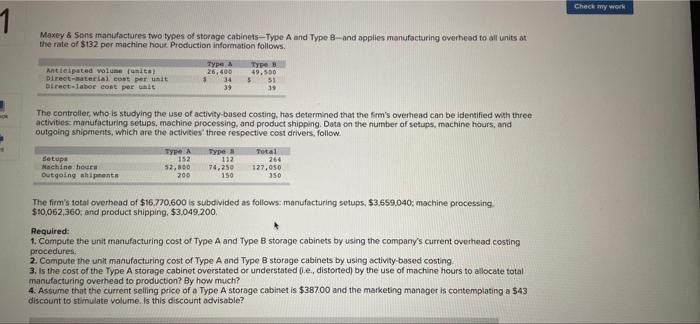

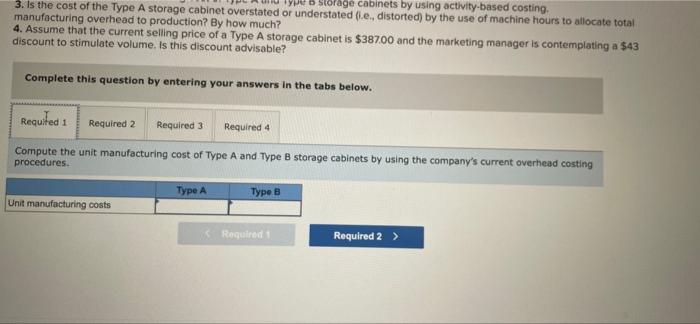

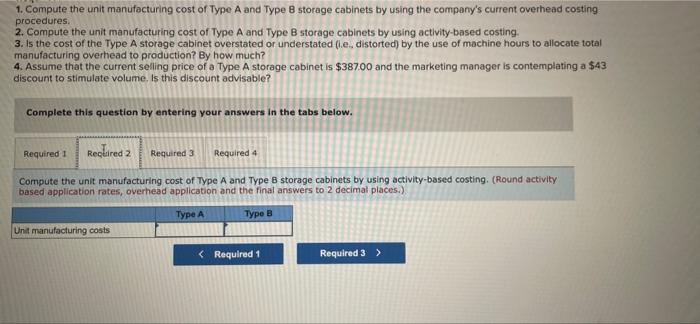

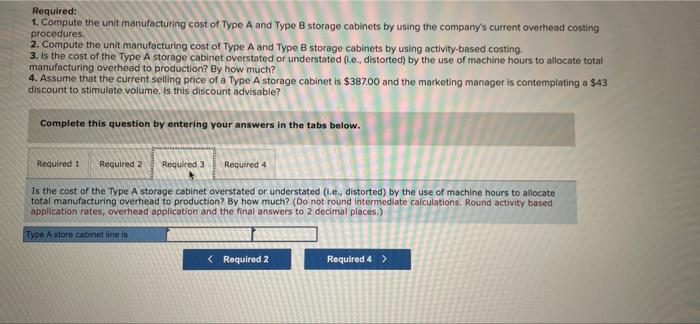

1 Maxey & Sons manufactures two types of storage cabinets-Type A and Type 8-and applies manufacturing overhead to all units at the rate of $132 per machine hour. Production information follows. Anticipated volume (units) Direct-material cost per unit Type A Type B 26,400 49,500 34 $ 51 39 Direct-labor cost per unit 39 The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities three respective cost drivers, follow " Total Setupa Type A 152 52,800 264 Type 112 74,250 150 Machine hours Outgoing shipments 200 127,050 350 The firm's total overhead of $16,770,600 is subdivided as follows: manufacturing setups, $3,659,040; machine processing. $10,062,360, and product shipping. $3,049,200, Requ 1. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing procedures. 2. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. 3. Is the cost of the Type A storage cabinet overstated or understated (.e., distorted) by the use of machine hours to allocate total manufacturing overhead to production? By how much? 4. Assume that the current selling price of a Type A storage cabinet is $387.00 and the marketing manager is contemplating a $43 discount to stimulate volume. Is this discount advisable? Check my work Type a storage cabinets by using activity-based costing. 3. Is the cost of the Type A storage cabinet overstated or understated (.e., distorted) by the use of machine hours to allocate total manufacturing overhead to production? By how much? 4. Assume that the current selling price of a Type A storage cabinet is $387.00 and the marketing manager is contemplating a $43 discount to stimulate volume. Is this discount advisable? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing procedures. Type A Type B Unit manufacturing costs Required 2 > Required 1 1. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing procedures. 2. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. 3. Is the cost of the Type A storage cabinet overstated or understated (.e., distorted) by the use of machine hours to allocate total manufacturing overhead to production? By how much? 4. Assume that the current selling price of a Type A storage cabinet is $387.00 and the marketing manager is contemplating a $43 discount to stimulate volume. Is this discount advisable? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. (Round activity based application rates, overhead application and the final answers to 2 decimal places.) Type A Type B Unit manufacturing costs Required 3 > 1. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using the company's current overhead costing procedures. 2. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing. 3. Is the cost of the Type A storage cabinet overstated or understated (i.e., distorted) by the use of machine hours to allocate total manufacturing overhead to production? By how much? 4. Assume that the current selling price of a Type A storage cabinet is $387.00 and the marketing manager is contemplating a $43 discount to stimulate volume. Is this discount advisable? Complete this question by entering your answers in the tabs below. Required 11 Required 2 Required 3 Required 4 Assume that the current selling price of a Type A storage cabinet is $387.00 and the marketing manager is contemplating a $43 discount to stimulate volume. Is this discount advisable? OYes ONO