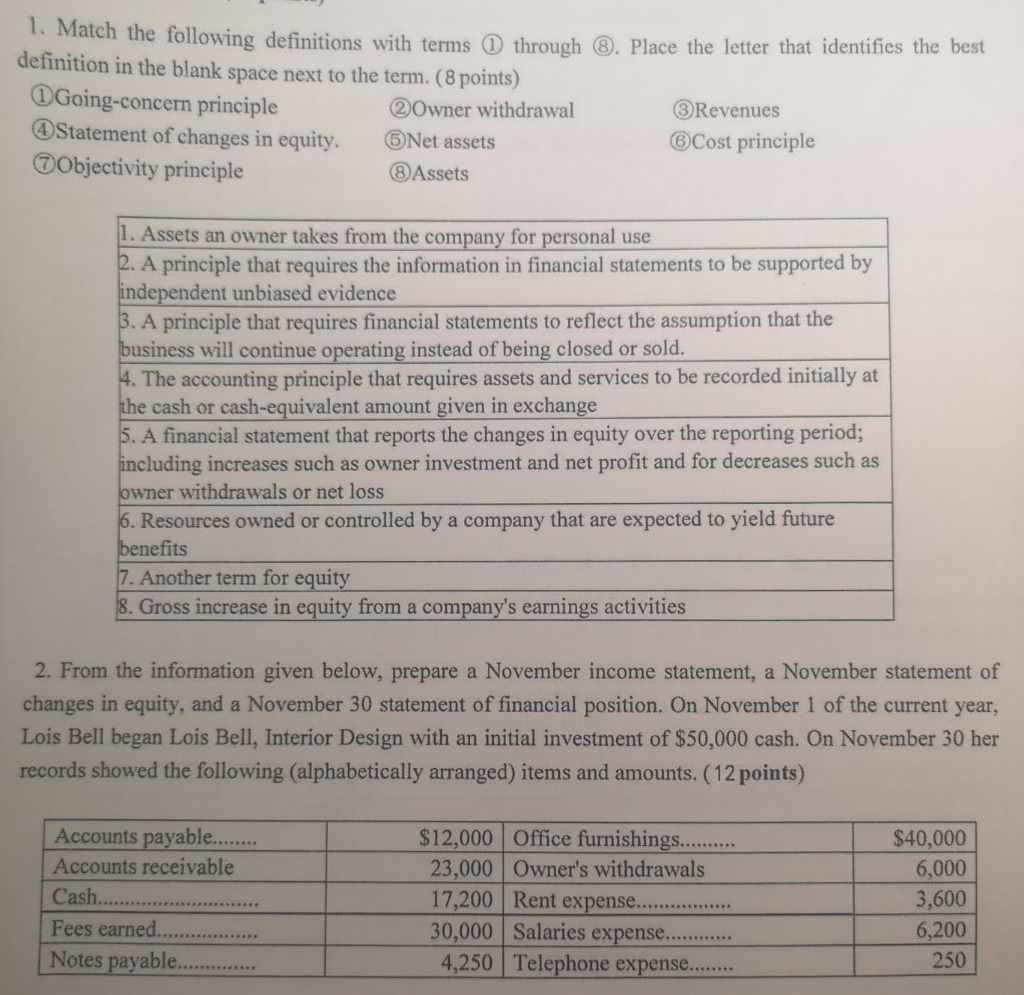

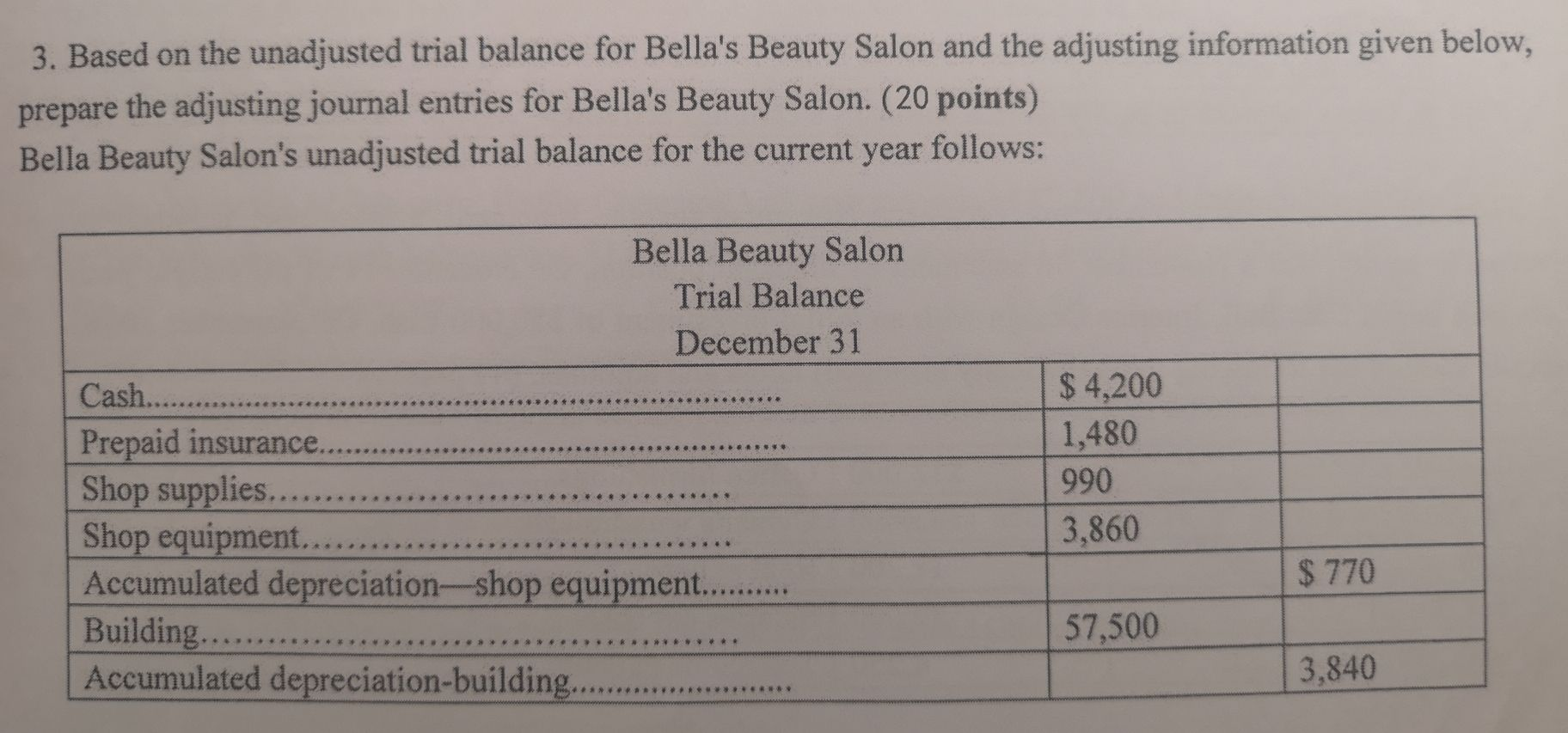

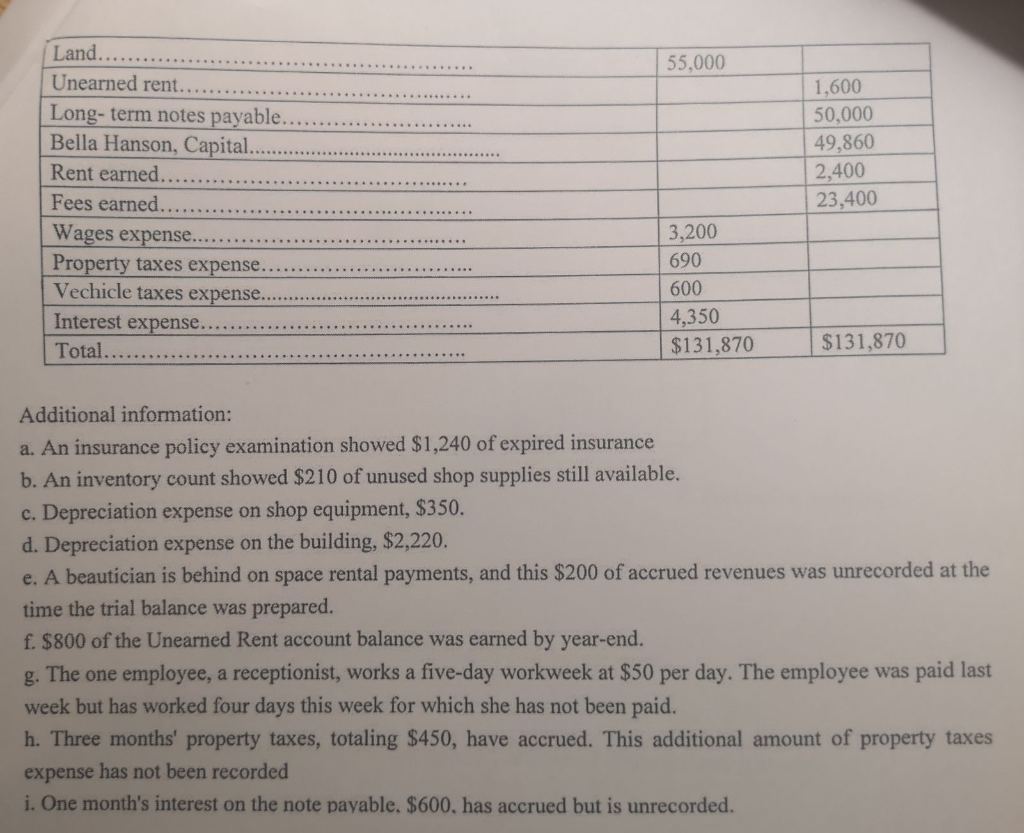

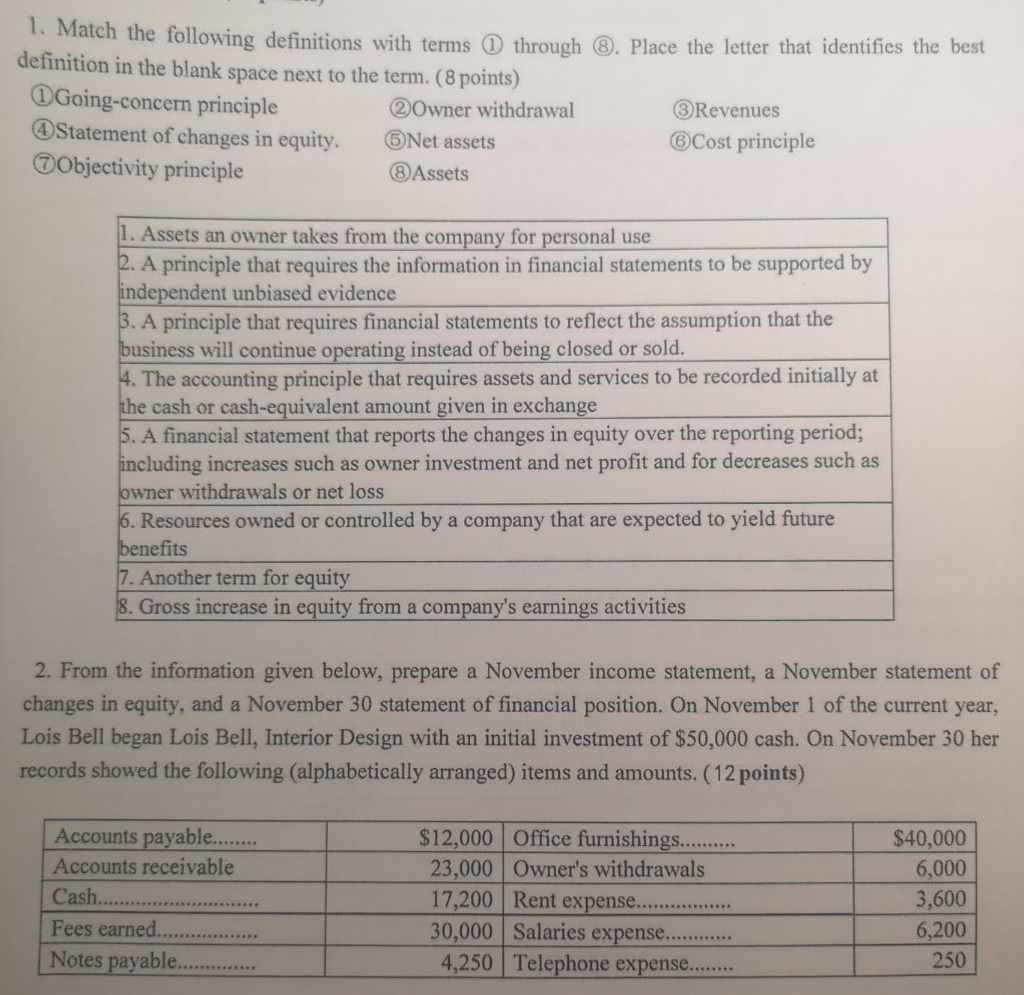

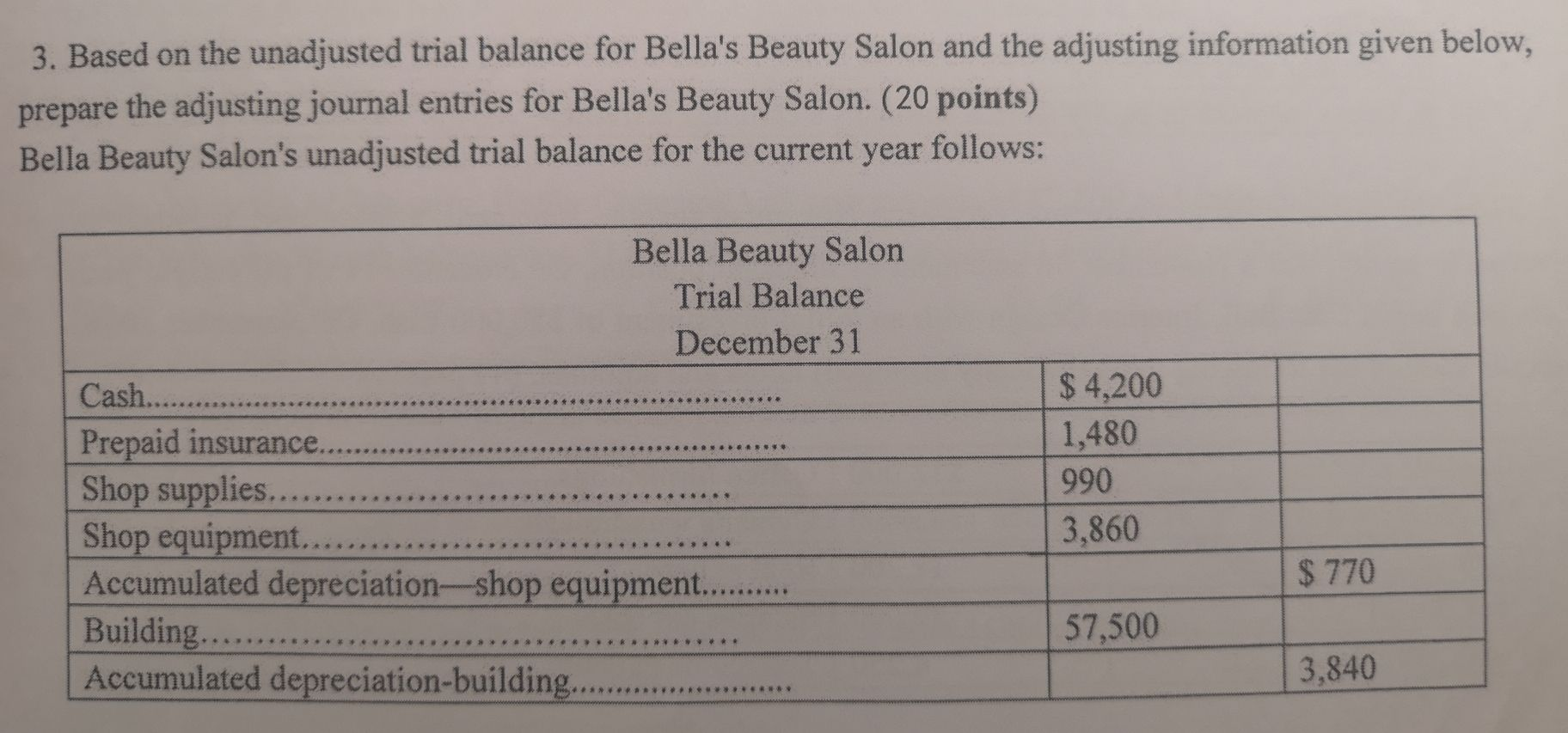

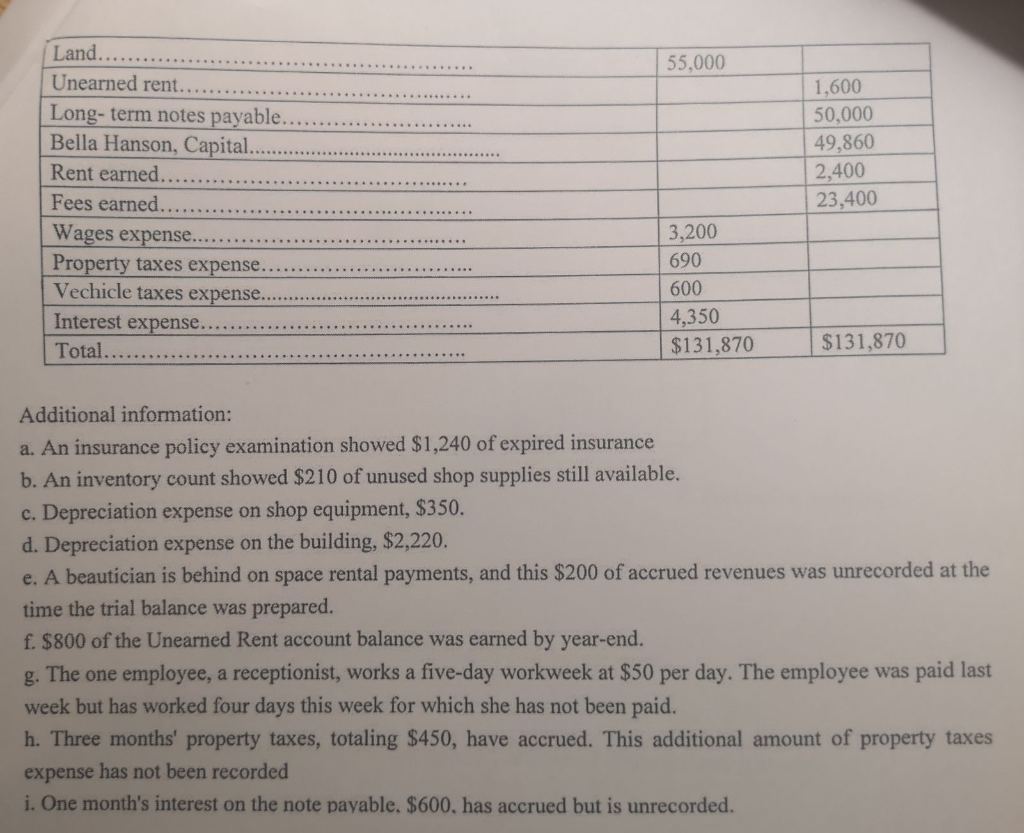

1. Match the following definitions w the following definitions with terms 1 through 8. Place the letter that identifies the best definition in the blank space next to the term. (8 points) Going-concern principle 2 Owner withdrawal Revenues Statement of changes in equity. Net assets Cost principle Objectivity principle Assets 1. Assets an owner takes from the company for personal use 2. A principle that requires the information in financial statements to be supported by independent unbiased evidence 3. A principle that requires financial statements to reflect the assumption that the business will continue operating instead of being closed or sold. 4. The accounting principle that requires assets and services to be recorded initially at the cash or cash-equivalent amount given in exchange 5. A financial statement that reports the changes in equity over the reporting period; including increases such as owner investment and net profit and for decreases such as owner withdrawals or net loss 6. Resources owned or controlled by a company that are expected to yield future benefits 17. Another term for equity 8. Gross increase in equity from a company's earnings activities 2. From the information given below, prepare a November income statement, a November statement of changes in equity, and a November 30 statement of financial position. On November 1 of the current year, Lois Bell began Lois Bell, Interior Design with an initial investment of $50,000 cash. On November 30 her records showed the following (alphabetically arranged) items and amounts. (12 points) Accounts payable........ Accounts receivable Cash.............. Fees earned................ Notes payable..... $12,000 Office furnishings.......... 23.000 Owner's withdrawals 17,200 Rent expense....... 30,000 Salaries expense......... 4,250 Telephone expense........ $40,000 6,000 3,600 6,200 250 3. Based on the unadjusted trial balance for Bella's Beauty Salon and the adjusting information given below, prepare the adjusting journal entries for Bella's Beauty Salon. (20 points) Bella Beauty Salon's unadjusted trial balance for the current year follows: L Bella Beauty Salon Trial Balance December 31 Cash..................................... ................ Prepaid insurance..................................................... Shop supplies............................................. Shop equipment............ Accumulated depreciation-shop equipment.......... Building................................................. Accumulated depreciation-building........ $4,200 1,480 990 3,860 770 57,300 3,840 55.000 Land.......... Unearned rent......... Long-term notes payable....... Bella Hanson, Capital.............. Rent earned......... Fees earned......................... Wages expense.......................... Property taxes expense.... Vechicle taxes expense............ Interest expense.................. Total....... 1,600 50,000 49,860 2,400 23,400 . 3,200 690 600 4,350 $131,870 $131,870 Additional information: a. An insurance policy examination showed $1,240 of expired insurance b. An inventory count showed $210 of unused shop supplies still available. c. Depreciation expense on shop equipment, $350. d. Depreciation expense on the building, $2,220. e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared. f. $800 of the Unearned Rent account balance was earned by year-end. g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid. h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded i. One month's interest on the note payable. $600, has accrued but is unrecorded