Question

1) Manufacturing Over-Head, MOH: a. Compute the Predetermined Manufacturing Overhead Rate?= b. Compute the Actual Manufacturing Overhead Costs for the Month?= c. Compute the Manufacturing

1) Manufacturing Over-Head, MOH:

a. Compute the Predetermined Manufacturing Overhead Rate?=

b. Compute the Actual Manufacturing Overhead Costs for the Month?=

c. Compute the Manufacturing Overhead Costs Applied to Mtn Bikes for the Month?=

d. Compute the Manufacturing Overhead Costs Applied to BMX Bikes for the Month?=

e. Compute the Manufacturing Overhead Account Balance, (Over or Under Applied) =

f. Compute the Error Percent for the MOH Balance =

g. Is the Amount Reasonable based on 5% Error Limit ? =

h. What should this Business do to their MOH Rate? =

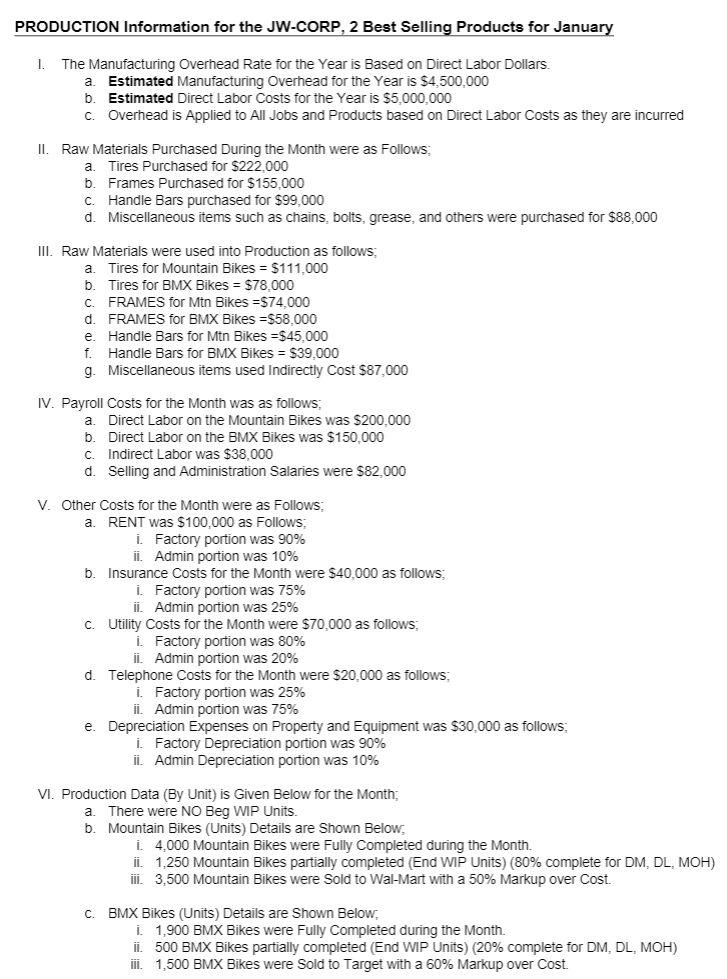

PRODUCTION Information for the JW-CORP, 2 Best Selling Products for January 1. The Manufacturing Overhead Rate for the Year is based on Direct Labor Dollars. a. Estimated Manufacturing Overhead for the Year is $4.500,000 b Estimated Direct Labor Costs for the Year is $5,000,000 c. Overhead is Applied to All Jobs and Products based on Direct Labor Costs as they are incurred II. Raw Materials Purchased During the Month were as follows: a Tires Purchased for $222.000 b. Frames Purchased for $ 155,000 C. Handle Bars purchased for $99,000 d. Miscellaneous items such as chains, bolts, grease, and others were purchased for $88,000 III. Raw Materials were used into Production as follows: a. Tires for Mountain Bikes = $111.000 b Tires for BMX Bikes = $78,000 C FRAMES for Mtn Bikes =$74.000 d. FRAMES for BMX Bikes =$58,000 e. Handle Bars for Men Bikes = $45.000 f. Handle Bars for BMX Bikes = $39.000 g. Miscellaneous items used Indirectly Cost $87,000 IV. Payroll Costs for the Month was as follows: a. Direct Labor on the Mountain Bikes was $200,000 b. Direct Labor on the BMX Bikes was $150.000 C. Indirect Labor was $38,000 d. Selling and Administration Salaries were $82,000 V. Other Costs for the Month were as Follows, a RENT was $100,000 as Follows, . Factory portion was 90% ii. Admin portion was 10% b. Insurance Costs for the Month were $40,000 as follows: . Factory portion was 75% ii. Admin portion was 25% c. Utility Costs for the Month were $70,000 as follows: . Factory portion was 80% ii. Admin portion was 20% d. Telephone Costs for the Month were $20,000 as follows: . Factory portion was 25% ii. Admin portion was 75% e. Depreciation Expenses on Property and Equipment was $30,000 as follows: . Factory Depreciation portion was 90% ii. Admin Depreciation portion was 10% VI. Production Data (By Unit) is Given Below for the Month; a There were NO Beg WIP Units. b. Mountain Bikes (Units) Details are shown Below, . 4.000 Mountain Bikes were Fully Completed during the Month. ii. 1,250 Mountain Bikes partially completed (End WIP Units) (80% complete for DM, DL, MOH) Tii. 3,500 Mountain Bikes were sold to Wal-Mart with a 50% Markup over Cost. C. BMX Bikes (Units) Details are shown Below, . 1,900 BMX Bikes were Fully Completed during the Month ii. 500 BMX Bikes partially completed (End WIP Units) (20% complete for DM, DL, MOH) iii. 1,500 BMX Bikes were sold to Target with a 60% Markup over Cost. PRODUCTION Information for the JW-CORP, 2 Best Selling Products for January 1. The Manufacturing Overhead Rate for the Year is based on Direct Labor Dollars. a. Estimated Manufacturing Overhead for the Year is $4.500,000 b Estimated Direct Labor Costs for the Year is $5,000,000 c. Overhead is Applied to All Jobs and Products based on Direct Labor Costs as they are incurred II. Raw Materials Purchased During the Month were as follows: a Tires Purchased for $222.000 b. Frames Purchased for $ 155,000 C. Handle Bars purchased for $99,000 d. Miscellaneous items such as chains, bolts, grease, and others were purchased for $88,000 III. Raw Materials were used into Production as follows: a. Tires for Mountain Bikes = $111.000 b Tires for BMX Bikes = $78,000 C FRAMES for Mtn Bikes =$74.000 d. FRAMES for BMX Bikes =$58,000 e. Handle Bars for Men Bikes = $45.000 f. Handle Bars for BMX Bikes = $39.000 g. Miscellaneous items used Indirectly Cost $87,000 IV. Payroll Costs for the Month was as follows: a. Direct Labor on the Mountain Bikes was $200,000 b. Direct Labor on the BMX Bikes was $150.000 C. Indirect Labor was $38,000 d. Selling and Administration Salaries were $82,000 V. Other Costs for the Month were as Follows, a RENT was $100,000 as Follows, . Factory portion was 90% ii. Admin portion was 10% b. Insurance Costs for the Month were $40,000 as follows: . Factory portion was 75% ii. Admin portion was 25% c. Utility Costs for the Month were $70,000 as follows: . Factory portion was 80% ii. Admin portion was 20% d. Telephone Costs for the Month were $20,000 as follows: . Factory portion was 25% ii. Admin portion was 75% e. Depreciation Expenses on Property and Equipment was $30,000 as follows: . Factory Depreciation portion was 90% ii. Admin Depreciation portion was 10% VI. Production Data (By Unit) is Given Below for the Month; a There were NO Beg WIP Units. b. Mountain Bikes (Units) Details are shown Below, . 4.000 Mountain Bikes were Fully Completed during the Month. ii. 1,250 Mountain Bikes partially completed (End WIP Units) (80% complete for DM, DL, MOH) Tii. 3,500 Mountain Bikes were sold to Wal-Mart with a 50% Markup over Cost. C. BMX Bikes (Units) Details are shown Below, . 1,900 BMX Bikes were Fully Completed during the Month ii. 500 BMX Bikes partially completed (End WIP Units) (20% complete for DM, DL, MOH) iii. 1,500 BMX Bikes were sold to Target with a 60% Markup over CostStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started