Answered step by step

Verified Expert Solution

Question

1 Approved Answer

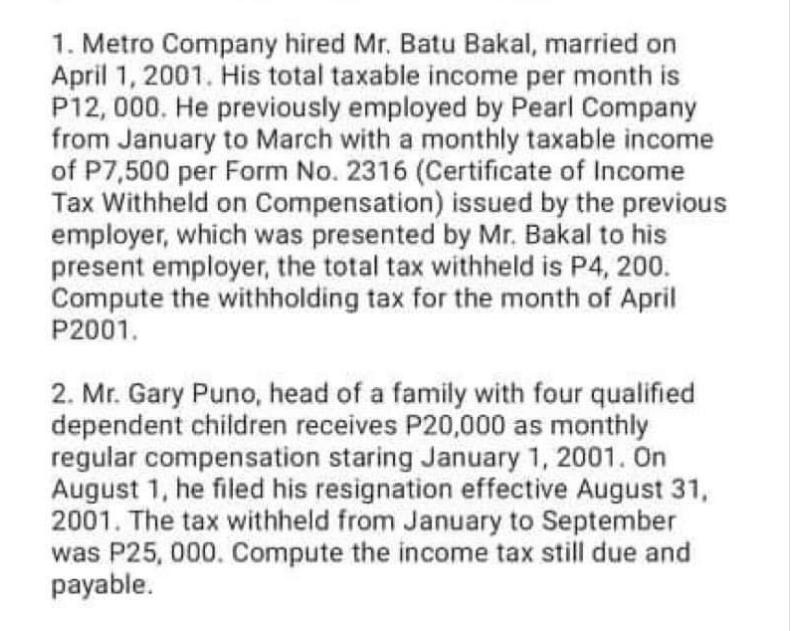

1. Metro Company hired Mr. Batu Bakal, married on April 1, 2001. His total taxable income per month is P12, 000. He previously employed

1. Metro Company hired Mr. Batu Bakal, married on April 1, 2001. His total taxable income per month is P12, 000. He previously employed by Pearl Company from January to March with a monthly taxable income of P7,500 per Form No. 2316 (Certificate of Income Tax Withheld on Compensation) issued by the previous employer, which was presented by Mr. Bakal to his present employer, the total tax withheld is P4, 200. Compute the withholding tax for the month of April P2001. 2. Mr. Gary Puno, head of a family with four qualified dependent children receives P20,000 as monthly regular compensation staring January 1, 2001. On August 1, he filed his resignation effective August 31, 2001. The tax withheld from January to September was P25, 000. Compute the income tax still due and payable. 4. Mr. Tommy Mapalo, a business of Bago City, forgot to file and pay his 2001 income tax amounting to P60,000 on April 15, 2002. Subsequently, he filed and paid his income taxes in Revenue District Office at General Santos City. How much is the amount of tax surcharge to be paid by Mr. Mapalo?

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Withholding Tax Calculations 1 Mr Batu Bakal Step 1 Calculate annual taxable income January to March ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started