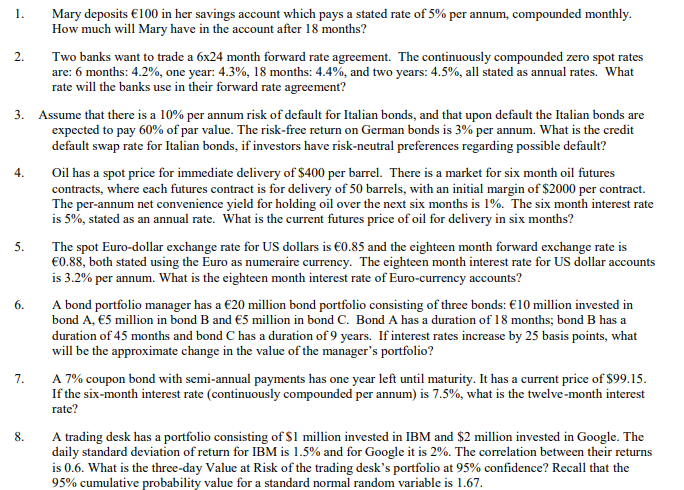

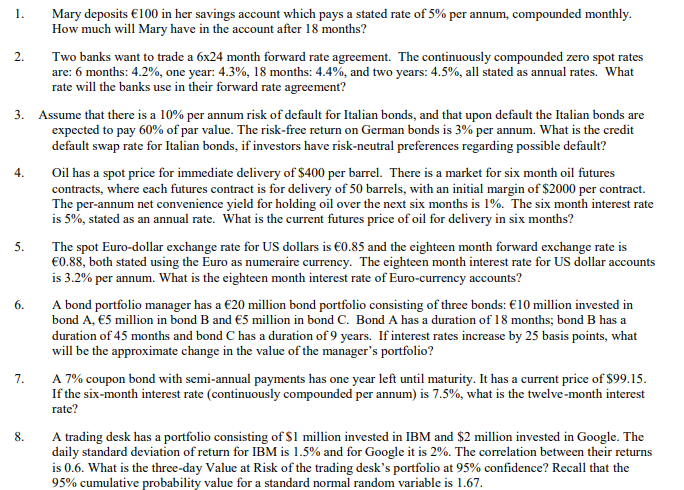

1. Mary deposits 100 in her savings account which pays a stated rate of 5% per annum, compounded monthly. How much will Mary have in the account after 18 months? 2. Two banks want to trade a 6x24 month forward rate agreement. The continuously compounded zero spot rates are: 6 months: 4.2%, one year: 4.3%, 18 months: 4.4%, and two years: 4.5%, all stated as annual rates. What rate will the banks use in their forward rate agreement? 3. Assume that there is a 10% per annum risk of default for Italian bonds, and that upon default the Italian bonds are expected to pay 60% of par value. The risk-free return on German bonds is 3% per annum. What is the credit default swap rate for Italian bonds, if investors have risk-neutral preferences regarding possible default? Oil has a spot price for immediate delivery of $400 per barrel. There is a market for six month oil futures contracts, where each futures contract is for delivery of 50 barrels, with an initial margin of $2000 per contract. The per-annum net convenience yield for holding oil over the next six months is 1%. The six month interest rate is 5%, stated as an annual rate. What is the current futures price of oil for delivery in six months? The spot Euro-dollar exchange rate for US dollars is 0.85 and the eighteen month forward exchange rate is 0.88, both stated using the Euro as numeraire currency. The eighteen month interest rate for US dollar accounts is 3.2% per annum. What is the eighteen month interest rate of Euro-currency accounts? A bond portfolio manager has a 20 million bond portfolio consisting of three bonds: 10 million invested in bond A, 5 million in bond B and 5 million in bond C. Bond A has a duration of 18 months; bond B has a duration of 45 months and bond C has a duration of 9 years. If interest rates increase by 25 basis points, what will be the approximate change in the value of the manager's portfolio? A 7% coupon bond with semi-annual payments has one year left until maturity. It has a current price of $99.15. If the six-month interest rate continuously compounded per annum) is 7.5%, what is the twelve-month interest rate? A trading desk has a portfolio consisting of $1 million invested in IBM and $2 million invested in Google. The daily standard deviation of return for IBM is 1.5% and for Google it is 2%. The correlation between their returns is 0.6. What is the three-day Value at Risk of the trading desk's portfolio at 95% confidence? Recall that the 95% cumulative probability value for a standard normal random variable is 1.67. 5. 6. 7. 8