Answered step by step

Verified Expert Solution

Question

1 Approved Answer

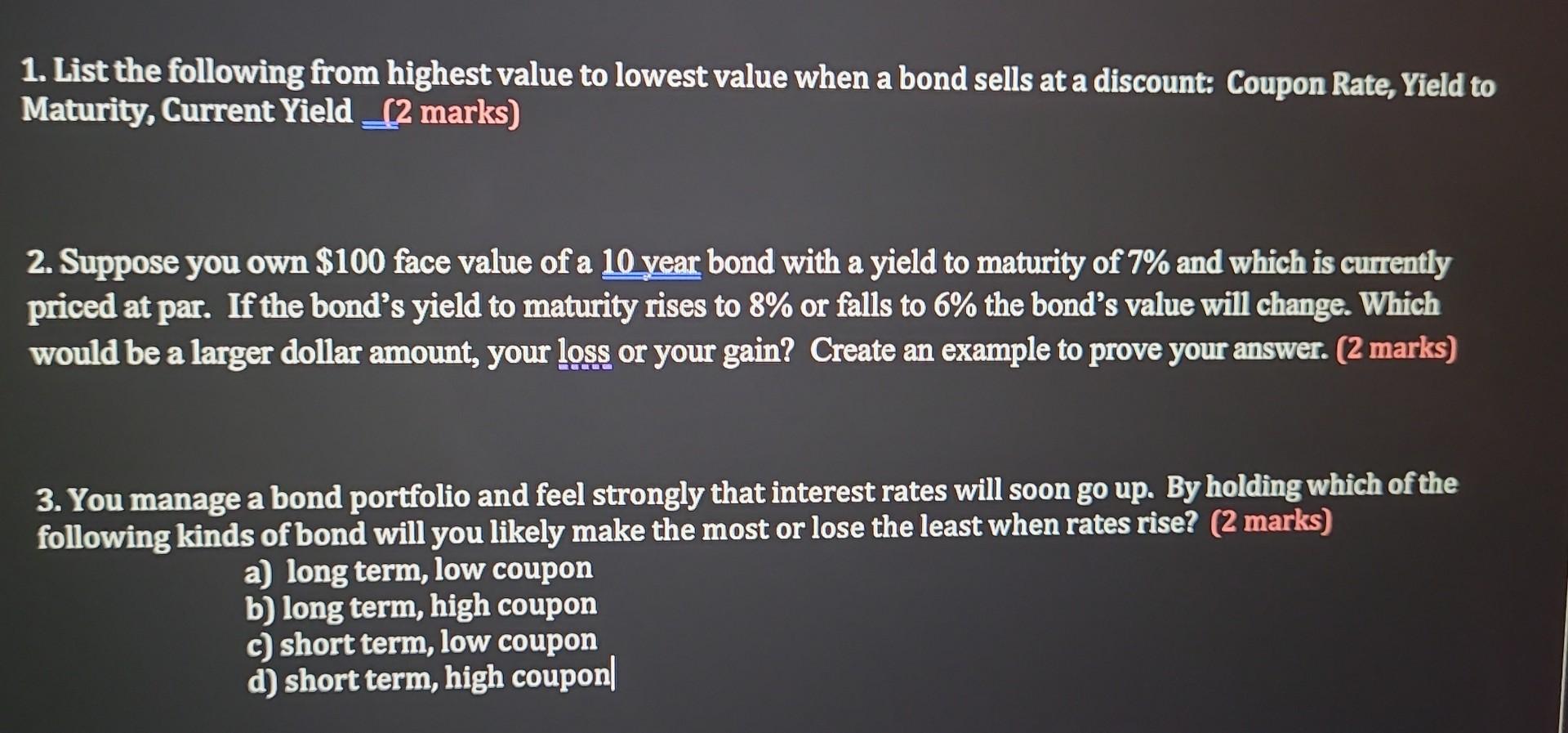

1. List the following from highest value to lowest value when a bond sells at a discount: Coupon Rate, Yield to Maturity, Current Yield (2

1. List the following from highest value to lowest value when a bond sells at a discount: Coupon Rate, Yield to Maturity, Current Yield (2 marks) 2. Suppose you own $100 face value of a 10 year bond with a yield to maturity of 7% and which is currently priced at par. If the bond's yield to maturity rises to 8% or falls to 6% the bond's value will change. Which would be a larger dollar amount, your loss or your gain? Create an example to prove your answer. ( 2 marks) 3. You manage a bond portfolio and feel strongly that interest rates will soon go up. By holding which of the following kinds of bond will you likely make the most or lose the least when rates rise? ( 2 marks) a) long term, low coupon b) long term, high coupon c) short term, low coupon d) short term, high coupon|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started