Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Let's track the capital stock, GDP, and rental rate of capital in the simplest Solow economy, one rigged to speed up the process

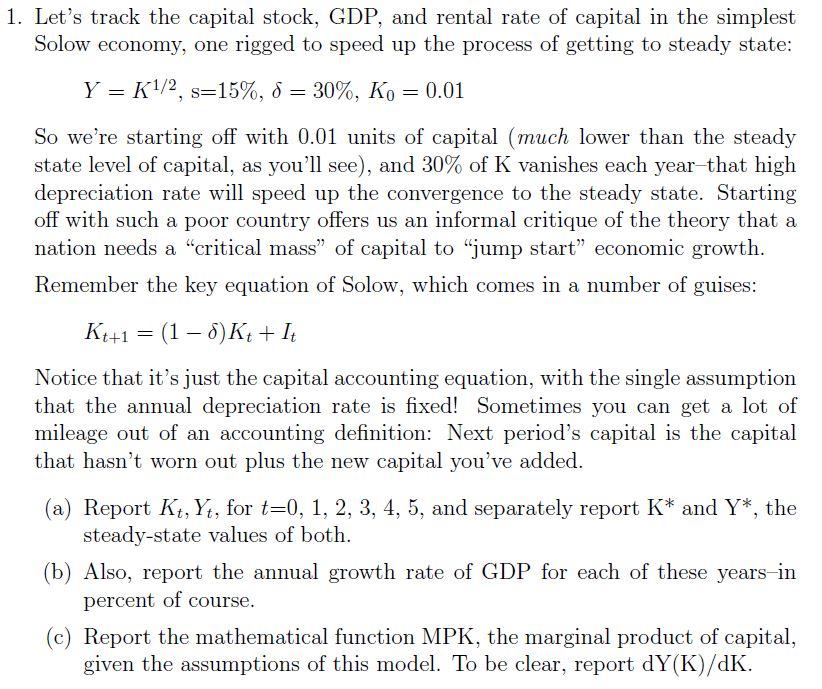

1. Let's track the capital stock, GDP, and rental rate of capital in the simplest Solow economy, one rigged to speed up the process of getting to steady state: Y = K1/2, s-15%, 8 = 30%, Ko = 0.01 So we're starting off with 0.01 units of capital (much lower than the steady state level of capital, as you'll see), and 30% of K vanishes each year that high depreciation rate will speed up the convergence to the steady state. Starting off with such a poor country offers us an informal critique of the theory that a nation needs a "critical mass" of capital to "jump start" economic growth. Remember the key equation of Solow, which comes in a number of guises: Kt+1 = = (1-6) Kt + It Notice that it's just the capital accounting equation, with the single assumption that the annual depreciation rate is fixed! Sometimes you can get a lot of mileage out of an accounting definition: Next period's capital is the capital that hasn't worn out plus the new capital you've added. (a) Report Kt, Yt, for t=0, 1, 2, 3, 4, 5, and separately report K* and Y*, the steady-state values of both. (b) Also, report the annual growth rate of GDP for each of these years in percent of course. (c) Report the mathematical function MPK, the marginal product of capital, given the assumptions of this model. To be clear, report dY(K)/dk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the values of capital Kt and output Yt for each period and the steadystate values K a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started