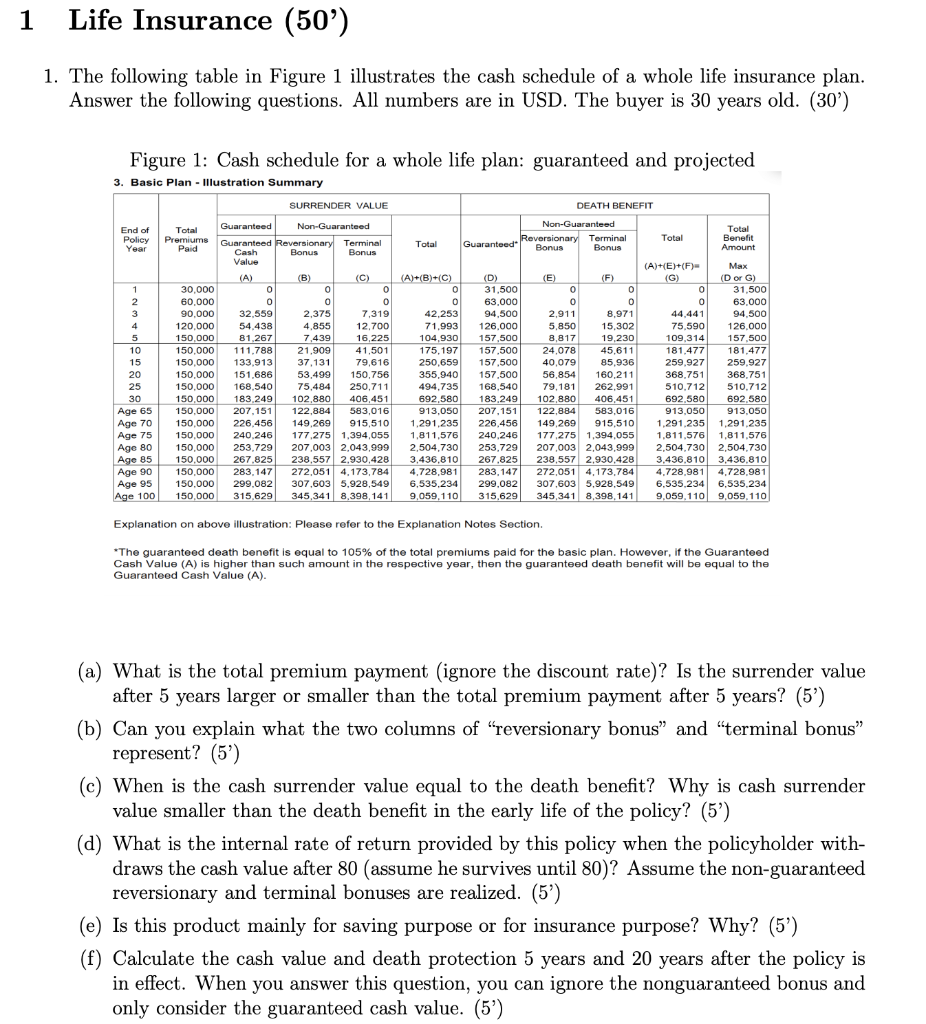

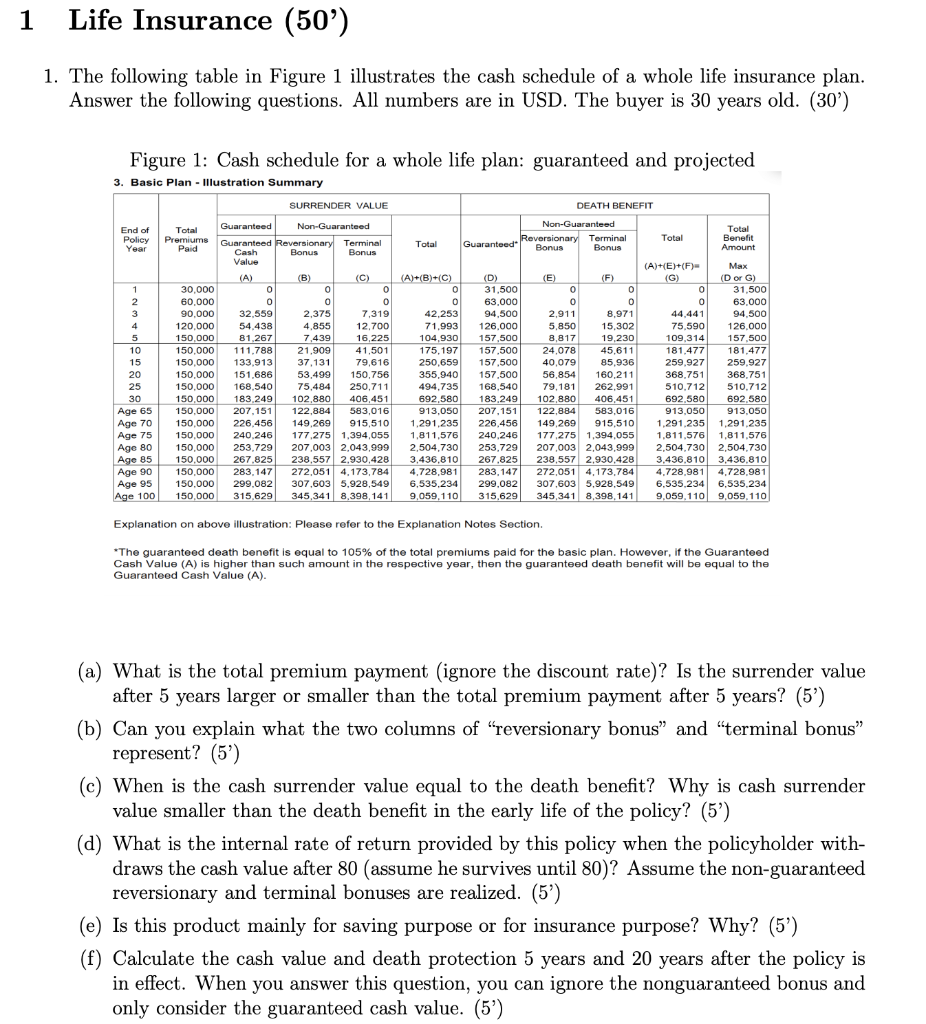

1 Life Insurance (50%) 1. The following table in Figure 1 illustrates the cash schedule of a whole life insurance plan. Answer the following questions. All numbers are in USD. The buyer is 30 years old. (30) Figure 1: Cash schedule for a whole life plan: guaranteed and projected 3. Basic Plan - Illustration Summary SURRENDER VALUE End of Policy Year DEATH BENEFIT Non-Guaranteed Reversionary Terminal Bonus Bonus Total Total Benefit Amount Total Guaranteed 1 2 3 4 5 10 15 20 25 30 Age 65 Age 70 Age 75 Age 80 Age 85 Age 90 Age 95 Age 100 Total Guaranteed Non-Guaranteed Premiums Guaranteed Reversionary Terminal Paid Cash Bonus Bonus Value (A) (B) (C) 30,000 0 o 0 60,000 0 0 0 90.000 32.559 2,375 7,319 120,000 54.438 4,855 12.700 150,000 81.267 7,439 16,225 150,000 111.788 21,909 41,501 150,000 133.913 37,131 79,616 150.000 151,686 53,499 150,756 150,000 168,540 75,484 250,711 150,000 183,249 102.880 406,451 150,000 207.151 122,884 583,016 150,000 226,456 149,269 915,510 150.000 240.246 177,275 1.394,055 150.000 253.729 207,003 2.043,999 150.000 267.825 238,557 2.930,428 150,000 283, 147 272,051 4.173.784 150.000 299.082 307,603 5.928,549 150,000 315,629 345,341 8,398,141 (A)+(B)+(C) 0 0 42,253 71,993 104,930 175,197 250,659 355,940 494,735 692,580 913.050 1.291,235 1,811,576 2,504.730 3,436,810 4,728,981 6,535,234 9,059, 110 (D) ) 31,500 63,000 94,500 126.000 157,500 157,500 157,500 157.500 168.540 183,249 207.151 226,456 240,246 253,729 267.825 283,147 299,082 315,629 (E) (F) 0 0 0 0 0 2,911 8,971 5,850 15,302 8,817 19,230 24.078 45,611 40,079 85,936 56,854 160,211 79,181 262,99 102.880 406,451 122,884 583,016 149,269 915,510 177,275 1,394,055 207,003 2,043,999 238,557 2.930,428 272,051 4,173,784 307,603 5,928,549 345,341 8,398,141 (A)+(E)+(F)- Max (G (Dor G) 0 31,500 0 63.000 44,441 94,500 75,590 126.000 109,314 157.500 181,477 181,477 259.927 259.927 368.751 368.751 510.712 510,712 692.580 692.580 913.050 913.050 1,291.235 1,291,235 1,811,576 1,811,576 2,504.730 2,504.730 3.436.810 3,436,810 4,728,981 4,728.981 6.535,234 6,535,234 9,059.110 9,059, 110 Explanation on above illustration: Please refer to the Explanation Notes Section *The guaranteed death benefit is equal to 105% of the total premiums paid for the basic plan. However, if the Guaranteed Cash Value (A) is higher than such amount in the respective year, then the guaranteed death benefit will be equal to the Guaranteed Cash Value (A). (a) What is the total premium payment (ignore the discount rate)? Is the surrender value after 5 years larger or smaller than the total premium payment after 5 years? (5') (b) Can you explain what the two columns of reversionary bonus" and "terminal bonus" represent? (5) (c) When is the cash surrender value equal to the death benefit? Why is cash surrender value smaller than the death benefit in the early life of the policy? (5') (d) What is the internal rate of return provided by this policy when the policyholder with- draws the cash value after 80 (assume he survives until 80)? Assume the non-guaranteed reversionary and terminal bonuses are realized. (5%) (e) Is this product mainly for saving purpose or for insurance purpose? Why? (5') (f) Calculate the cash value and death protection 5 years and 20 years after the policy is in effect. When you answer this question, you can ignore the nonguaranteed bonus and only consider the guaranteed cash value. (5')