Answered step by step

Verified Expert Solution

Question

1 Approved Answer

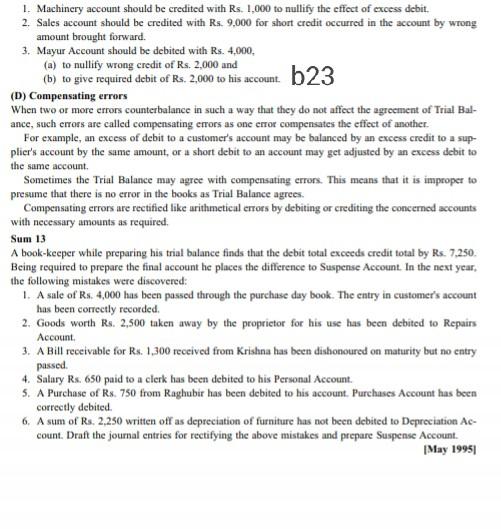

1. Machinery account should be credited with Rs. 1,000 to nullify the effect of excess debit. 2. Sales account should be credited with Rs. 9,000

1. Machinery account should be credited with Rs. 1,000 to nullify the effect of excess debit. 2. Sales account should be credited with Rs. 9,000 for short credit occurred in the account by wrong amount brought forward. 3. Mayur Account should be debited with Rs. 4.000, (a) to nullify wrong credit of Rs. 2,000 and (5) to give required debit of Rs. 2,000 to his account. b23 (D) Compensating errors When two or more errors counterbalance in such a way that they do not affect the agreement of Trial Bal- ance, such errors are called compensating errors as one error compensates the effect of another. For example, an excess of debit to a customer's account may be balanced by an excess credit to a sup- plier's account by the same amount, or a short debit to an account may get adjusted by an excess debit to the same account Sometimes the Trial Balance muy agree with compensating errors. This means that it is improper to presume that there is no error in the books as Trial Balance agrees. Compensating errors are rectified like arithmetical errors by debiting or crediting the concerned accounts with necessary amounts as required. Sum 13 A book-keeper while preparing his trial balance finds that the debit total exceeds credit total by Rs. 7.250. Being required to prepare the final account hic places the difference to Suspense Account. In the next year, the following mistakes were discovered: 1. A sale of Rs. 4,000 has been passed through the purchase day book. The entry in customer's account has been correctly recorded. 2. Goods worth Rs. 2,500 taken away by the proprietor for his use has been debited to Repairs Account 3. A Bill receivable for Rs. 1,300 received from Krishna has been dishonoured on maturity but no entry passed 4. Salary Rs.650 paid to a clerk has been debited to his Personal Account 5. A Purchase of Rs.750 from Raghubir has been debited to his account. Purchases Account has been correctly debited. 6. A sum of Rs. 2.250 written off as depreciation of furniture has not been debited to Depreciation Ac- count. Draft the journal entries for rectifying the above mistakes and prepare Suspense Account. | May 19951

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started