Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Max had to pay income taxes of $3 440.00 plus 22% of the amount by which his taxable income exceeded $36 000.00. If

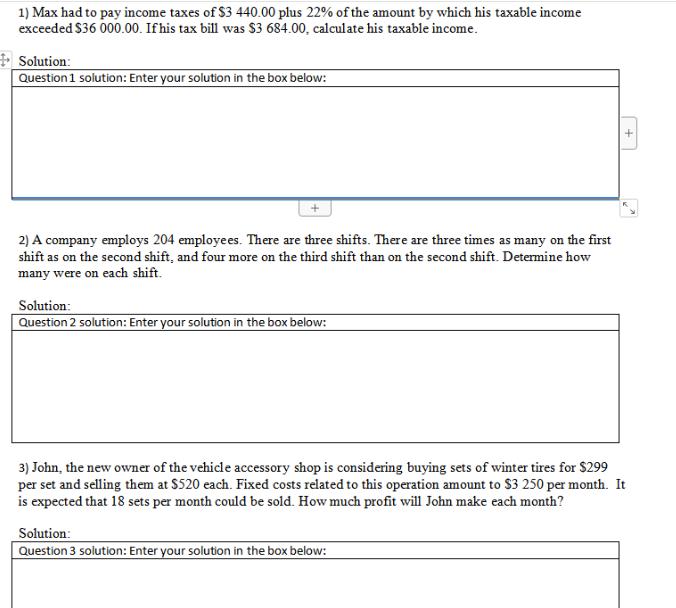

1) Max had to pay income taxes of $3 440.00 plus 22% of the amount by which his taxable income exceeded $36 000.00. If his tax bill was $3 684.00, calculate his taxable income. Solution: Question 1 solution: Enter your solution in the box below: 2) A company employs 204 employees. There are three shifts. There are three times as many on the first shift as on the second shift, and four more on the third shift than on the second shift. Determine how many were on each shift. Solution: Question 2 solution: Enter your solution in the box below: 3) John, the new owner of the vehicle accessory shop is considering buying sets of winter tires for $299 per set and selling them at $520 each. Fixed costs related to this operation amount to $3 250 per month. It is expected that 18 sets per month could be sold. How much profit will John make each month? Solution: Question 3 solution: Enter your solution in the box below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started