Question

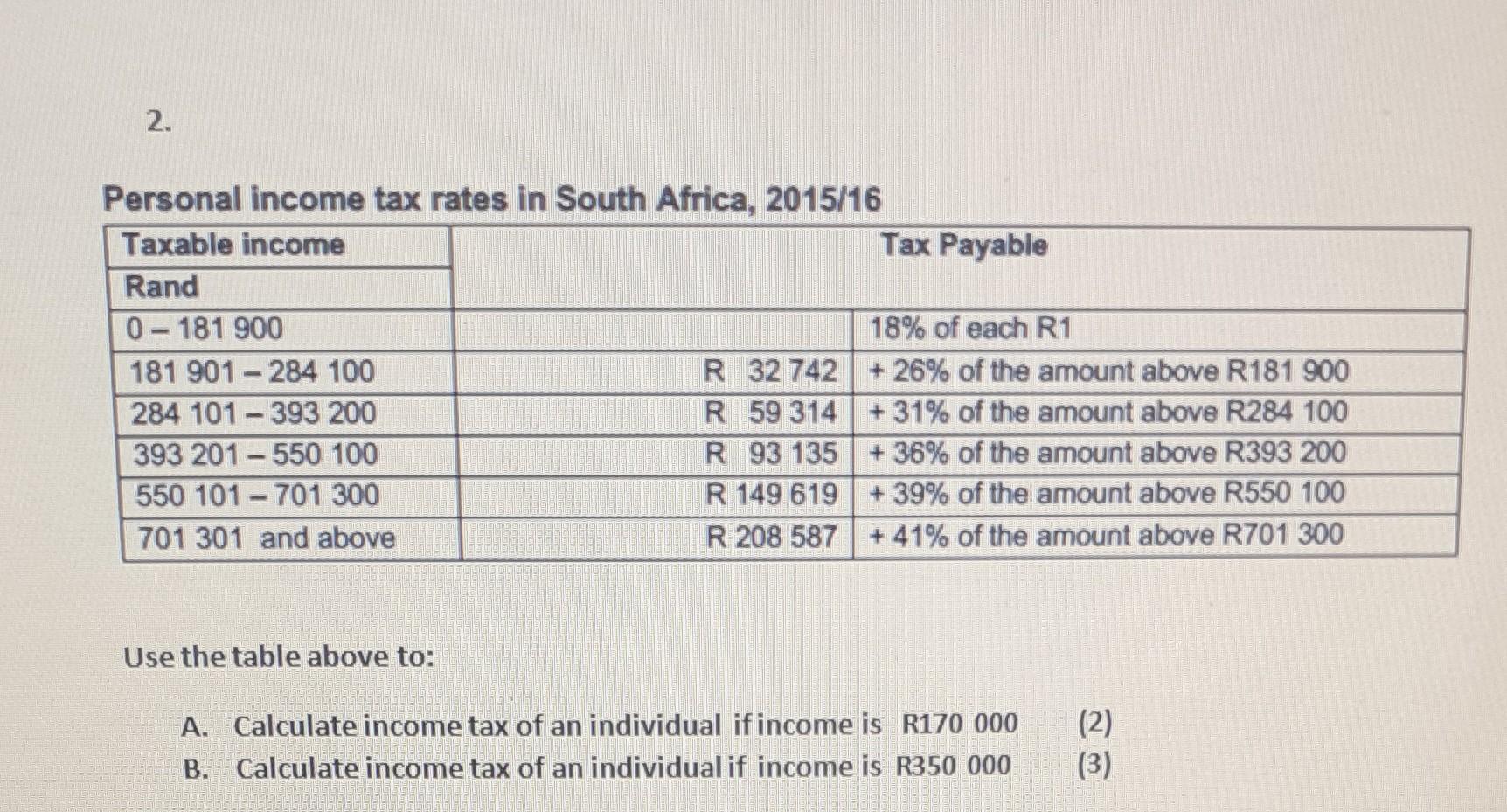

2. Personal income tax rates in South Africa, 2015/16 Taxable income Rand 0-181 900 181 901 284 100 284 101-393 200 393 201-550 100

2. Personal income tax rates in South Africa, 2015/16 Taxable income Rand 0-181 900 181 901 284 100 284 101-393 200 393 201-550 100 550 101-701 300 701 301 and above Use the table above to: R 32 742 R 59 314 R 93 135 R 149 619 R 208 587 Tax Payable 18% of each R1 +26% of the amount above R181 900 +31% of the amount above R284 100 +36% of the amount above R393 200 + 39% of the amount above R550 100 +41% of the amount above R701 300 A. Calculate income tax of an individual if income is R170 000 B. Calculate income tax of an individual if income is R350 000 (2) (3)

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

4 Since taxable income falls in ronge of 0181900 Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applying International Financial Reporting Standards

Authors: Keith Alfredson, Ken Leo, Ruth Picker, Paul Pacter, Jennie Radford Victoria Wise

3rd edition

730302121, 978-0730302124

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App