribution per share is $4.60 and a dividend distribution per share is $2.10. Assuming the NAV increased from $39.10 to $46.21, calculate your total percent return. 2. You are considering investing in the "Make-Me-Rich" Mutual Fund. The fund has two share classes with different costs: Class A Class B Front-end Load 0.0% 3.0% Management Fee 0.5% 0.5% 12b-1 fee 0.0% 0.5% Assume you plan to invest $10,000. You expect the fund to return 10% per year before expenses. A. For each share class, calculate the value of your investment in the fund at the end of one year. B. How much would you have at the end of 20 years? Note: this is a TVM question. I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started