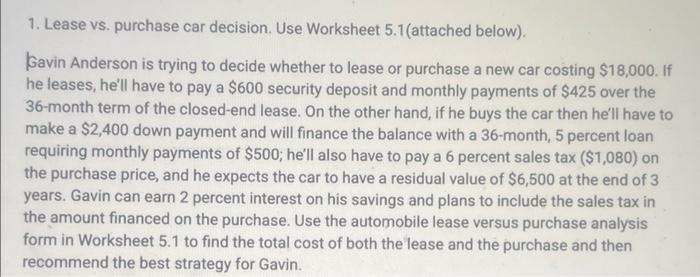

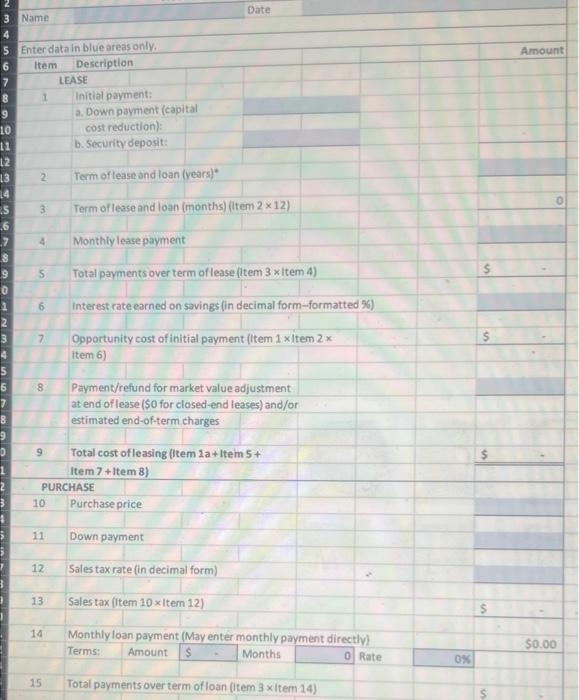

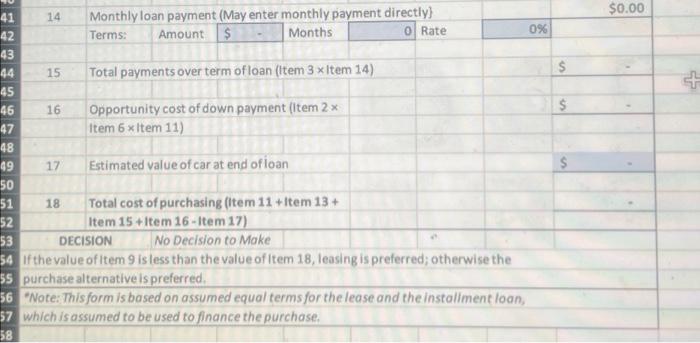

1. Lease vs. purchase car decision. Use Worksheet 5.1(attached below). Gavin Anderson is trying to decide whether to lease or purchase a new car costing $18,000. If he leases, he'll have to pay a $600 security deposit and monthly payments of $425 over the 36-month term of the closed-end lease. On the other hand, if he buys the car then he'll have to make a $2,400 down payment and will finance the balance with a 36-month, 5 percent loan requiring monthly payments of $500; he'll also have to pay a 6 percent sales tax ($1,080) on the purchase price, and he expects the car to have a residual value of $6,500 at the end of 3 years. Gavin can earn 2 percent interest on his savings and plans to include the sales tax in the amount financed on the purchase. Use the automobile lease versus purchase analysis form in Worksheet 5.1 to find the total cost of both the lease and the purchase and then recommend the best strategy for Gavin. 3 Name 10 11 8 D 1 Enter data in blue areas only. Item Description LEASE 2 3 4 S 6 7 8 9 PURCHASE 10 11 12 13 14 15 Date Initial payment: a. Down payment (capital cost reduction): b. Security deposit: Term of lease and loan (years) Term of lease and loan (months) (Item 2 x 12) Monthly lease payment Total payments over term of lease (Item 3 x Item 4) Interest rate earned on savings (in decimal form-formatted %) Opportunity cost of initial payment (Item 1 x Item 2 x item 6) Payment/refund for market value adjustment at end of lease ($0 for closed-end leases) and/or estimated end-of-term charges Total cost of leasing (Item 1a+Item 5+ Item 7 +Item 8) Purchase price Down payment Sales tax rate (in decimal form) Sales tax (Item 10 x Item 12) Monthly loan payment (May enter monthly payment directly) Terms: Amount $ Months 0 Rate Total payments over term of loan (item 3 x Item 14) 0% $ $ Amount 0 $0.00 41 Monthly loan payment (May enter monthly payment directly) Terms: Amount $ 42 Months 0 Rate 43 44 Total payments over term of loan (Item 3 x Item 14) 45 46 Opportunity cost of down payment (Item 2 x Item 6 x Item 11) 47 48 49 Estimated value of car at end of loan 50 51 Total cost of purchasing (Item 11+Item 13+ Item 15 +Item 16-Item 17) 52 53 DECISION No Decision to Make 54 If the value of item 9 is less than the value of Item 18, leasing is preferred; otherwise the 55 purchase alternative is preferred. 56 "Note: This form is based on assumed equal terms for the lease and the installment loan, 57 which is assumed to be used to finance the purchase. 58 14 15 16 17 18 0% $ $ $0.00 +