Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Manchester United has been a bit touch-and-go on the pitch for the last year but none of their on-field volatility has impacted the

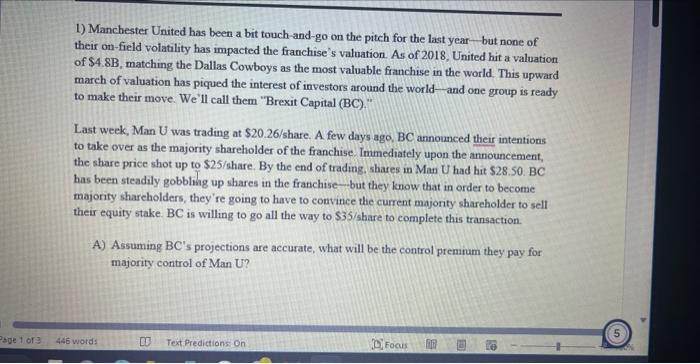

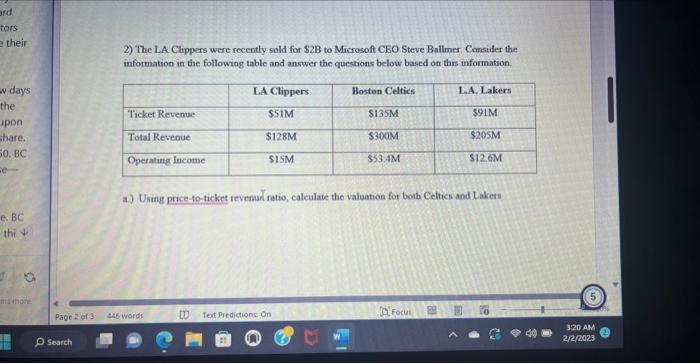

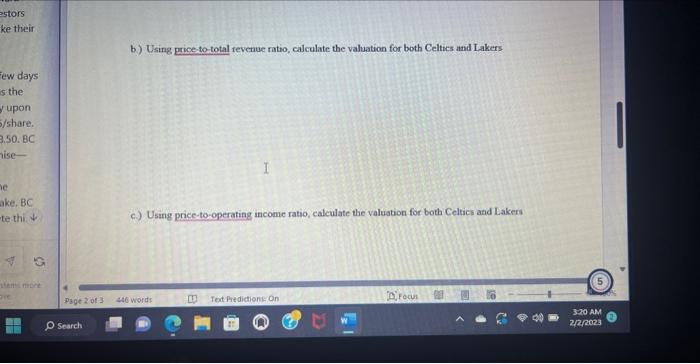

1) Manchester United has been a bit touch-and-go on the pitch for the last year but none of their on-field volatility has impacted the franchise's valuation. As of 2018, United hit a valuation of $4.SB, matching the Dallas Cowboys as the most valuable franchise the world. This upward march of valuation has piqued the interest of investors around the world and one group is ready to make their move. We'll call them "Brexit Capital (BC)." Last week, Man U was trading at $20.26/share. A few days ago, BC annou nounced their intentions to take over as the majority shareholder of the franchise. Immediately upon the announcement, the share price shot up to $25/share. By the end of trading, shares in Man U had hit $28.50. BC has been steadily gobbling up shares in the franchise-but they know that in order to become majority shareholders, they're going to have to convince the current majority shareholder to sell their equity stake. BC is willing to go all the way to $35/share to complete this transaction. A) Assuming BC's projections are accurate, what will be the control premium they pay for majority control of Man U? Page 1 of 3 446 words 83 Text Predictions: On Focus 20 ard tors e their w days the ipon share. 50. BC e. BC thi 10 Page 2 of 3 Search 2) The LA Clippers were recently sold for $2B to Microsoft CEO Steve Ballmer. Consider the information in the following table and answer the questions below based on this information. Ticket Revenue Total Revenue Operating Income 446 words LA Clippers $51M $128M $15M DD Boston Celtics a) Using price-to-ticket revenud ratio, calculate the valuation for both Celtics and Lakers Text Predictions: On $135M $300M $53.4M L.A. Lakers $91M $205M $12.6M Focus 3:20 AM 2/2/2023 estors ke their Few days is the upon 5/share. 3.50. BC hise- he ake, BC -te thi 4 G b.) Using price-to-total revenue ratio, calculate the valuation for both Celtics and Lakers Search Using price-to-operating income ratio, calculate the valuation for both Celtics and Lakers Page 2 of 3 446 words 10 Text Predictions: On Foan 3:20 AM 2/2/2023 d volatility 18, United wboys as oward westors ake their few days as the ly upon -5/share. 8.50, BC chise- he take. BC ete thi S d.) Consider that a minority stake (10%) in the LA Lakers was sold for $150M. Assuming we trust our price-to total revenue ratio for an accurate total valuation of the team (at the majority ownership valuation), what is the controlling interest premium (CIP) for the Lakers? Search 3) Back in 2012, Justin Timberlake spent $5M to buy a minority stake in the Memphis Grizzlies of 2.84%. Let's assume that the controlling interest premium for the NBA at this point was 150% I a) Given this control premium and JT's minority purchase, what would we expect the entire Grizzlies franchise to be worth at the stage when JT purchased his stake? Page 3 of 3 445 words M Text Predictions: On Focus E 3:21 AM 2/2/2023 wboys as upward nvestors make their A few days er as the tely upon $25/share. $28.50. BC nchise y the stake. BC plete thi A ystems mote manye G Page 3 of 3 Search b) Look up the Forbes valuation of the Grizzlies today. Based on your answer in Part A, do you think Mr. Timberlake made a solid investment? Or is be "crying a river?" IF 446 words 13 Text Predictions On Foo 3:21 AM 2/2/2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A To calculate the control premium we need to find the difference between the final share price offe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started