Question

1. Look up Johnson & Johnson on Yahoo! Finance. a. Recalculate book- and market-value balance sheets using the most recent available financial information. Use the

1. Look up Johnson & Johnson on Yahoo! Finance.

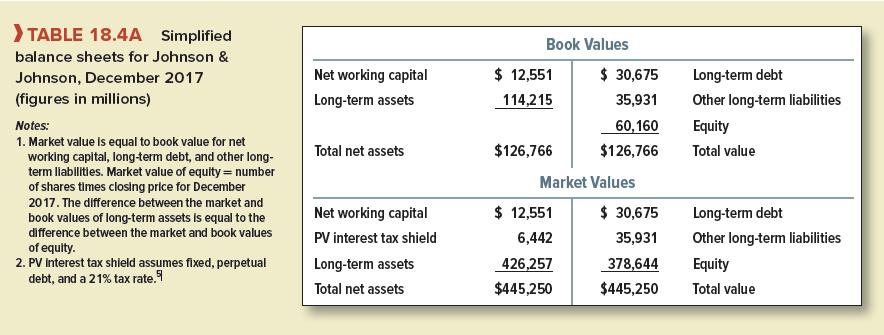

a. Recalculate book- and market-value balance sheets using the most recent available financial information. Use the same format as for Table 18.4.

a. Recalculate book- and market-value balance sheets using the most recent available financial information. Use the same format as for Table 18.4.

b. Track Johnson & Johnsons long-term debt and debt ratio over the last five years (you will need to go to the companys website to do this). How have they changed? Does it appear that the company has a stable target debt ratio? Do you see any evidence of pecking-order financing?

c. How much has the company spent to repurchase its own shares? Would the trade-off theory predict share repurchases for a conservatively financed company like Johnson & Johnson?

I think I know how to do this question, but I don't know where to find The Data I need on yahoo.finance!!!

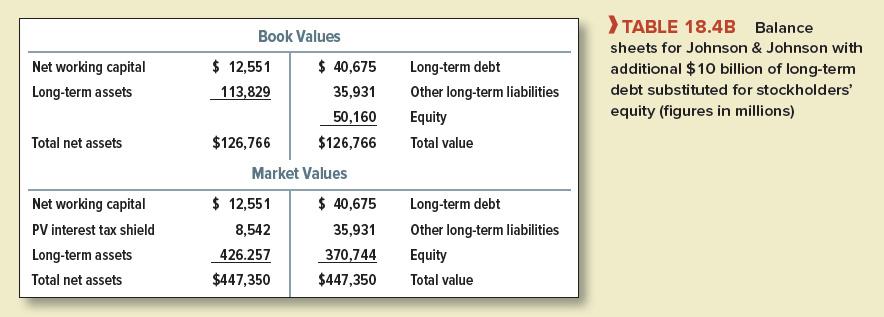

Net working capital Long-term assets > TABLE 18.4A Simplified balance sheets for Johnson & Johnson, December 2017 (figures in millions) Notes: 1. Market value is equal to book value for net working capital, long-term debt, and other long- term liabilities. Market value of equity = number of shares times closing price for December 2017. The difference between the market and book values of long-term assets is equal to the difference between the market and book values of equity. 2. PV interest tax shield assumes fixed, perpetual debt, and a 21% tax rate. Long-term debt Other long-term liabilities Equity Total value Total net assets Book Values $ 12,551 $ 30,675 114,215 35,931 60,160 $126,766 $126,766 Market Values $ 12,551 $ 30,675 6,442 35,931 426,257 378,644 $445,250 $445,250 Net working capital PV interest tax shield Long-term assets Total net assets Long-term debt Other long-term liabilities Equity Total value Net working capital Long-term assets Long-term debt Other long-term liabilities Equity Total value > TABLE 18.4B Balance sheets for Johnson & Johnson with additional $10 billion of long-term debt substituted for stockholders' equity (figures in millions) Total net assets Book Values $ 12,551 $ 40,675 113,829 35,931 50,160 $126,766 $126,766 Market Values $ 12,551 $ 40,675 8,542 35,931 426.257 370,744 $447,350 $447,350 Net working capital PV interest tax shield Long-term assets Total net assets Long-term debt Other long-term liabilities Equity Total value Net working capital Long-term assets > TABLE 18.4A Simplified balance sheets for Johnson & Johnson, December 2017 (figures in millions) Notes: 1. Market value is equal to book value for net working capital, long-term debt, and other long- term liabilities. Market value of equity = number of shares times closing price for December 2017. The difference between the market and book values of long-term assets is equal to the difference between the market and book values of equity. 2. PV interest tax shield assumes fixed, perpetual debt, and a 21% tax rate. Long-term debt Other long-term liabilities Equity Total value Total net assets Book Values $ 12,551 $ 30,675 114,215 35,931 60,160 $126,766 $126,766 Market Values $ 12,551 $ 30,675 6,442 35,931 426,257 378,644 $445,250 $445,250 Net working capital PV interest tax shield Long-term assets Total net assets Long-term debt Other long-term liabilities Equity Total value Net working capital Long-term assets Long-term debt Other long-term liabilities Equity Total value > TABLE 18.4B Balance sheets for Johnson & Johnson with additional $10 billion of long-term debt substituted for stockholders' equity (figures in millions) Total net assets Book Values $ 12,551 $ 40,675 113,829 35,931 50,160 $126,766 $126,766 Market Values $ 12,551 $ 40,675 8,542 35,931 426.257 370,744 $447,350 $447,350 Net working capital PV interest tax shield Long-term assets Total net assets Long-term debt Other long-term liabilities Equity Total valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started